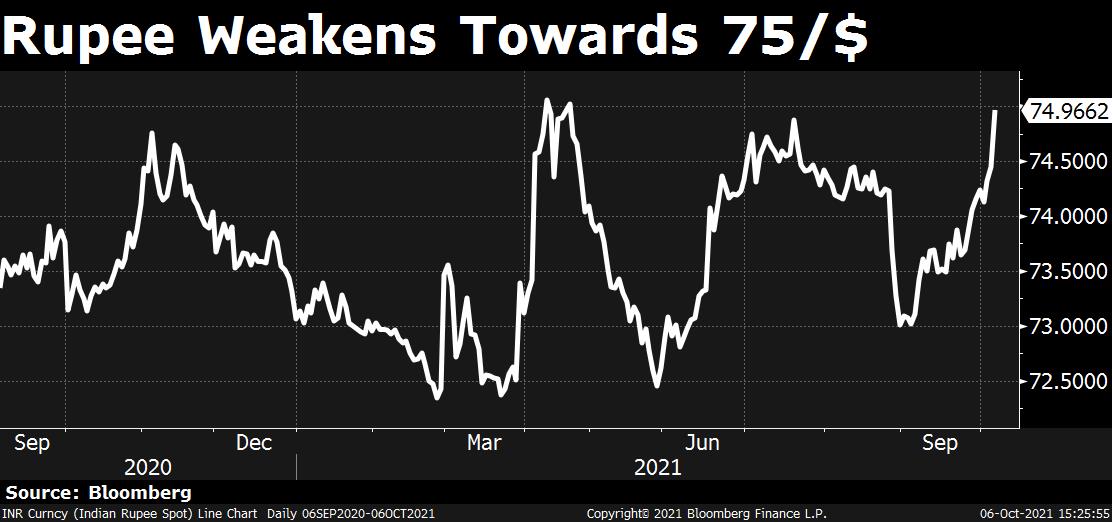

The Indian rupee continued to slide on Wednesday, moving towards the 75-a-dollar mark. The local currency's trading at a near six-month low against the U.S. dollar.

Over the past one month, the rupee has weakened by nearly 2.5% and is one of the worst performing Asian currencies. A stronger dollar, a steady climb in U.S. bond yields, higher oil prices have all been factors behind the depreciation of the rupee.

The rupee will continue to be under pressure amid a surge in oil prices that are at multi-year highs, said Imran Kazi, vice president at Mecklai Financial. Brent crude oil moved past $82 per barrel, the 10-year treasury yield moved higher above 1.5%, and the dollar index moved past the 94 mark, Kazi said, explaining the confluence of factors weighing on the rupee.

The fact that most economies are moving towards monetary tightening won't help emerging market currencies either, he said.

The dollar/rupee pair should face some resistance in the 74.80-75/$ band, but a break of that can trigger a significant upmove in the dollar against the rupee.Imran Kazi, Vice President, Mecklai Financial

Market participants now await the outcome of the Reserve Bank of India's monetary policy review, said IFA Global in a note on Wednesday. Traders will also wait to see when the central bank steps in to support the currency, which will help draw a line in the sand for levels to watch for.

The rupee closed near 75/$, the highest level since April 23 this year, said Anindya Banerjee of Kotak Securities. "A combination of rising oil prices, fear of liquidity ebbing due to central banks rolling back easing measures, rising bond yields, and weakness in stocks, all have had a negative impact on rupee," he said.

In addition, carry traders were forced to cover short positions once the rupee 74.65 levels, said Banerjee, adding that the rupee may trade within a range of 74.80 and 75.40 over the near term.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.