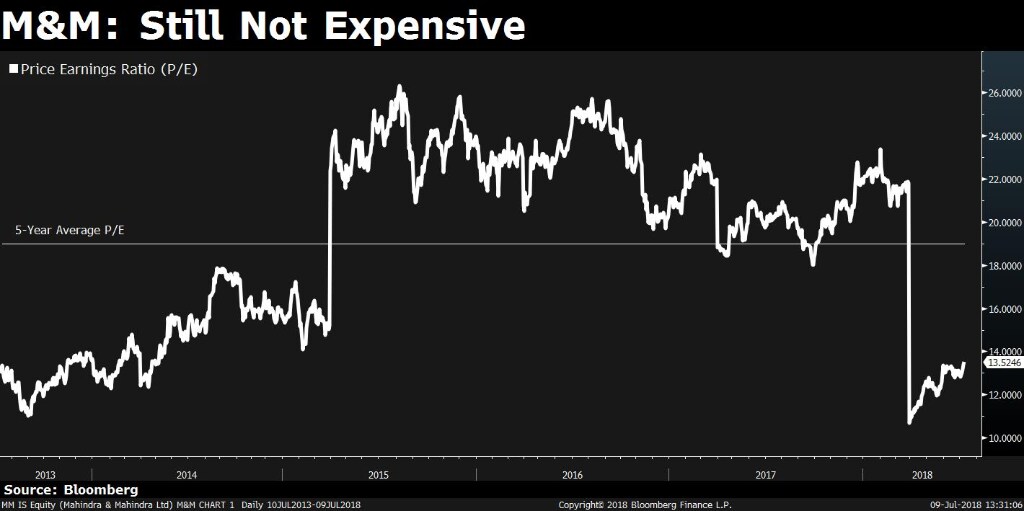

Mahindra & Mahindra Ltd. has risen the most among automakers so far this year. Yet, it's still cheaper than its long-term valuations.

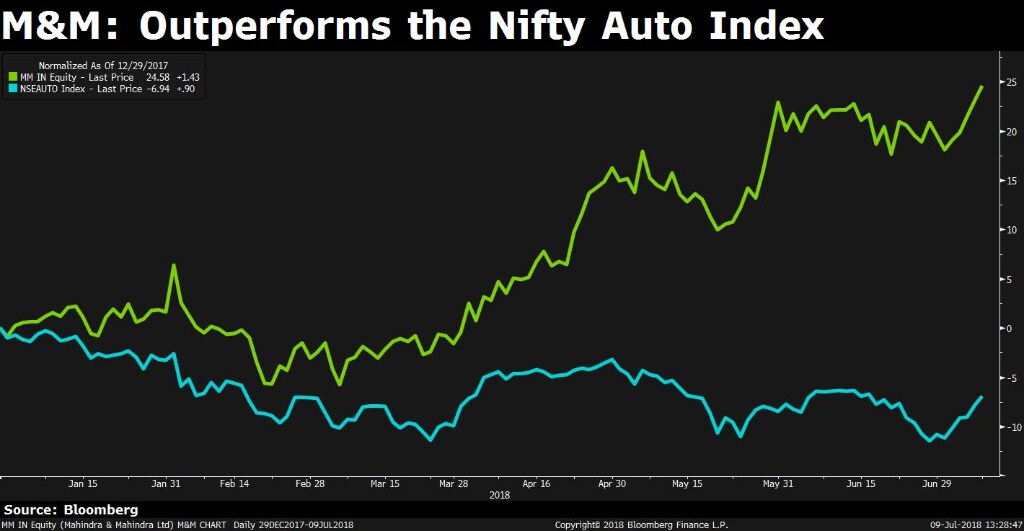

Shares of the maker of tractors and utility vehicles rose to a record today to trade at Rs 940 apiece. That's a 25 percent rise so far in 2018 compared with a 7.3 percent decline in the Nifty Auto Index.

The stock trades at a price-to-earnings multiple of 13.5, a discount of nearly 30 percent from its five-year average.

The automaker has benefited from two successive normal monsoons, helping boost demand for tractors. The company aims to increase its share in the domestic tractor market from 43 percent to 50 percent. It also plans to increase the share of the global farm equipment business from 37 percent to 50 percent of its total revenue.

“We remain confident of M&M's domestic tractor business,” brokerage Prabhudas Lilladher said in a recent report. “The company's strategy to ramp up its global business and launches in the utility vehicle space is likely to boost volumes.”

Ninety-eight percent of analysts surveyed by Bloomberg have a ‘Buy' rating on the stock. The consensus target price is Rs 1,009.6 apiece, a potential upside of 7.9 percent from the current level.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.