(Bloomberg) -- Polish inflation fell to the central bank's target for the first time in three years in March even as policymakers are expected to keep interest rates steady due to concerns over resurgent price growth later in 2024.

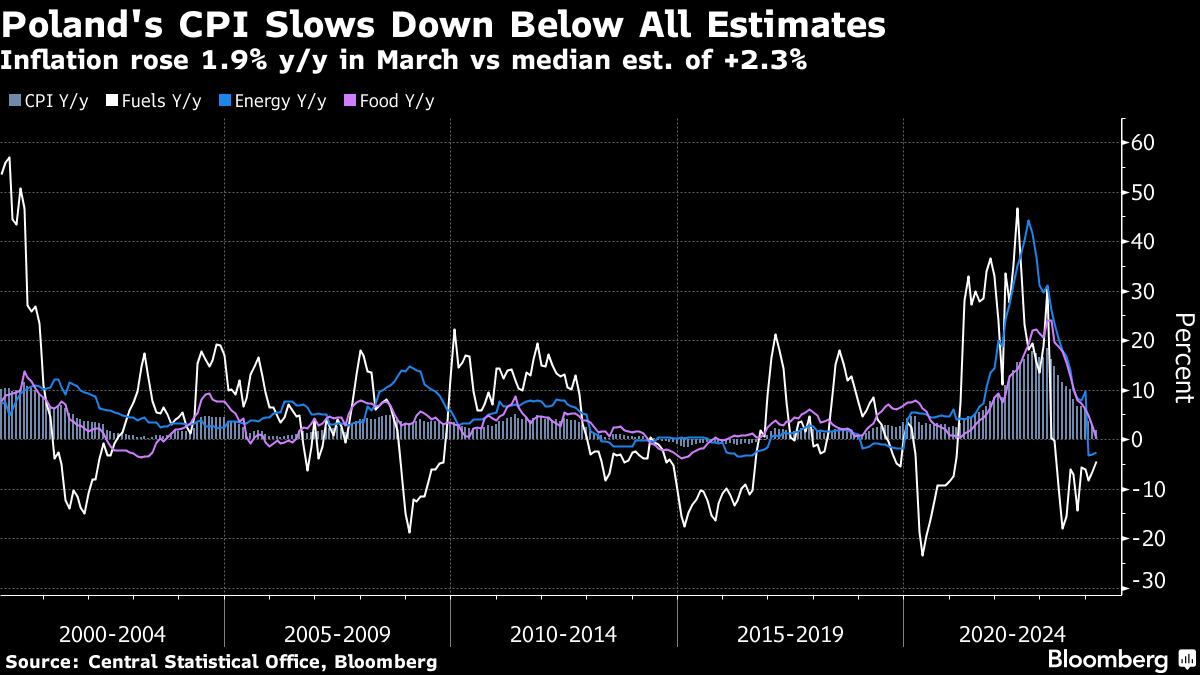

The consumer price index rose 1.9% this month on an annual basis, slipping below the central bank's 2.5% medium-term price goal, data from the Central Statistics Office showed on Friday. Inflation stood at 2.8% in February and the March reading undershot all 22 forecasts in a Bloomberg survey, whose median amounted to 2.3%.

Central bankers have said that they aim to keep monetary policy tight despite slowing price growth as higher taxes on food and a lifting of energy-price caps is expected to revive price growth within months.

“Inflation is only in the target for a while — it will rise again soon,” Ludwik Kotecki, a member of the central bank's rate-setting Monetary Policy Council, told public television before the reading. CPI may jump as much as 8% at the end of 2024, in the worst case scenario, he said.

Gabriela Maslowska, another central bank policymaker, told PAP news agency that rate setters have factor in “significant uncertainty” over inflation — and said rate hikes can't be ruled out. Poland has kept its benchmark at 5.75% since October, when inflation stood at 6.6%.

Poland's new government applauded the data, saying it was further evidence that the country's economy was in good shape.

“Wages are up, inflation is down, the zloty is strong, GDP is growing, unemployment is record low,” Finance Minister Andrzej Domanski said on X, formerly known as Twitter. “Last week, there was 9 billion zloty of demand for Polish bonds. We're gradually getting the economy back on track.”

--With assistance from Piotr Bujnicki.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.