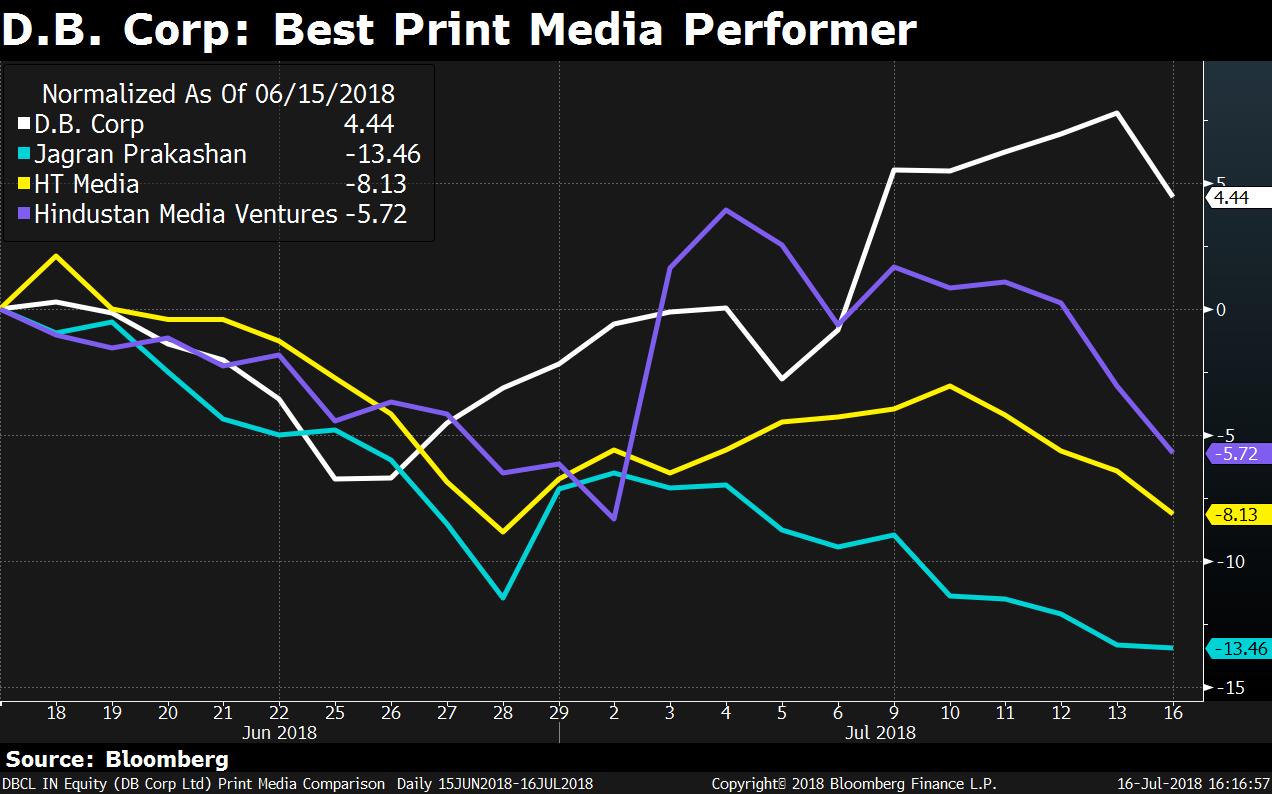

DB Corp Ltd. has risen the most among its peers on the Nifty Media Index in the last one month. Yet, it's still cheaper than its long-term valuations.

Shares of the media company rose close to 5 percent in the last one month compared with an 11 percent decline in the Nifty Media Index. The stock trades at a price-to-earnings multiple of 14.5, a discount of over 30 percent from its five-year average.

The stock rallied after the company approved a proposal to buy back shares worth Rs 312.8 crore on May 26. For the year, though, it has declined more than 20 percent.

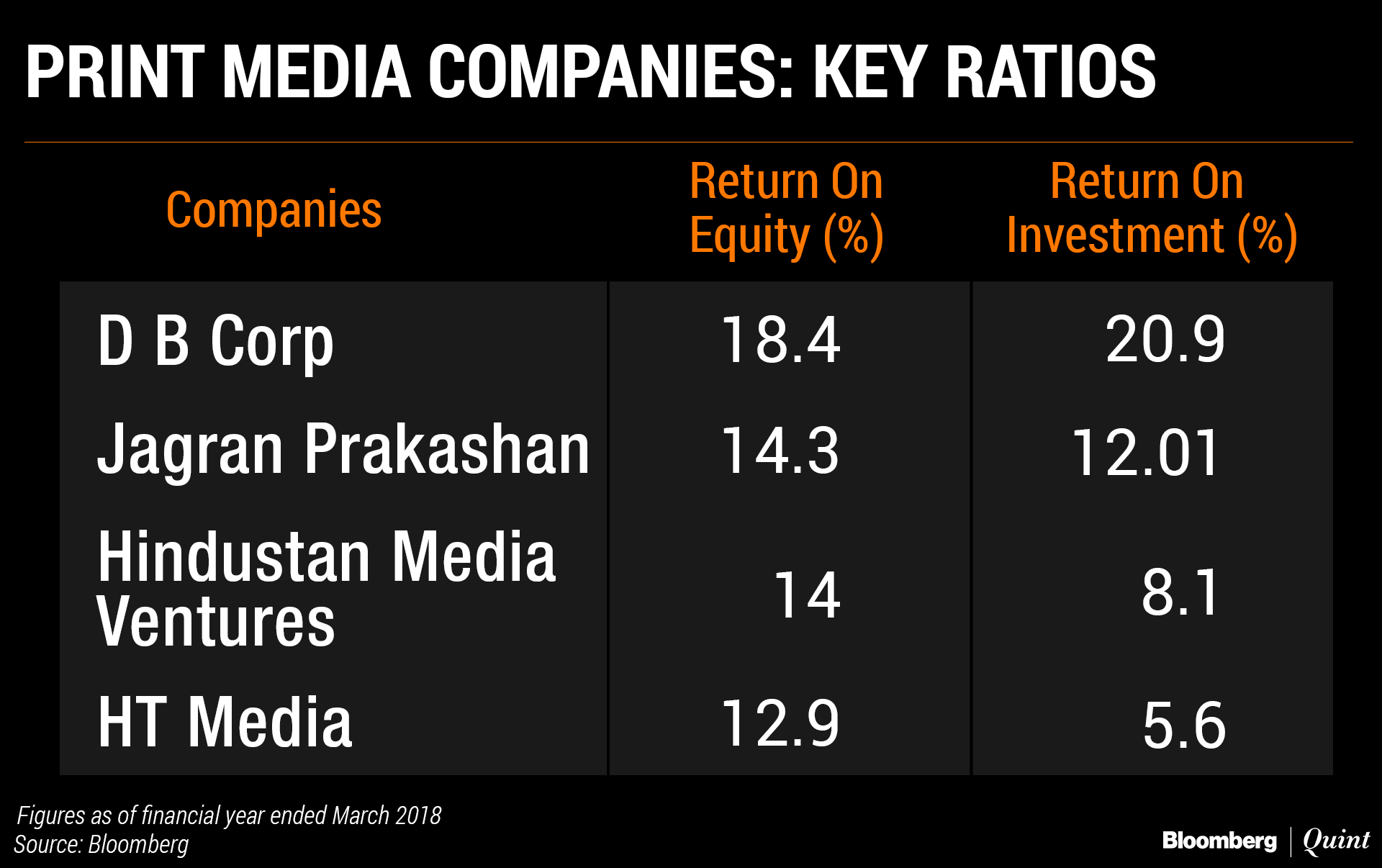

The company has the highest return on investment and return on equity among its peers because of low debt and high net worth.

“We expect improving advertising growth led by market recovery and elections in the company's key markets,” Brokerage Ambit Capital said in a note. “DB Corp will gain market share owing to its local news focus.”

Nearly 68 percent analysts tracked by Bloomberg have a ‘Buy' rating on the stock, with an estimated 12-month target price of Rs 323.3, a potential upside of 15 percent. Twenty-six percent of the analysts rate the stock a ‘Hold', while 6 percent recommend a ‘Sell', according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.