Dalmia Bharat Ltd. has gained 94 percent in one year, and yet the gap between its current market price and the Bloomberg consensus 12-month price target is at its widest.

The consensus price target provided by 14 analysts is Rs 2,110, which indicates a 43 percent potential upside for the stock from the current market price. 13 of 17 analysts have a 'buy' rating on the stock.

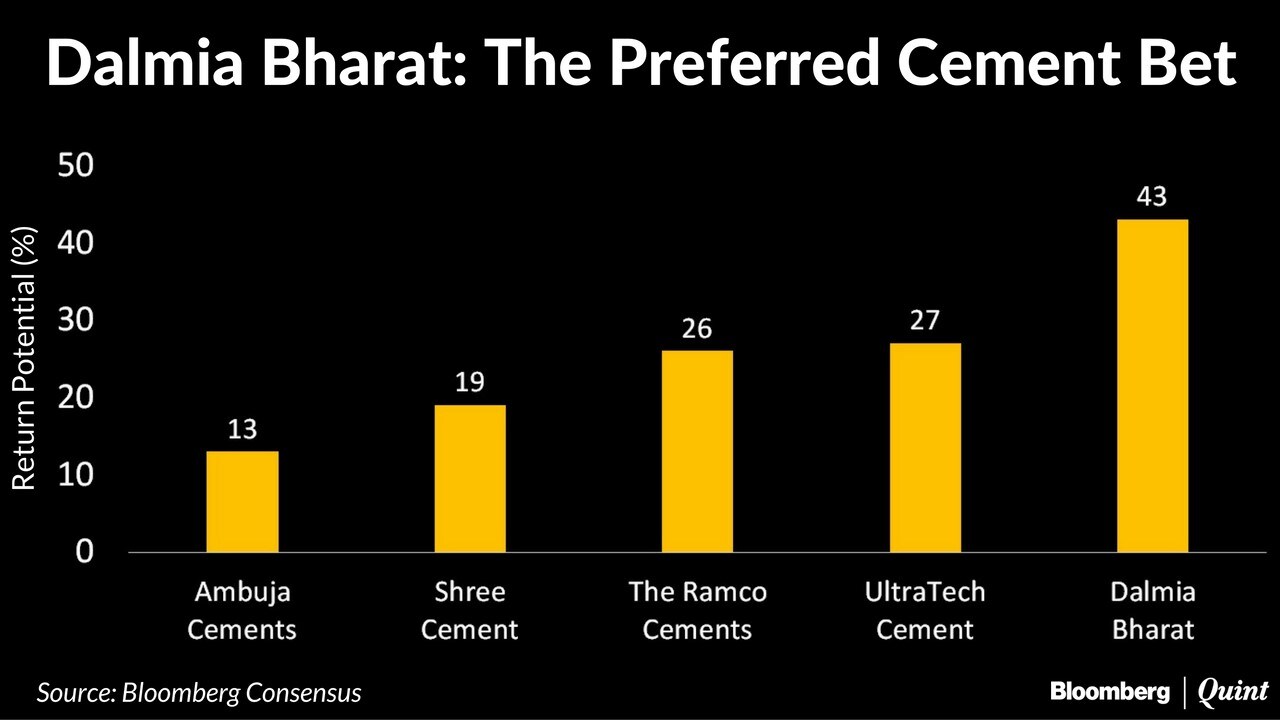

In fact, its return potential based on Bloomberg consensus is also the best when compared to its four largest peers by market capitalisation: Ambuja Cements Ltd., UltraTech Cement Ltd., Shree Cement Ltd., and Ramco Cements Ltd.

So why are analysts most bullish on Dalmia Bharat in the cement industry?

The company's recent proposal to merge with its subsidiary OCL India Ltd. will lead to a simplified corporate structure, which in turn will bring down the tax burden as well as overhead expenses.

Steady earnings over the last two quarters have also led analysts to assign high price targets over the near-term.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.