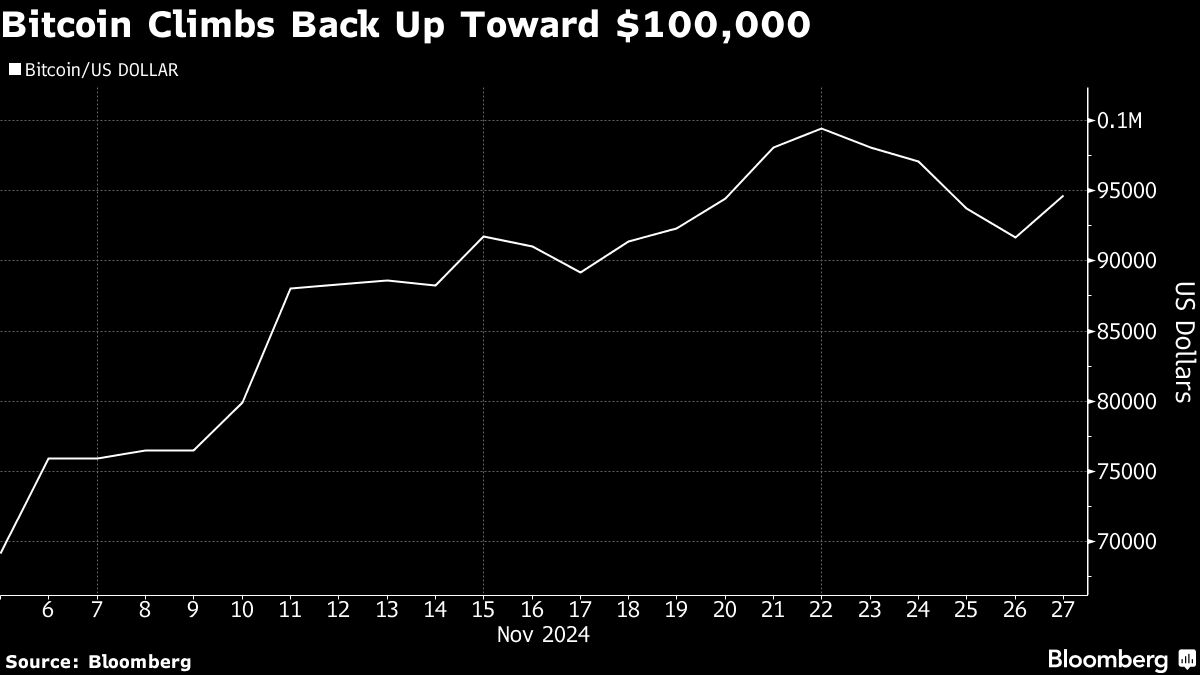

(Bloomberg) -- Bitcoin is climbing back toward the elusive $100,000 price level again, snapping its longest losing since Donald Trump's presidential victory triggered a record-breaking rally in the largest cryptocurrency.

Since the election, Bitcoin has risen around 40% as traders anticipate a more friendly regulatory environment for crypto with a president who has said he supports the industry. The token reached an all-time high of $98,943 on Friday before turning negative the past four days. Bitcoin climbed as much as 4.7% to $95,934 on Wednesday. It has more than doubled this year.

“In earlier Bitcoin times, this drawdown wouldn't have raised eyebrows, as sharp corrections were extremely common,” Alex Thorn, head of firmwide research at Galaxy Digital wrote in a note to clients. “These days, however, all eyes are on Bitcoin, including many that have not been in the trenches of Bitcoin volatility.”

Some of the decline in Bitcoin was caused by people taking their profits as it neared the historic milestone. Nikolay Karpenko, a director at B2C2, said that this was tactical and that he expects Bitcoin to cross $100,000 soon.

“As we almost reached six digits, we were thinking that it may trigger some of them profit taking among the institutionals, among the market participants who were buying before the election and people just want to pick their profits,” Karpenko said in an interview.

Thorn also expects that this selling will cool down leading prices back up.

“Once some leverage is flushed and shorter term buyers are done taking profits, we believe Bitcoin may find a strong base of support and could make another attempt to surpass the $100k level (the sell wall!) in the near term,” Thron wrote.

There was also some volatility in markets earlier this week after Trump announced potential additional tariffs on China, Mexico and Canada.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.