.jpg?downsize=773:435)

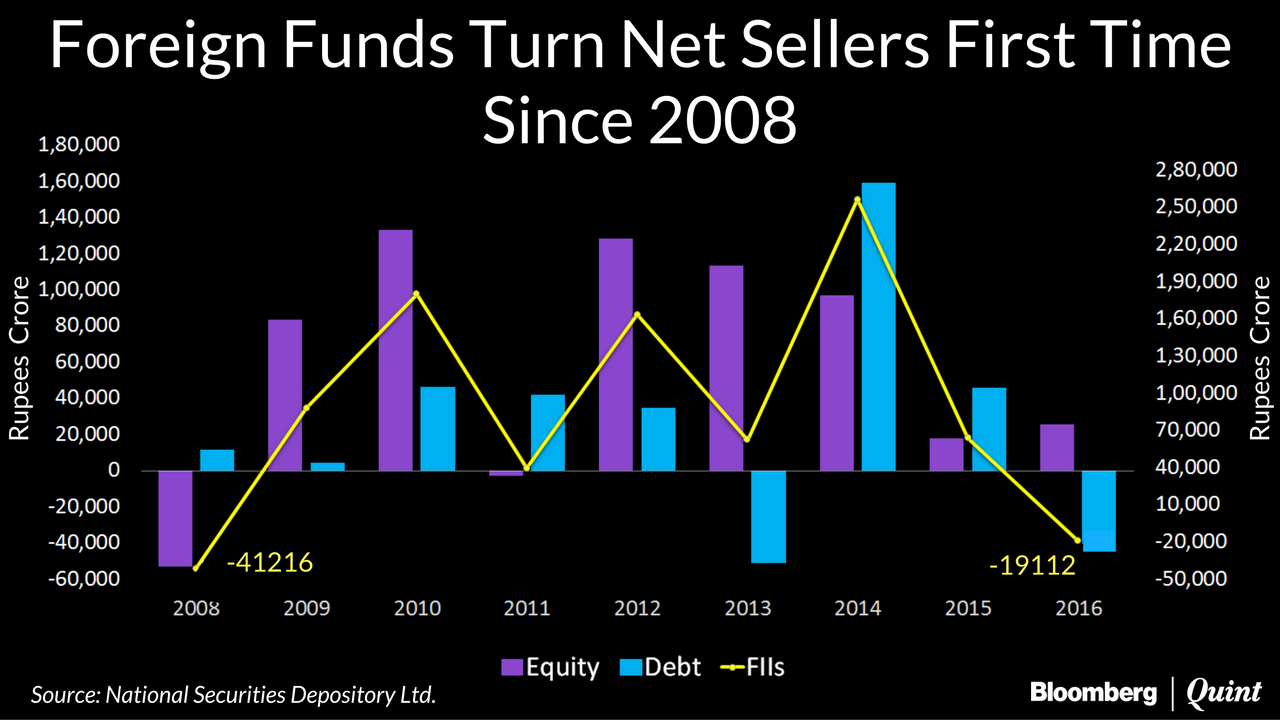

Foreign Institutional Investors have turned net sellers in India for the first time since the global financial crisis. FIIs pulled out Rs 19,112 crore so far this year, with the debt segment bearing the brunt.

Global investors sold Rs 44,685 crore of debt this year, even as they purchased equities worth Rs 25,573 crore. The picture was very different in 2008 when FIIs offloaded equity and bought debt, taking the net outflow to Rs 41,215 crore.

Analysts say the narrowing of the spread between U.S. and Indian bond yields is the main reason behind the sell-off in debt. While U.S. sovereign bond yields rose after Donald Trump's election victory, Indian 10-year bond yields declined after Narendra Modi government's demonetisation decision. The expectation of future rate hikes from the U.S. Federal Reserve is also making Indian bonds less attractive.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.