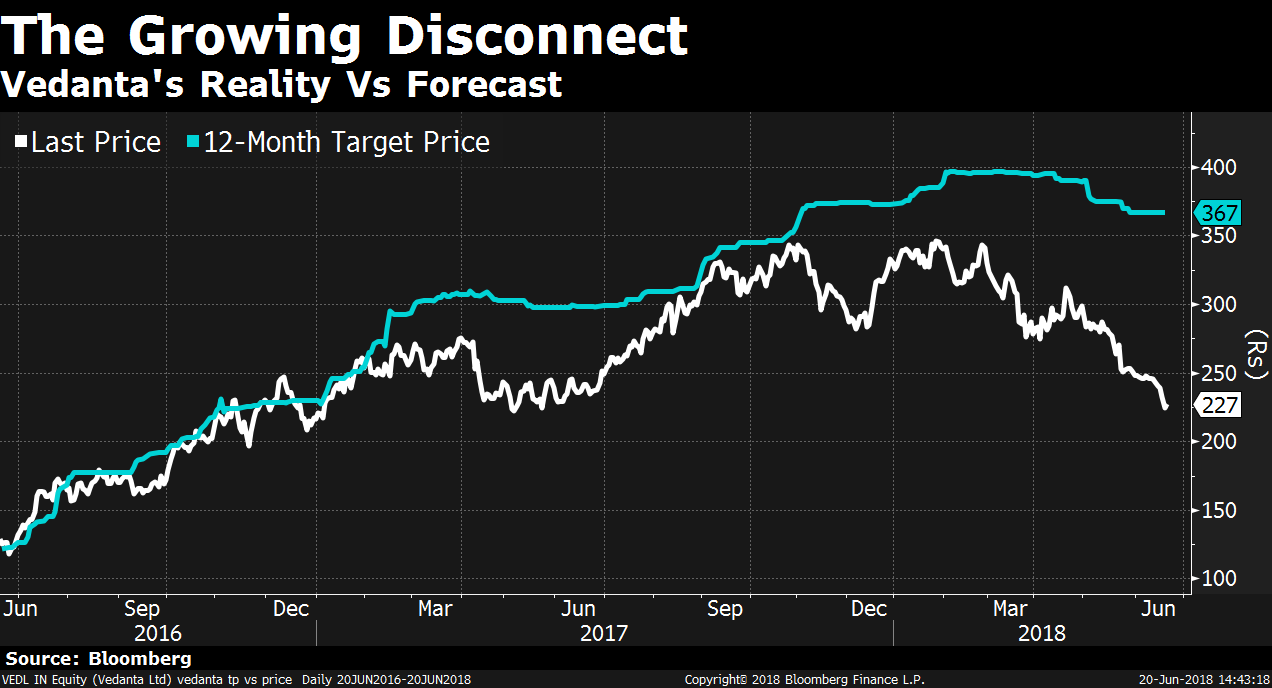

For billionaire Anil Agarwal's Vedanta Ltd., the difference between analyst expectations and reality is at its highest in two years.

The stock, which was recently included in the S&P BSE Sensex Index, has fallen more than 30 percent so far this year. What that means is that the gap between the current price and the consensus target price of estimates compiled by Bloomberg is the widest since 2016.

That implies an upside potential of 60 percent, the highest among companies in the 30-share Sensex. But it may be up for a rerating given the prevailing conditions.

Prices of aluminium and zinc, Vedanta's two key businesses, have remained volatile through the year. The company faces an iron ore ban in Goa, and its copper smelter has been shut in Tamil Nadu after 13 protesters were killed in police firing.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.