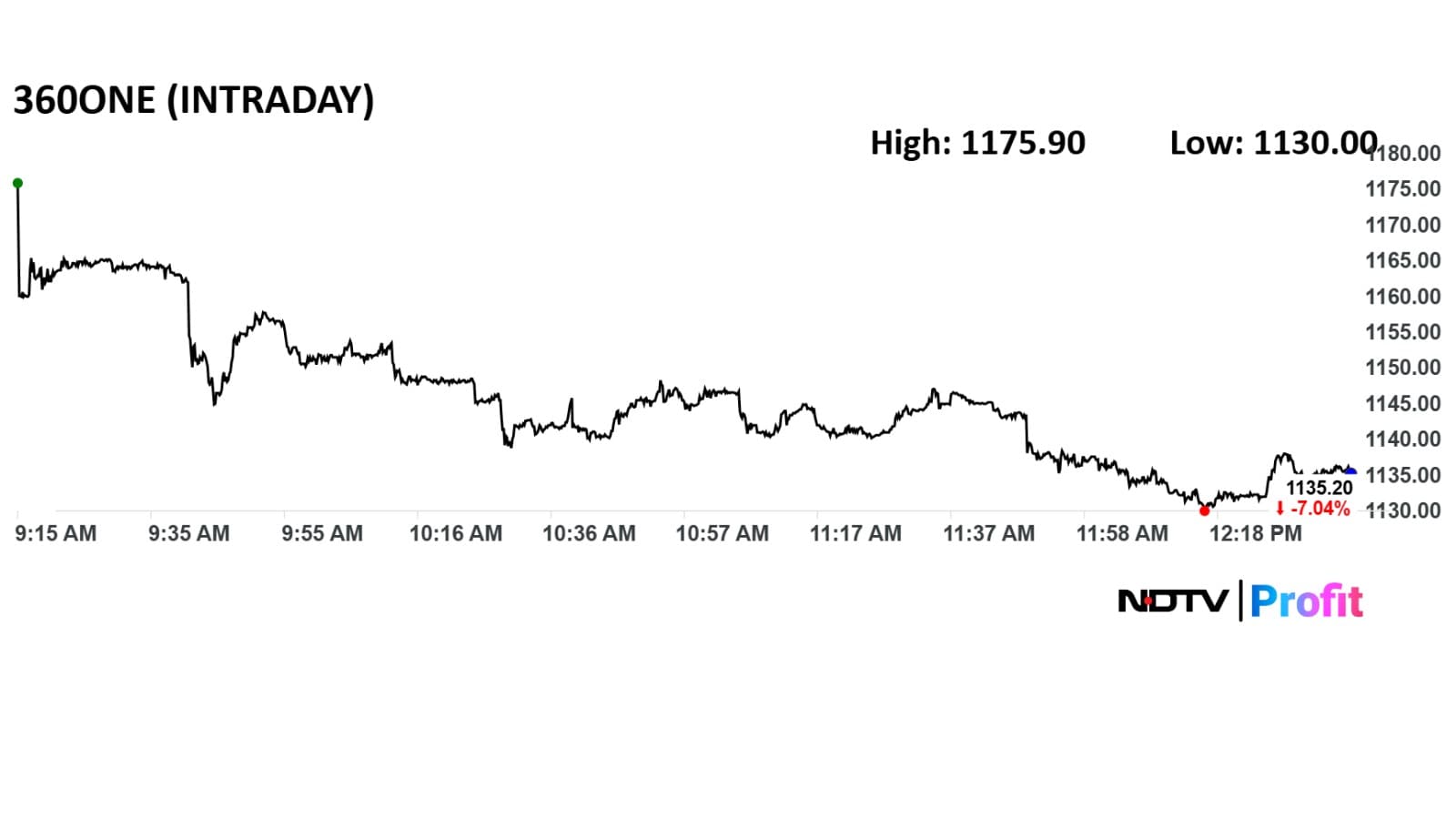

360 ONE WAM Ltd. has fallen more than 6.5% in trade on Tuesday on the back of a block deal, with 2.52 crore shares changing hands.

This comes on the back of Bain Capital-led BC Asia Investments Ltd. likely selling 3.7% equity—around 1.5 crore shares—at a value of Rs 1,160. The stock is currently trading at Rs 1,135, which represents almost a 7% fall from yesterday's close.

The seller will be subjected to a 120-day lock-up period following the transaction, and the deal is being arranged by JPMorgan, as per the term sheet.

360 ONE WAM Ltd. has fallen more than 6.5% in trade on Tuesday

360 One WAM's Shareholding

BC Asia Investments' likely stake sale represents a broader trend of the investment firm gradually trimming its stake in the wealth and asset management company.

As the single-largest shareholder in One 360 WAM, BC Asia Investment held a 24.42% stake in June 2024, which has come down to 21.92% in June 2025.

The stake is likely to fall further following the recent block deal.

Apart from BC Asia Investments, other notable FII entities holding a stake in 360 One WAM include Smallcap World Fund Inc., which holds a 7.26% stake in the company as of June 2025.

Another key theme that has played out in 360 One WAM's shareholding picture is the falling promoter share.

In June 2023, promoters held a 21.46% stake in the wealth and asset management company, which fell to 15.79% in June 2024.

As of June 2025, promoters only hold a 6.27% stake in 360 One WAM, with IIFL Finance's Nirmal Jain completely exiting from the company.

Brokerages On 360 One WAM?

As per Bloomberg data, a total of 12 analysts cover 360 One WAM, with nine giving out buy calls on the counter. Three analysts have given hold calls.

The average 12-month analyst price target of Rs 1288 implies a potential upside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.