(Bloomberg) -- Asian nations are seeing a revival in inflation pressures, signaling weakening support for the region's bonds.

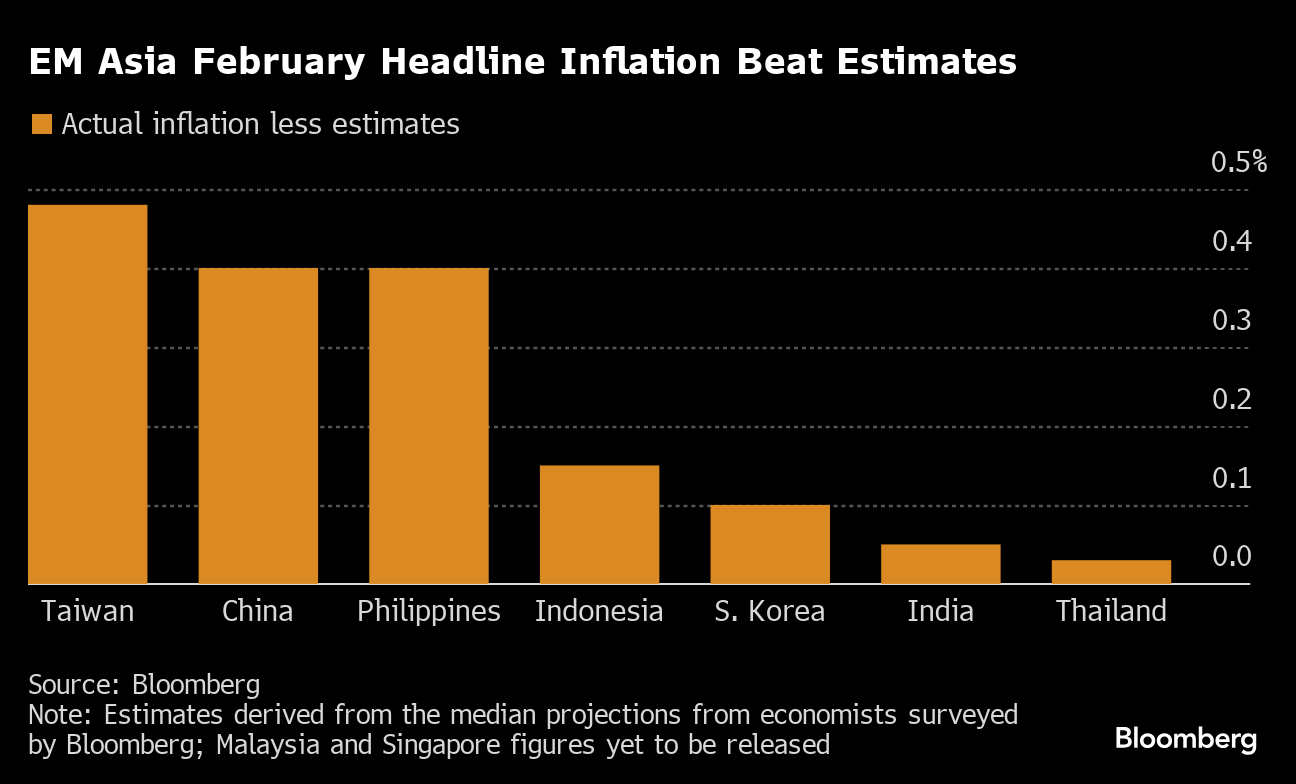

Headline inflation data in February from Thailand, Indonesia, the Philippines, South Korea, China, India and Taiwan exceeded economist estimates mostly due to a surge in food prices. Sustained price pressures will pose a risk to emerging Asian bonds, as they may potentially delay interest-rate cuts by the region's central banks.

“These surprises have been largely led by food prices, reflecting the confluence of El Nino impacts and the Lunar New Year,” said Philip McNicholas, an Asia sovereign strategist at Robeco Group in Singapore. Taiwan and the Philippines in particular are seeing resilient core price momentum, which will make it harder for these economies to ease monetary policy imminently. It will also increase the risk of a further shift higher in their yield curves, he added.

Emerging Asian bonds handed investors a return of 0.5% so far this quarter compared with over 5% in the last three months of 2023, according to a Bloomberg index. The slimmer returns can be explained by a less favorable inflation backdrop domestically and in the US.

Back in January, nine emerging Asian economies — including Singapore and Malaysia — saw headline inflation undershoot estimates by an average of minus 0.24%, undershooting estimates by the most since April 2020. February inflation from Malaysia and Singapore will be released later in March.

Fed Cut Doubts

The trend in prices seen in emerging Asia resembles that in the US, where the drop in inflation hasn't been linear and has caused wild swings in Treasuries.

US bonds fell after underlying US inflation topped forecasts for a second month in February, reinforcing the Federal Reserve's cautious approach to cutting interest rates.

While more concrete signs of an eventual pivot from the Fed at next week's meeting will provide a strong tailwind for emerging Asian bonds, a persistent rebound in local inflationary pressures will be a drag.

READ: Fed Impact Wanes as Local Factors Take Priority in EM Asia Bonds

The Bangko Sentral ng Pilipinas this month signaled the risk of higher food prices due to the impact of El Nino. The climate pattern has also pushed Indonesia's inflation to a three-month high in February. The price of Thai white rice 5% broken, an Asian benchmark, is over 2 standard deviations above the five-year average. The Bank of Korea said it expects inflation slowdown to be “bumpy rather than smooth.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.