Shares of IRB Infrastructure Developers Ltd. hit an upper circuit on Thursday as Ferrovial S.E. unit, Cintra, will buy a 24% stake in IRB Infrastructure Trust from GIC affiliates.

"It is clarified that the company will continue to act as the sponsor and the project manager to the private InvIT and will continue to hold approximately 51% of the units in the private InvIT and approximately 51% of the equity share capital of the investment manager," an exchange filing said.

Cintra and an affiliate of GIC have also entered into an arrangement with Meerut Budaun Expressway Ltd., under which Cintra will have the right to exercise a put option over 4.7% of each of the NCDs and equity shares of MBEL held by the GIC affiliate. This will be upon expiry of two years from the commercial operations date, the filing said.

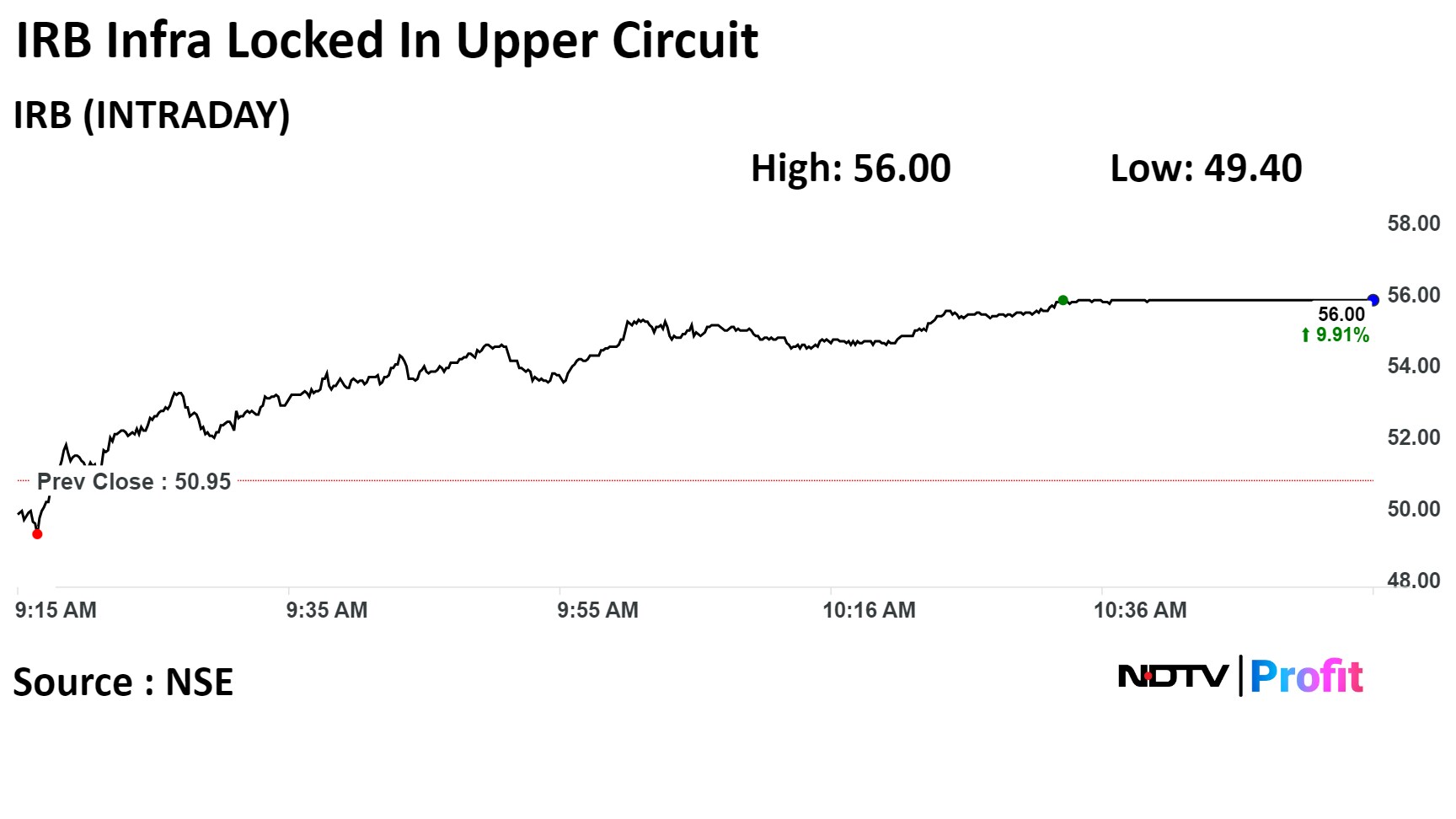

Shares of the company rose as much as 10% to Rs 56 apiece and were locked in the upper circuit limit as of 11:10 a.m. This compares to a 0.4% advance in the NSE Nifty 50.

The stock has risen 122.66% on a year-to-date basis. The total traded volume so far in the day stood at 1.35 times its 30-day average. The relative strength index was at 41.22.

Of the nine analysts tracking the company, five have a 'buy' rating on the stock, two recommend 'hold' and as many suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.