Rates for most items and services under the Goods and Services Tax have been finalised in the two-day meeting of the GST Council that ended on Friday. While the rates on key daily use items like sugar, tea and hair oil have come down, they have been increased for luxury and sin products. Eating out in a five-star restaurant will be taxed at the highest bracket.

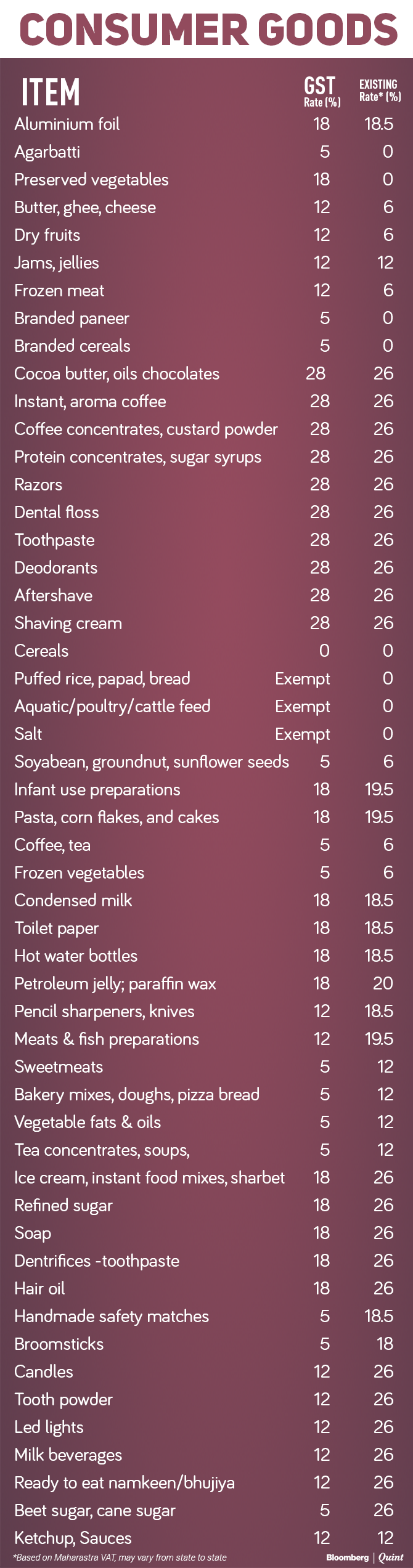

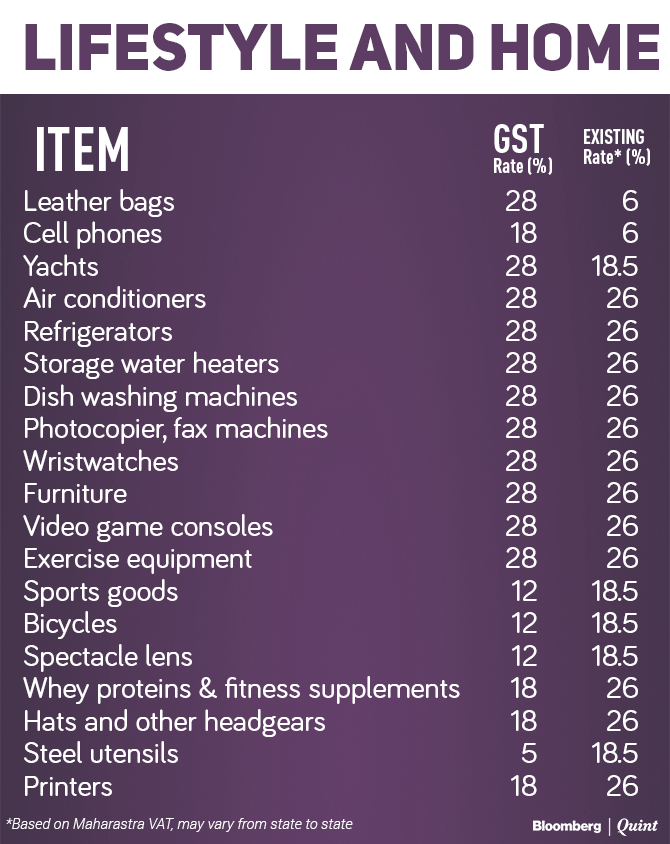

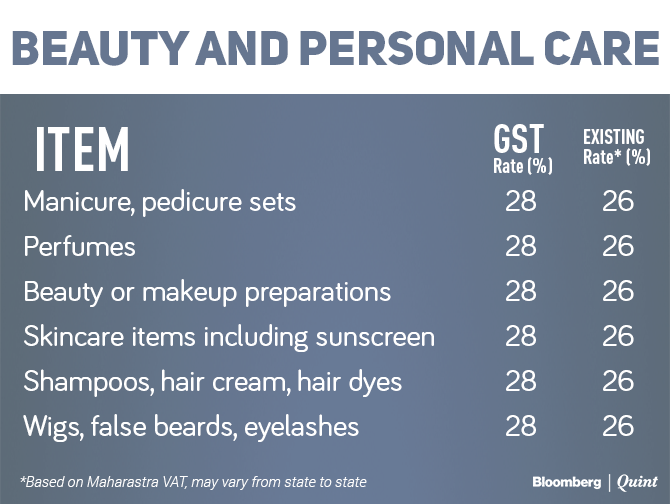

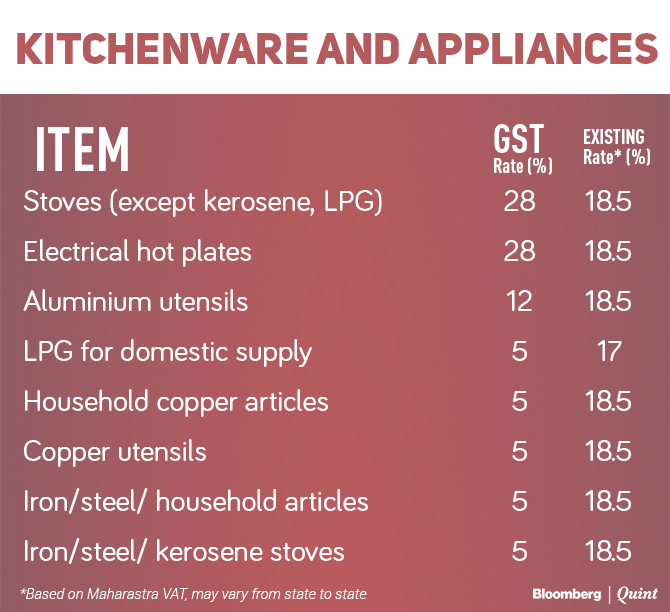

BloombergQuint, in collaboration with tax consultancy SKP Business Consulting LLP, breaks down how the rates under GST compare with the current tax structure. The calculations took into account Maharashtra VAT, which means existing rates may vary for other states. Here's the list...

Toothpaste, Branded Cereals May Cost More

Also Read: What Is GST? Why Should You Care?

Rates Up For Mobile Phones, Refrigerators

Shampoos, Perfumes May Cost More

Also Read: GST: Five-Star Hotels And Gold-Class Movie Experiences Get Pricier

Higher Rate On Electric Hot Plates

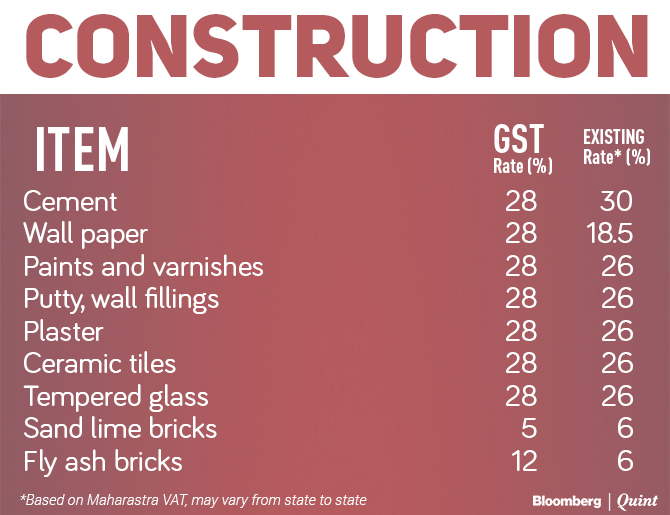

Wallpaper, Paints In Highest Slab

Fresh Milk, Vegetables Exempt

.png)

Also Read: GST Rates On Services: Telecom Industry Disappointed

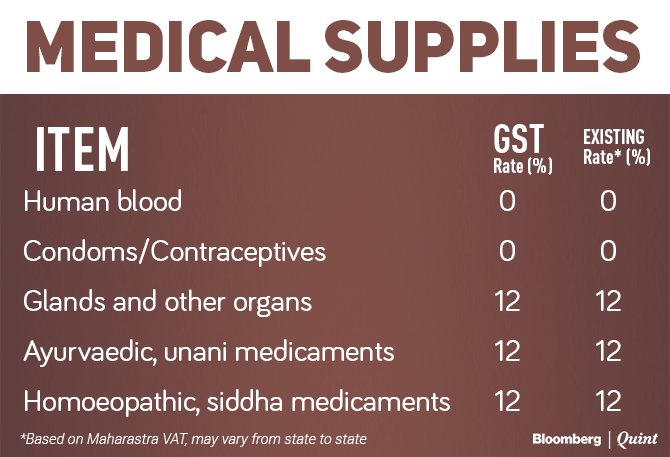

No Tax On Condoms

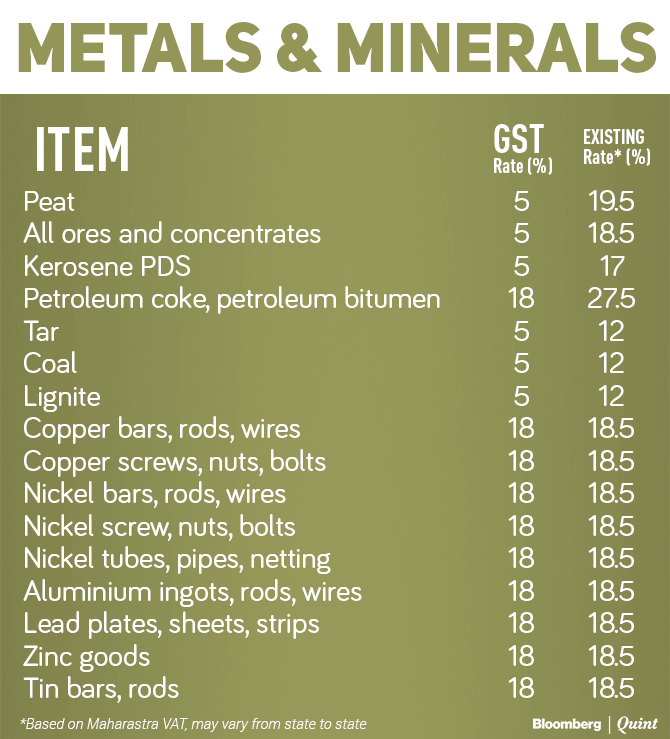

Lower Tax On Kerosene

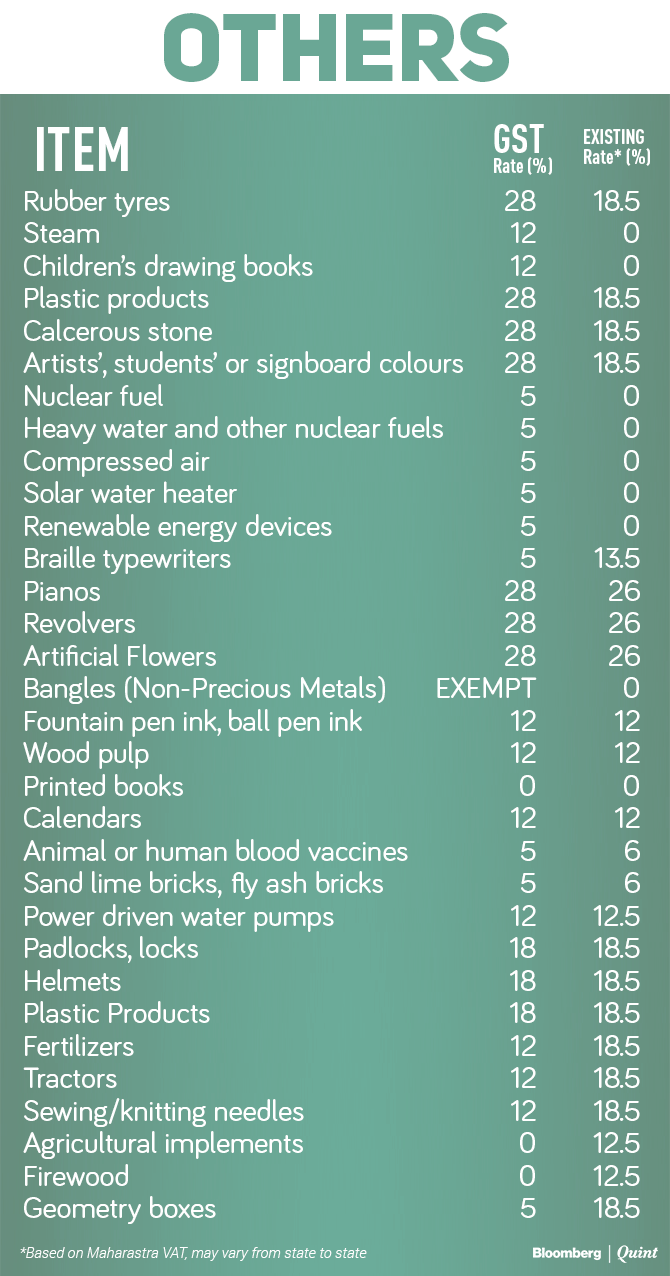

Plastic Products To Cost More

Eating Out, Phone Calls Costlier

Also Read: Come GST, Which Services Will Burn A Bigger Hole In Your Pocket?

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.