(Bloomberg) -- The chances of a euro-zone recession rose as private-sector activity worsened — strengthening the case for interest-rate cuts that the European Central Bank is so far resisting.

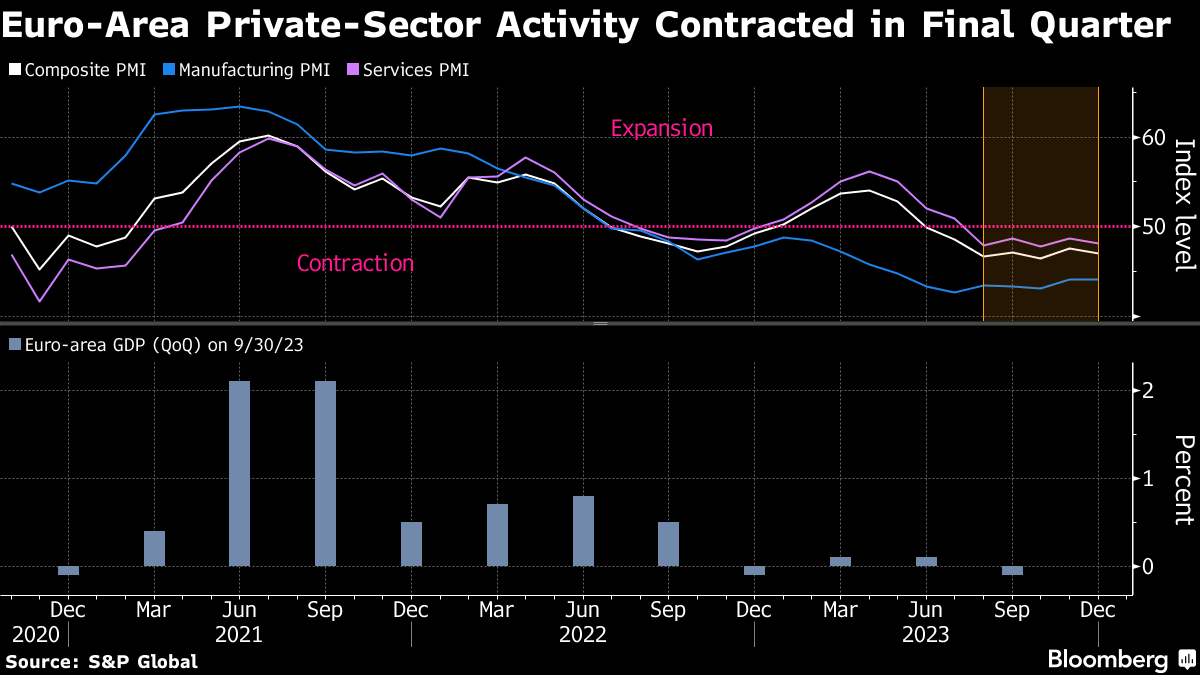

Data Friday showed S&P Global's purchasing managers' index contracted for a seventh month in December, falling to 47. That defied economist expectations for a slight uptick, with readings for manufacturing and services signaling a slump.

Despite that weakness, however, ECB policymakers were united in rejecting talk of imminent reductions in borrowing costs, which they ramped up by 450 basis points in just over a year to tackle soaring inflation.

While consumer-price growth is now tumbling, Bank of France chief Francois Villeroy de Galhau and his Estonian counterpart Madis Muller both poured cold water on investor expectations for a rate cut in the first half of next year.

Such hopes are “a bit optimistic” and “a bit premature,” Muller said Friday. Villeroy urged “confidence and patience,” saying the ECB is guided by data, not a calendar.

“Giving a date for the first interest rate cut goes against the principle of being data dependent,” Portuguese central bank Governor Mario Centeno noted in Lisbon.

The comments chime with President Christine Lagarde, who said Thursday that officials “absolutely” shouldn't lower their guard, and that rate cuts weren't discussed “at all” at this week's policy meeting, where the deposit rate was left at record 4%.

She also unveiled a rosier outlook for the final quarter of the year than that suggested by the PMI figures, pointing to output growing 0.1%.

What Bloomberg Economics Says...

“The survey suggests the broader picture is one of an economy still contracting. That creates downside risks for our forecasts as well as the ECB's and should keep market expectations for an interest-rate reduction before June alive.”

—David Powell, economist. Click here for full REACT

Economists surveyed by Bloomberg aren't so upbeat, also anticipating a first downturn since the pandemic for the 20-nation bloc in the second half of this year.

“The figures paint a disheartening picture as the euro-zone economy fails to display any distinct signs of recovery,” Hamburg Commercial Bank Chief Economist Cyrus de la Rubia said. “The likelihood of the euro zone being in a recession since the third quarter remains notably high.”

That lack of momentum is on display in forecasts for the region's two top economies. The Bundesbank said Friday that Germany will expand just 0.4% next year; a day earlier, France's statistics office said it sees output remaining flat this quarter and growing just 0.2% in the first two quarters of 2024.

“Barring shocks or surprises, rate hikes are over — but that doesn't mean a quick rate cut,” Villeroy said. “In mountains there are peaks and descents and there are plateaus,” he said. “Today we are on a plateau and we need to give ourselves time to enjoy the view — to appreciate the effects of monetary policy.”

--With assistance from James Regan, Alexander Weber, Ott Tammik, William Horobin, Joao Lima and Henrique Almeida.

(Updates with Centeno in sixth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.