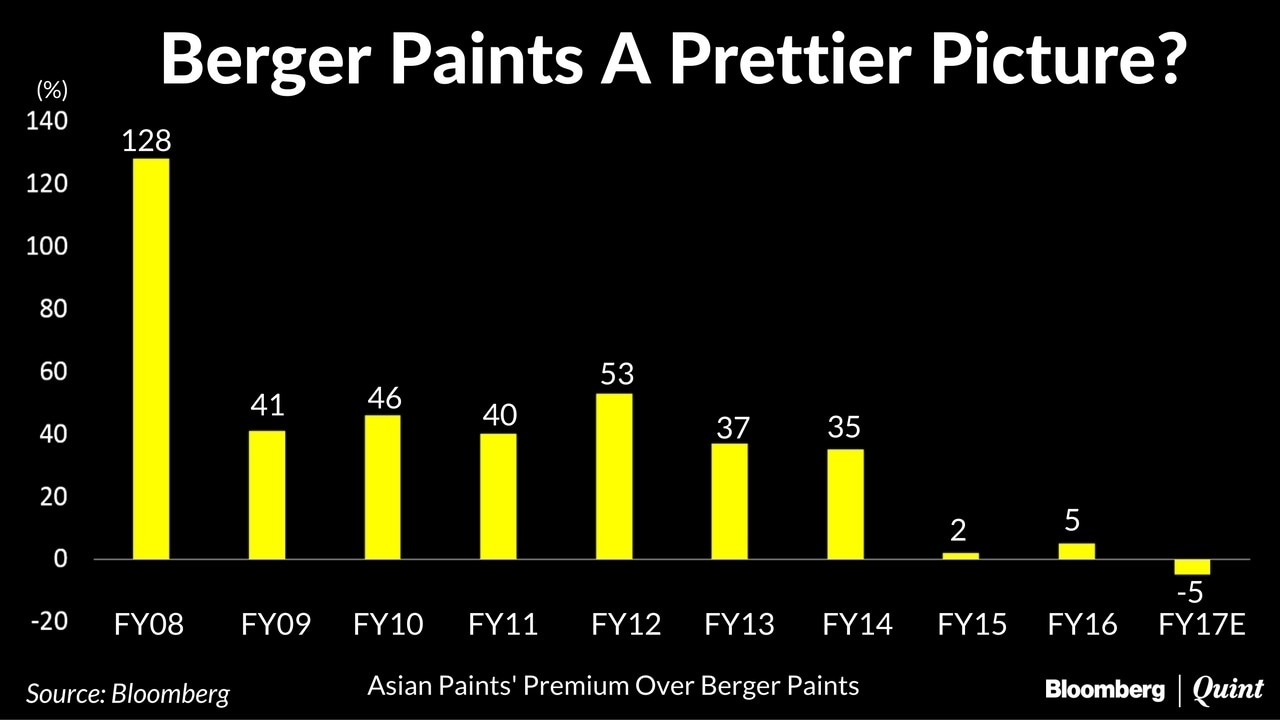

Asian Paints Ltd. has consistently traded at a premium to Berger Paints Ltd., at least over the last ten years. But that premium may turn into a discount for the first time in a decade.

According to Bloomberg estimates, Asian Paints is trading at an estimated price to earnings ratio of 41.29, lower than Berger Paints' PE ratio of 43.65 for financial year, 2017.

In terms of stock price performance, Asian Paints has corrected by a sharper 16.3 percent since November 8, compared to a decline of 14.9 percent in the shares of Berger Paints.

This despite the fact that Berger Paints is expected to take a greater hit from demonetisation, given its higher exposure to the middle income segment and smaller cities where digital payments are less prominent.

So Why This Reversal?

Analysts expect faster margin improvement in Berger Paints than for Asian Paints, led by aggressive dealer network expansion and product premiumisation.

Berger Paints' EBITDA margin is seen at 15.6 percent in FY17 compared to 19.1 percent for Asian Paints, leaving significant room for margin expansion. The recent rally in crude oil prices could act as a dampener though.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.