Shares of Indian Railway Catering and Tourism Corp. extended losses for the fifth consecutive session on Wednesday as its consolidated net profit in the fourth quarter of financial year 2024 missed analysts' expectations.

The company's net profit was up only 1.9% to Rs 284 crore versus Rs 279 crore in the year-ago period. The company also recorded an exceptional gain of Rs 7.89 crore.

IRCTC Q4 FY24 Earnings Highlights (Consolidated, YoY)

Revenue up 20% to Rs 1,155 crore versus Rs 965 crore (Bloomberg estimate: Rs 1,146 crore).

Ebitda up 12% to Rs 362 crore versus Rs 325 crore (Bloomberg estimate: Rs 394 crore).

Margin at 31.4% versus 33.6% (Bloomberg estimate: 34.3%).

Net profit up 1.9% at Rs 284 crore versus Rs 279 crore (Bloomberg estimate: Rs 311 crore).

Board recommends final dividend of Rs 4 per share.

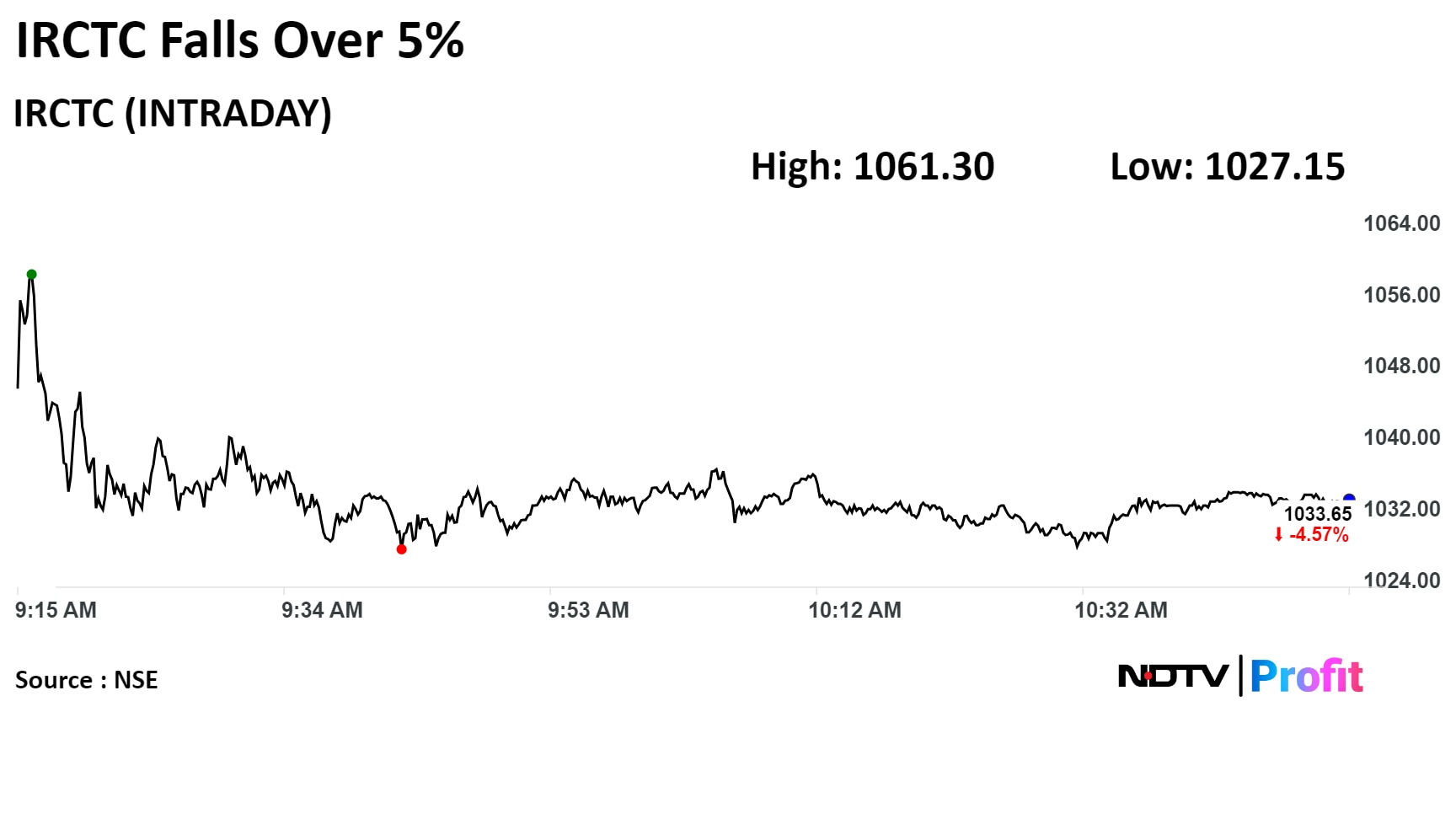

On the NSE, shares of IRCTC fell as much as 5.17% during the day to Rs 1,027.15 apiece, the lowest since May 15. It was trading 4.45% lower at Rs 1,034.60 per share, compared to a 0.63% decline in the benchmark Nifty at 11:03 a.m.

The share price has risen 16.47% on a year-to-date basis and 59.28% in the last 12 months. The total traded volume so far in the day stood at 1.58 times its 30-day average. The relative strength index was at 46.22.

Four out of the nine analysts tracking the company have a 'buy' rating of the stock, two recommend 'hold' and three suggest 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 12.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.