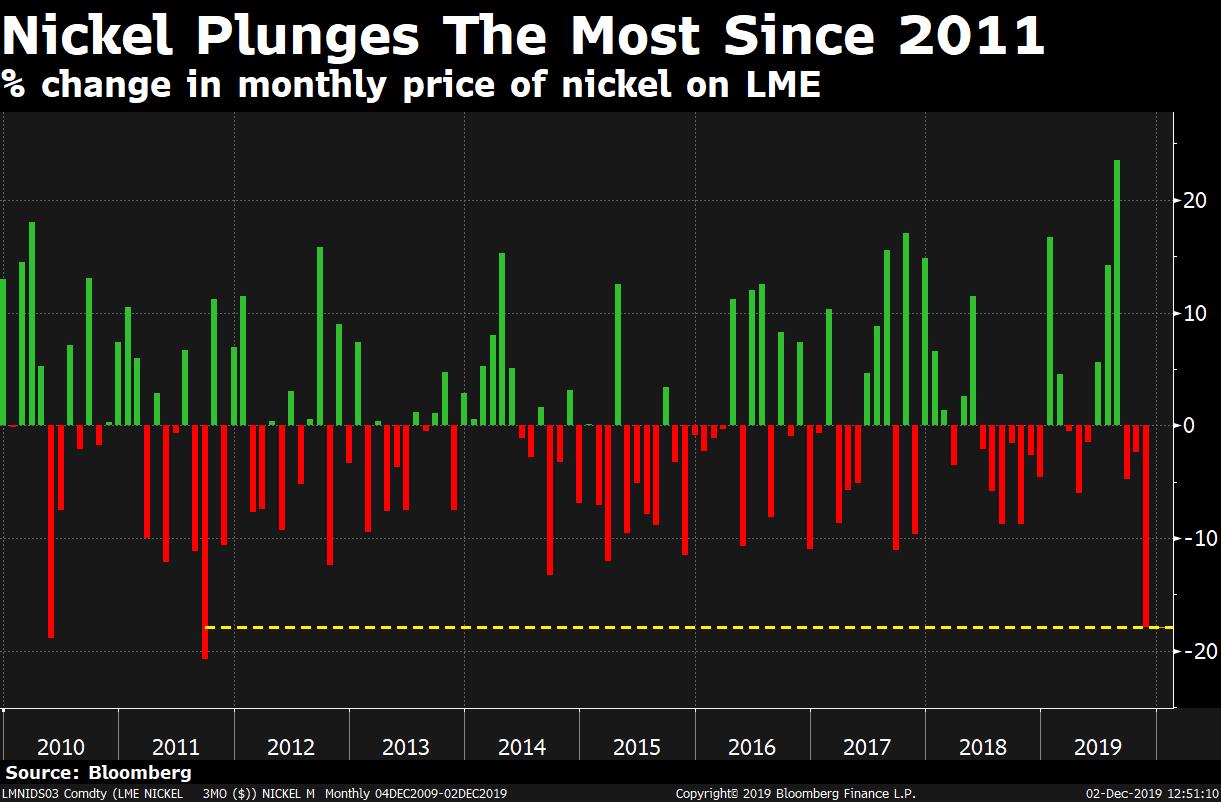

Nickel prices tumbled the most in more than eight years on weakening demand for steel in a slowing global economy.

Prices of nickel, used in steelmaking and batteries, plunged nearly 18 percent in November, according to London benchmark tracked by Bloomberg. That's the biggest fall since September 2011.

Nickel prices have crashed below $14,000 tonne, the lowest since July. The metal entered a bear market after retreating more than 20 percent from its peak of $18,850 a tonne in September, and slipped below the 200-day moving average, a key support indicator, for the first time since May 24.

The decline stems from concerns over a slowdown in China, the world's largest consumer of the metal, and surplus inventory. China's manufacturing purchasing managers' index, a gauge of industrial activity, dropped to the lowest level since February, underlining the uncertainty faced by businesses struggling with weak domestic demand and the trade war with the U.S.

Nickel producers in Indonesia, the world's biggest supplier of ore, have been boosting shipments to China in the run-up to a ban on exports of the raw material commencing from January, causing the inventory to pile up.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.