Have you lost your PAN card? The Income Tax Department enables PAN or Permanent Account Number holders to verify their personal identification number online. PAN is a 10-character alphanumeric number issued to income tax assessees, and is used by the taxman to identify them. The user is required to enter details such as name, date of birth and PAN (available with him or her) to verify if the same is valid or not, according to Income Tax Department's e-filing portal - incometaxindiaefiling.gov.in.

How to find out if you have the correct PAN card details or not

To be able to verify your PAN details on the Income Tax Department's website, the user should first click on the "Verify Your PAN Details" link on the e-filing website.

(Also read: How to apply for a PAN card, check application status online | What happens if you hold more than one PAN?)

On the next page, the user is required to provide basic details including the PAN available with him or her. Once done, he/ she can proceed by clicking on the "Submit" button at the bottom of the page.

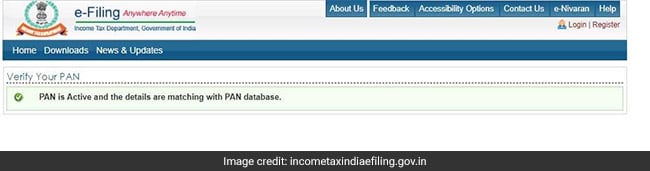

Income Tax Department confirms the entry of a valid PAN along with correct details by displaying the message: “PAN is Active and the details are matching with PAN database."

(“PAN is Active and the details are matching with PAN database" - this message appears if PAN, details are valid.)

In case the PAN entered by user is invalid, the portal displays the message: "No record found for the given PAN."

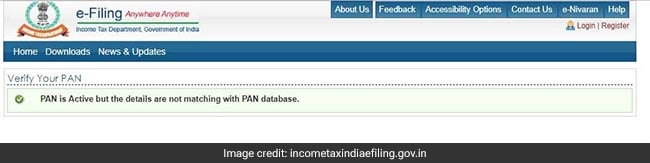

In case the PAN is valid but the details - such as name and date of birth - entered by the user do not match with the given PAN, the Income Tax Department's portal confirms the same by displaying the message: "PAN is Active but the details are not matching with PAN database."

("PAN is Active but the details are not matching with PAN database" - this message appears if PAN is valid but the details do not match.)

Those with incorrect details fed into the PAN database can apply online to make corrections.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.