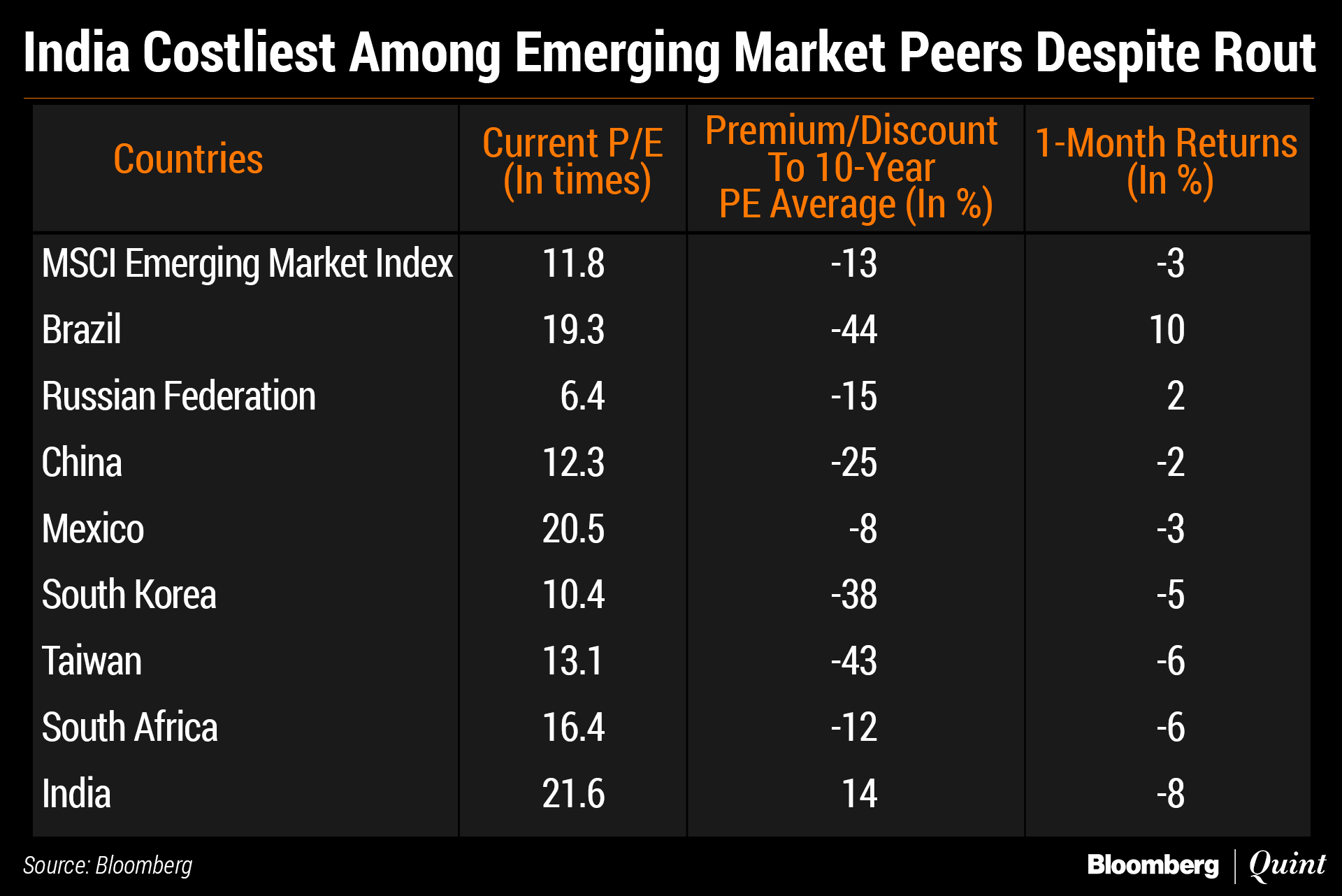

India has been the worst performer among emerging market peers over the last one month. Yet, it's the only country to command a premium to its 10-year average.

The Indian indices fell 8 percent last month compared with a 3 percent decline in the MSCI Emerging Market Index, Bloomberg data showed. Equity benchmarks in China, South Korea and Taiwan fell in the range of 2-6 percent during the period.

India, however, has a price-to-earnings multiple of 21.6 compared to its 10-year average P/E of 18.9 times, a premium of 14 percent, according to data compiled by BloombergQuint.

This suggests that the worst is not over for the Indian markets and the indices would continue to witness a downside, according to brokerages CLSA and Bank of America Merrill Lynch.

CLSA said rising interest rates and political uncertainties aren't fully absorbed by the markets.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.