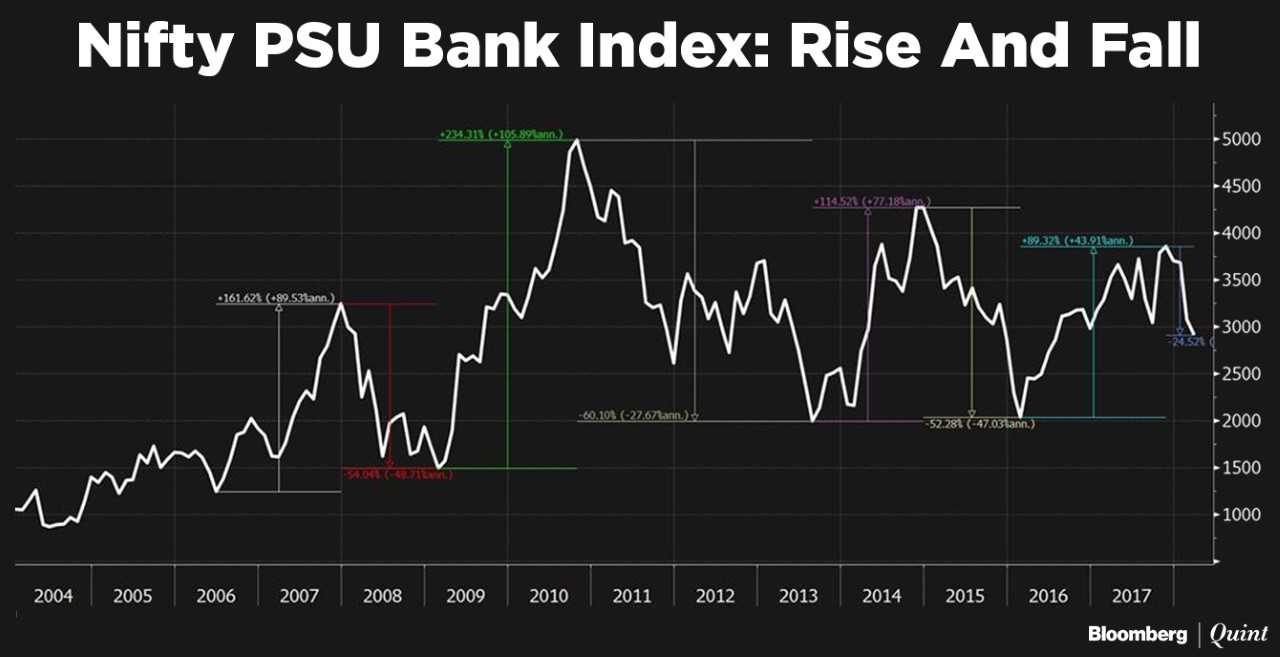

A measure of the country's largest state-run banks, which is down over 20 percent so far this year, may be poised for further weakness.

Recent bank frauds, rising bond yields and associated mark-to-market treasury losses, and the Reserve Bank of India's new framework on stressed assets which will increase provisioning requirements could put further pressure on corporate earnings of state-owned lenders and keep sentiments muted.

During each of the three major corrections earlier, the Nifty PSU Bank index had corrected more than 50 percent from its peak. In this latest downtrend, the index has fallen 23 percent so far.

Will it follow the historic trend and correct further or could we see a reversal?

That's the chart of the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.