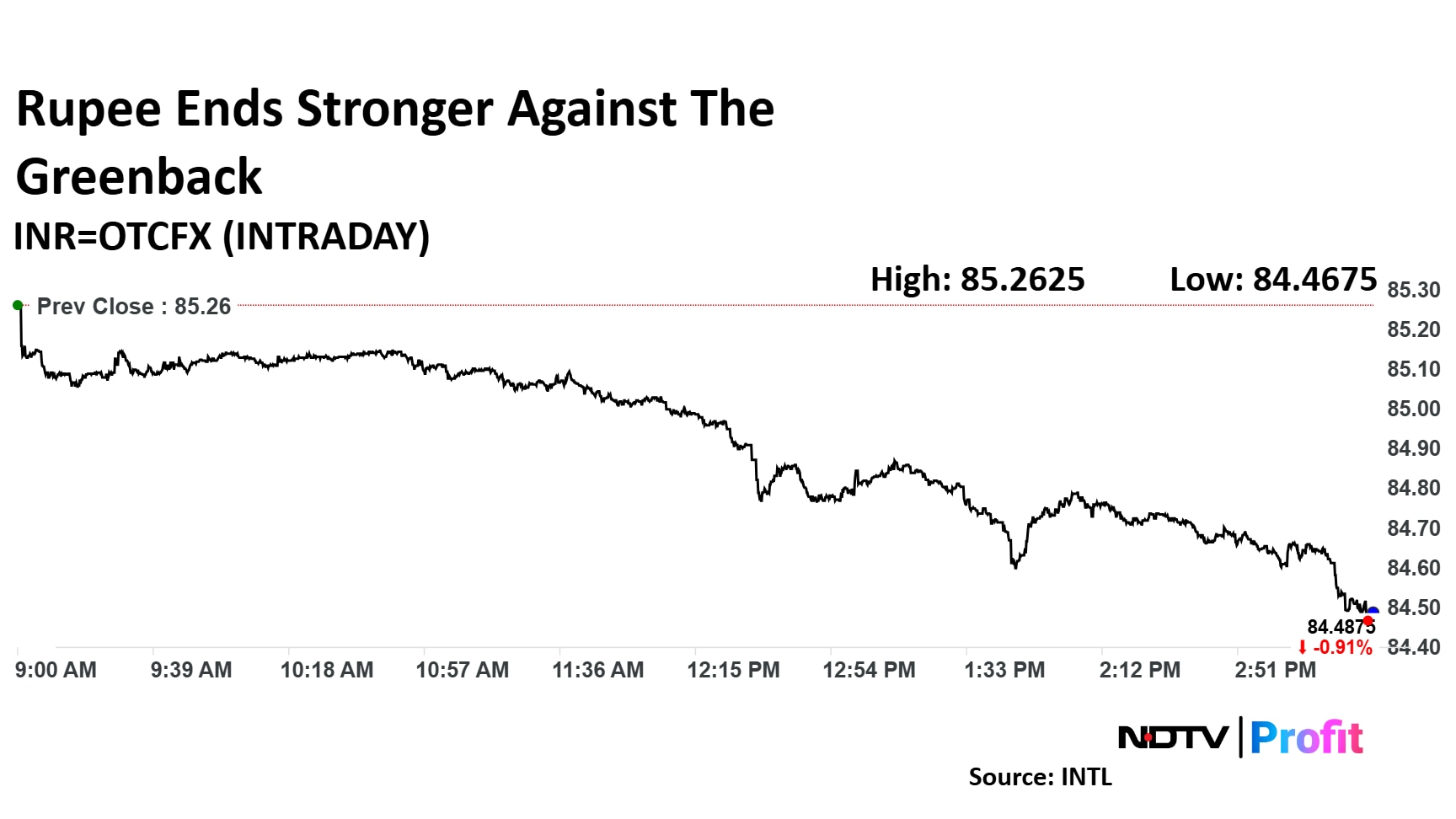

The Indian rupee closed 74 paise stronger against the US Dollar on Wednesday at 84.49, the highest close since November 2024, in contrast to a weaker close at 85.26 on Tuesday, according to Bloomberg.

The currency touched an intraday high of 84.49, as compared to Tuesday's intraday high at 84.95. Rupee recovered from a day's loss at open on Wednesday.

On Monday, rupee emerged as one of the best performing Asian currencies. "US Treasury Secretary Scott Bessent hinted that India could become the first country to sign a trade deal with the United States. While still speculative, such a development would boost medium-term sentiment for the rupee and underscore India's rising strategic importance," said CX Forex Advisors Managing Director Amit Pabari.

The dollar index rose 0.23% and was trading stable at 99.24 as of 3:00 p.m. on Wednesday.

Brent crude slumped to its largest monthly decline since November to trade at $63 a barrel. Crude has been trading in the red this month, touching a four-year low on account of US President Donald Trump's hefty levies on China—one of the biggest importers, Bloomberg reported.

"On the supply side, OPEC+ has been easing output curbs, with JPMorgan Chase & Co. warning the cartel may accelerate planned production increases at a meeting next week," noted Bloomberg.

Giving an outlook on rupee's health in the coming term Amit stated, "Looking ahead, the rupee is expected to find immediate support in the 84.90–85.00 range, with a slight upward bias, moving towards the 85.80–86.00 levels in the near term."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.