SBI Cards & Payment Services Ltd.'s healthy spending growth might be a bane for its profitability.

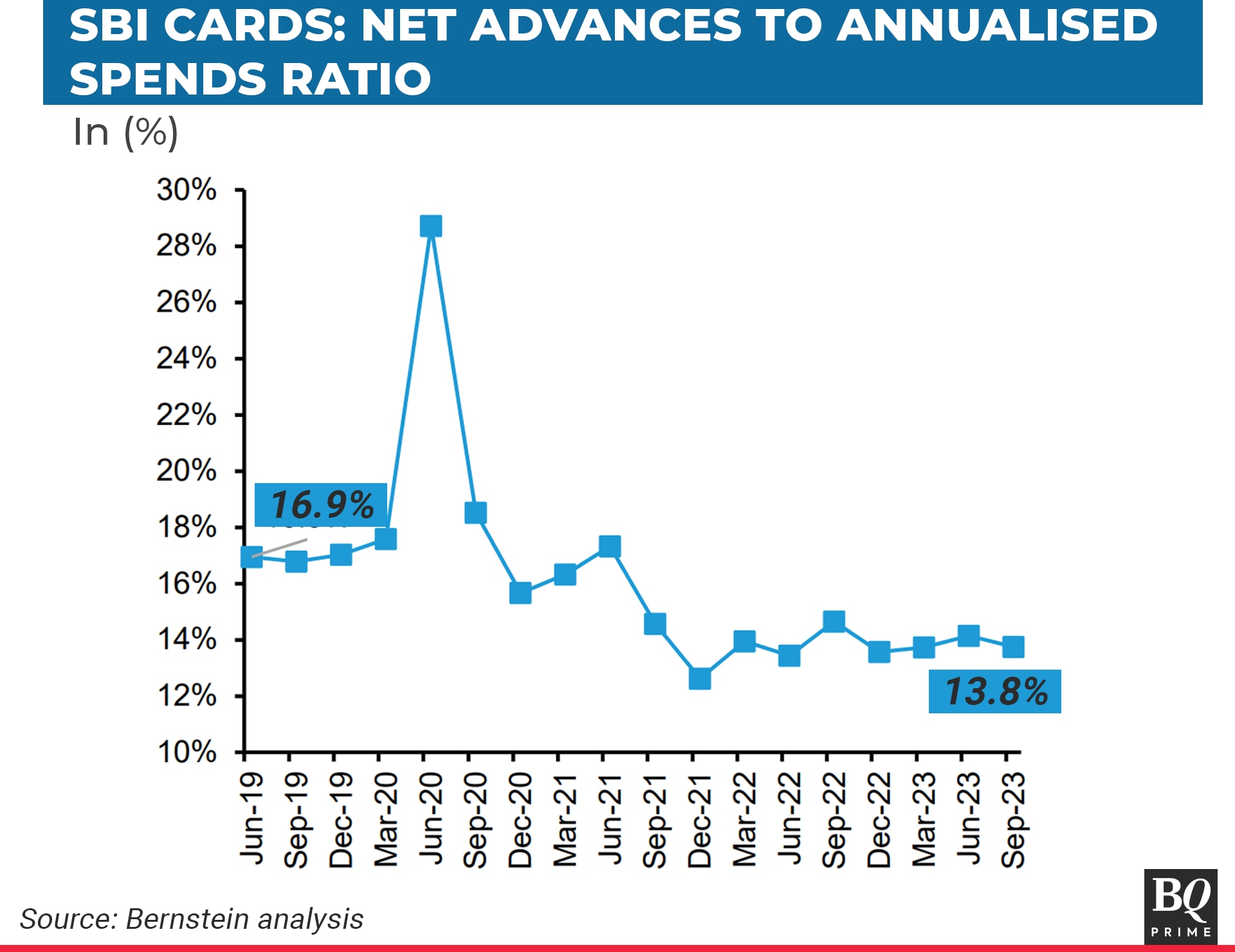

According to analysts at Bernstein Research, the credit card company's lowering 'net advances-to-annualised spends' ratio is making it less attractive as an investment option.

The ratio between SBI Card's credit business and the spends it is recording has declined to 13.8% as of September, as compared with a high of over 28% in June 2020. The main reason for this seems to stem from the fact that users are paying back their credit card dues in full, leading to fewer interest-income opportunities.

Customers revolving their credit card dues contributed 24% of net advances as of Sept. 30, as compared with over 40% in June 2020.

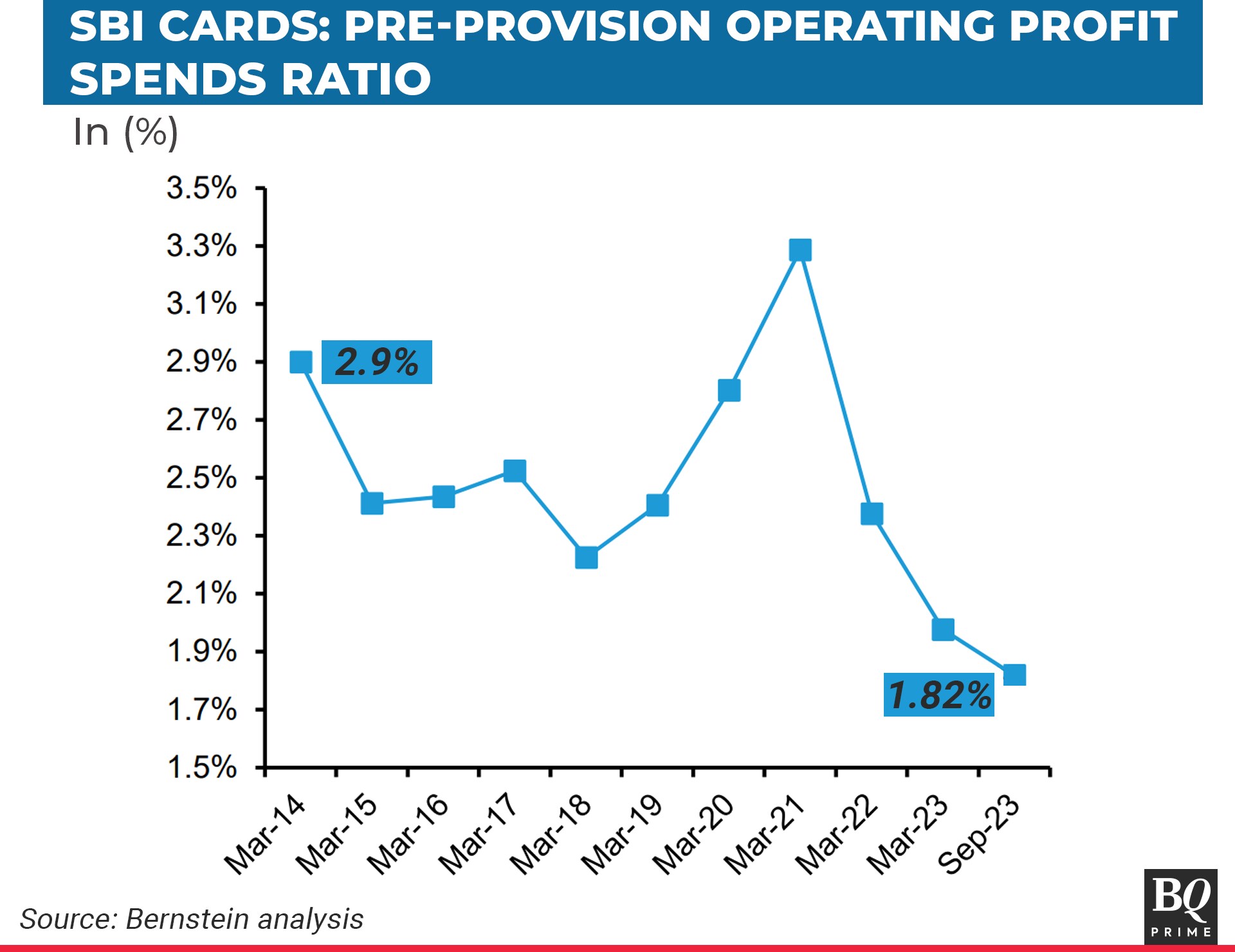

The lack of enough customers revolving around their credit card dues is resulting in slower growth in the pre-provisioning operating profit, the analysts said. SBI Card's monthly credit card spends have risen 27% year-on-year in September to Rs 24,966 crore, as compared with 24% for the entire system.

"If the PPoP to spends ratio continues to decline, then the earnings growth ahead would be a lot weaker (mid-teens is our expectation) even if the spends growth remains healthy at 20–30% YoY growth," they said.

The pre-provisioning operating profit to spend ratio declined to 1.82% in September, as compared with 3.3% as of March 2021 and 2.9% as of March 2014.

The Bernstein analysts noted the example of credit card businesses in the United States of America, where credit card spending was actually loss-making for the card issuers. This was because interchange and annual fees earned on the cards were lower than the rewards paid out to customers.

Bernstein has an "underperform" rating on SBI Cards & Payment Services, with a target price of Rs 620 per share. As of 2:03 p.m. on Thursday, the credit card company's stock was trading at Rs 752 apiece.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.