Bernstein Research has initiated coverage on Bajaj Finance Ltd., saying that the non-banking lender had been a "superstar" in the Indian lending landscape. However, the brokerage expects a downside of 7% for the stock against its previous close, given the cyclical headwind and intensified competition.

Bajaj Finance bagged a 'market-perform' rating with a target price of Rs 6,800 per share, compared to the scrip's previous close of Rs 7,341.55.

The non-banking financial company's "stellar" earnings trajectory and "tremendous" execution discipline have led to great interest in the firm. A relatively benign competitive environment, a sharp surge in consumption credit and a rise in the consumption cycle also aided the lender over the last decade, Bernstein said in a note on June 18.

The brokerage expects a downside as much of the story is priced into valuations currently alongside its other challenges. It said the business faces a cyclical headwind as the cycle turns from consumption to investment.

The scale-up in new segments has limited overlap with current core segments and the competition in the retail lending segment has significantly intensified, it said. "Given these challenges, we expect a greater tussle between growth versus profitability than what is priced in."

Bernstein said that the lender's business model and execution will remain as strong as ever, but it might just not be enough to meet the very high expectations.

The brokerage has also initiated coverage on IndusInd Bank Ltd. and Muthoot Finance Ltd. with a potential upside of 28% and 14%, respectively.

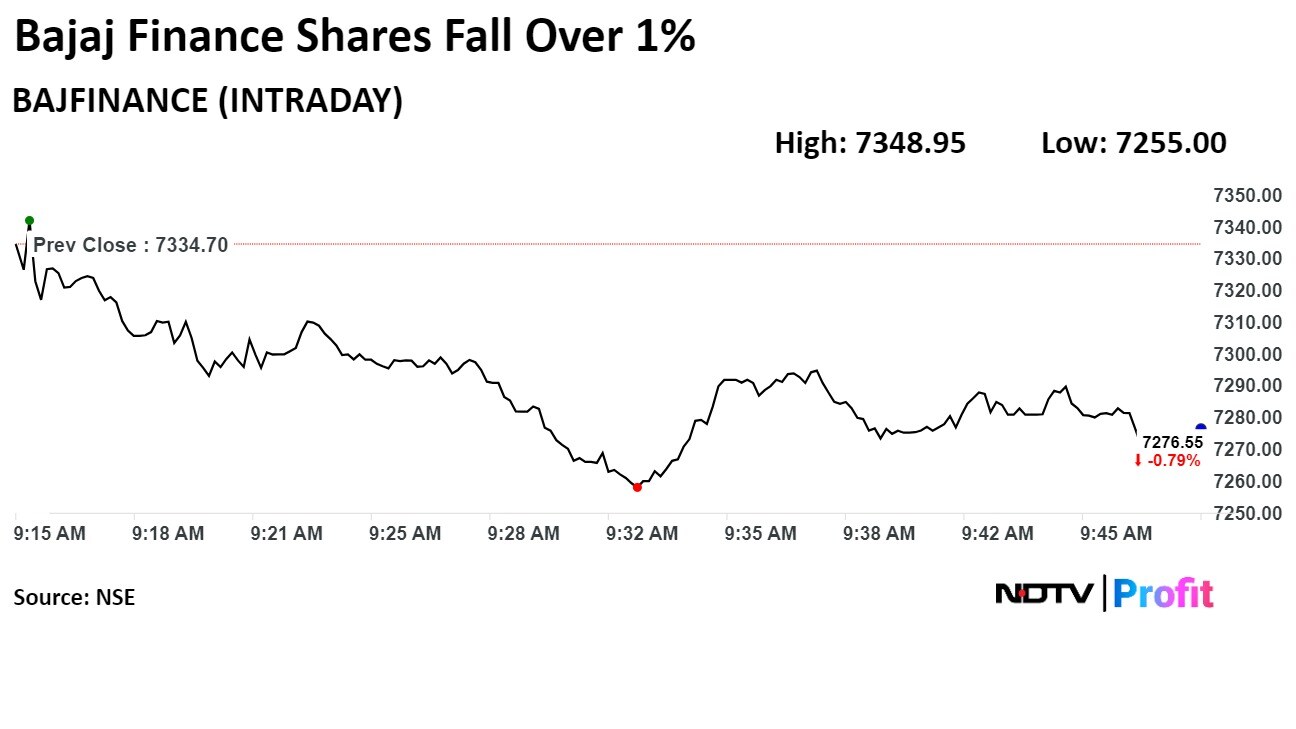

Bajaj Finance's stock fell as much as 1.09% during the day to Rs 7,255 apiece on the NSE. It was trading 0.73% lower at Rs 7,281.3 apiece, compared to a 0.01% decline in the benchmark Nifty 50 as of 9:44 a.m.

It has declined by 1.37% in the last 12 months and 0.54% on a year-to-date basis. The relative strength index was at 50.

Twenty-eight out of the 36 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.