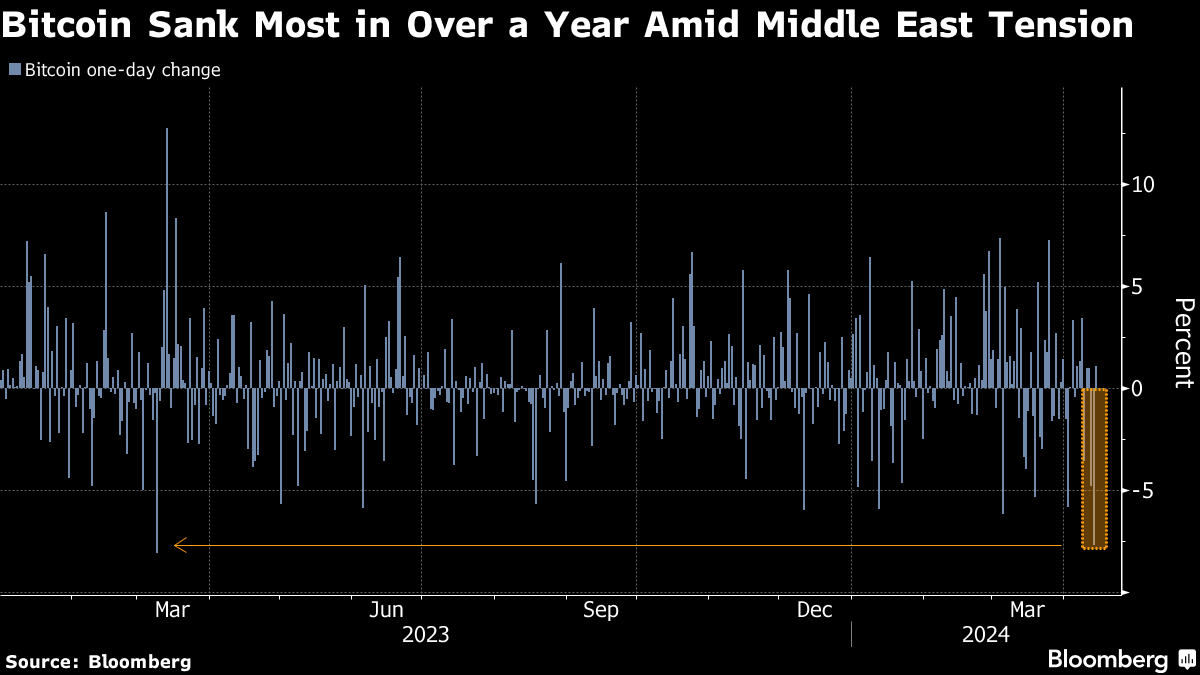

(Bloomberg) -- Bitcoin struggled for traction after sinking the most in more than a year, part of a wider tumble in cryptocurrency markets as escalating geopolitical tension in the Middle East spurred risk aversion.

The largest cryptocurrency slid 7.7% on Saturday, the biggest such retreat since March 2023. The token pared some of the drop to change hands at about $63,230 as of 11:36 a.m. in Singapore on Sunday. Most other major coins such as Ether, Solana and meme-crowd favorite Dogecoin nursed 24-hour losses.

Iran launched attack drones and missiles against Israel in apparent retaliation for a strike in Syria that killed top Iranian military officers, taking the conflict in the region into a perilous new phase. Digital assets trade during the weekends, giving investors a window on the potential mood when traditional markets reopen on Monday — though much can change between now and the restart.

Read more: Israel Under Attack by Iran as Mideast Enters Perilous New Phase

A continuation of the crypto selloff “is probably contingent on further escalation,” said Zaheer Ebtikar, founder of crypto fund Split Capital, adding “people will really look for what markets will look like on Monday.”

As Israel braced for an attack, the tension hurt stocks Friday and boosted havens such as bonds and the dollar. Coinglass data show about $1.5 billion of bullish crypto wagers via derivatives were liquidated on Friday and Saturday, one of the heaviest two-day liquidations in at least six months.

Leverage “has gotten completely overwhelmed in the last three days, so that's caused prices to materially deteriorate” in digital assets, said Ebtikar.

Bitcoin is down about $10,000 from a mid-March record of $73,798. Demand for dedicated US exchange-traded funds that debuted in January helped the token reach an all-time high but net inflows into the products have moderated lately.

Crypto speculators are awaiting the so-called Bitcoin halving, which will reduce new supply of the token in half and is expected around April 20. Historically, the halving has proved a tailwind for prices, though there are growing doubts about whether a repeat is likely given Bitcoin recently hit a historical peak.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.