.jpg?downsize=773:435)

Indian stocks are hovering around all-time highs on signs that Asia's third largest economy had a lower-than-expected impact from the cash ban in November.

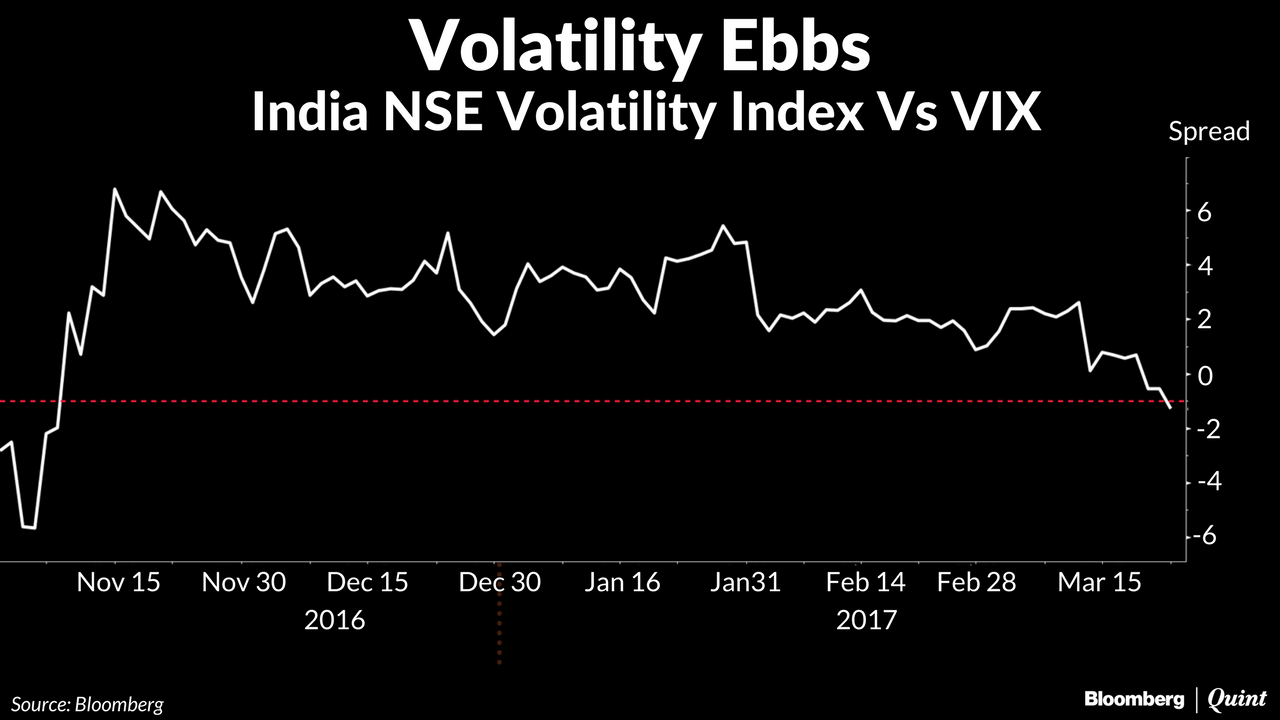

The optimism of the bull run has lulled traders into complacency and they are shunning protection. The spread between India's fear-gauge, NSE Volatility Index, and that of Chicago Board of Exchange's VIX, which prices U.S. options, is now at the lowest level since November 2016. That's a stark contrast to other markets and asset classes that saw a surge in volatility this week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.