Adani Commodities, a promoter of Adani Wilmar, has sold 13.5% of its stake through an offer-for-sale on Friday and Monday. As a result, the shareholding of the promoter and promoter group is changed and has been reduced to 74.36%, an exchange filing said.

As of quarter ended December 2024, the promoter and promoter group held 87.87% stake in the company, out of which, Adani Commodities held 43.94%, according to BSE data.

Consequently, the company is now in compliance with the requirement of maintaining a minimum public shareholding of 25%, the filing said.

On Monday, Adani Wilmar had said that Lence Pte., a subsidiary of Wilmar International, allowed Adani Commodities LLP to sell 9.3 crore shares, or 7.13% stake, in the company via the offer-for-sale.

"Upon ACL's request, Lence by way of its consent dated January 09, 2025 has permitted ACL to sell, as part of the offer for sale, certain shares i.e. 92,665,806 equity shares", a regulatory filing stated.

Last week, Adani Commodities had proposed to undertake the OFS to offload up to 25.99 crore equity shares, constituting 20% of the equity share capital, of Adani Wilmar, according to the company's exchange filing.

Earlier on Dec. 30, Adani Enterprises Ltd. announced that it will exit Adani Wilmar by divesting its entire 44% stake in the joint venture.

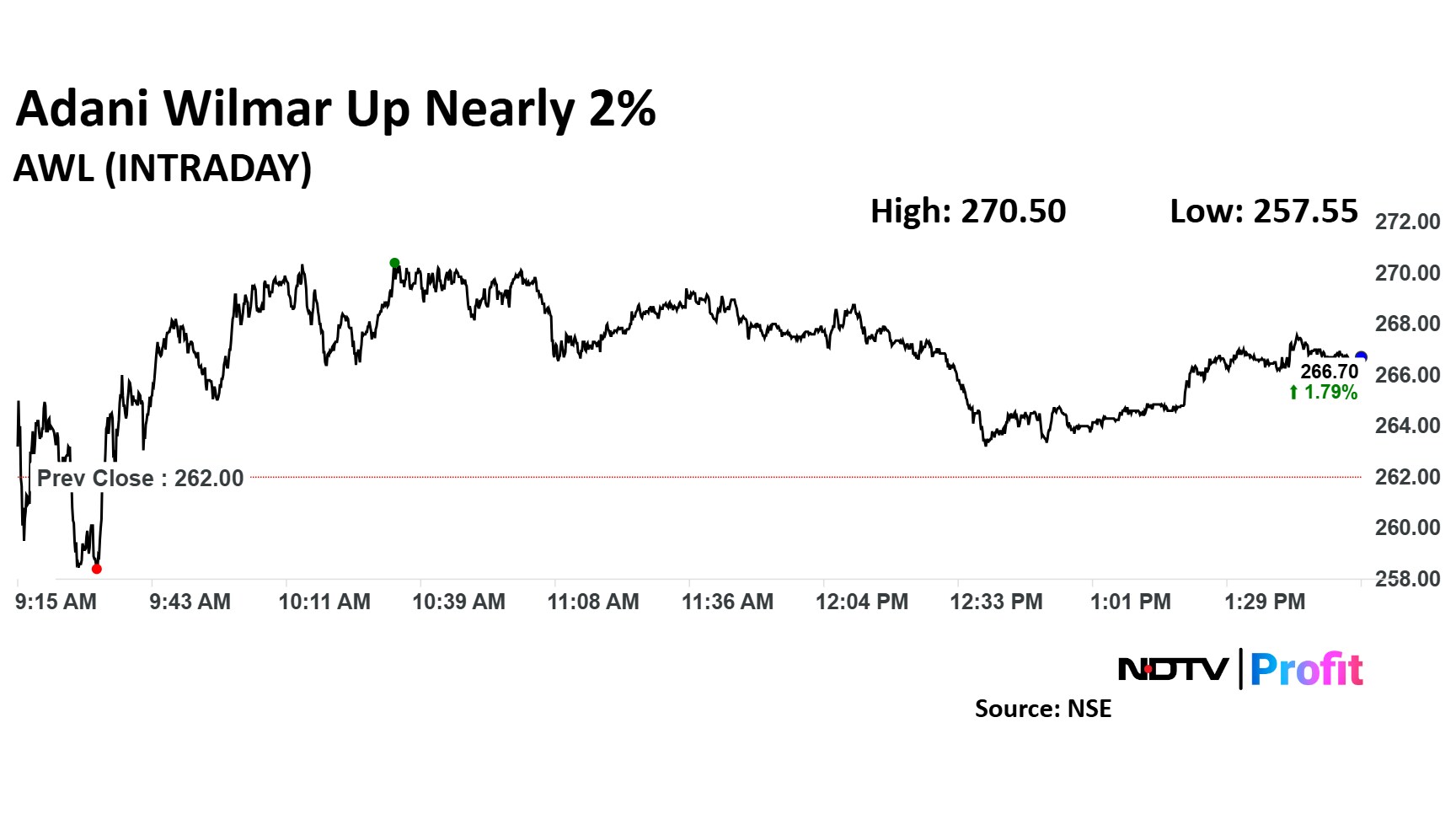

The scrip rose as much as 3.2% to Rs 270.50 apiece. The rise came after four sessions of losses after it hit Rs 257.55 earlier in the day, its lowest level since February 2022. It pared gains to trade 1.9% higher at Rs 266.90 apiece, as of 2:02 p.m. This compares to a 0.3% advance in the NSE Nifty 50 Index.

It has fallen 25% in the last 12 months. Total traded volume so far in the day stood at 2.18 times its 30-day average. The relative strength index was at 30, indicating that the stock may be oversold.

Out of five analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 36.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.