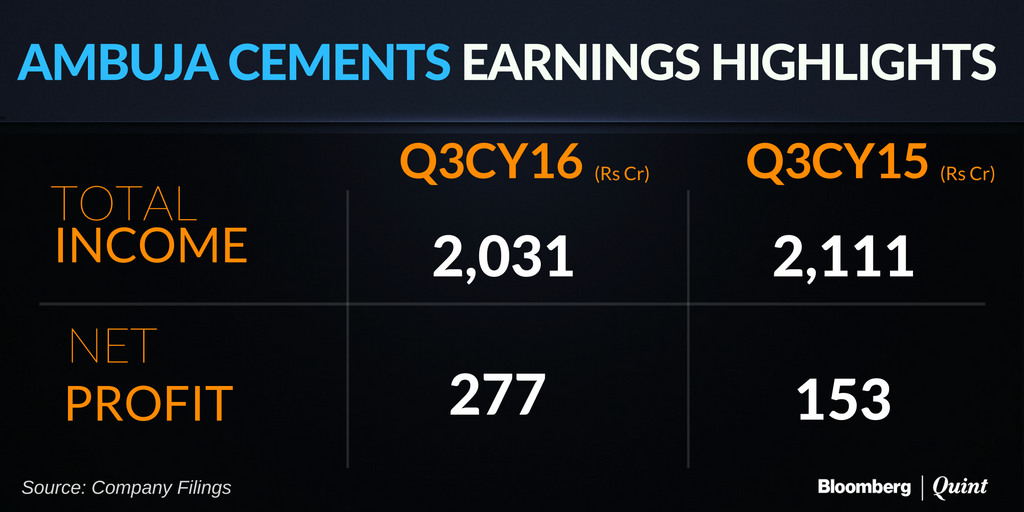

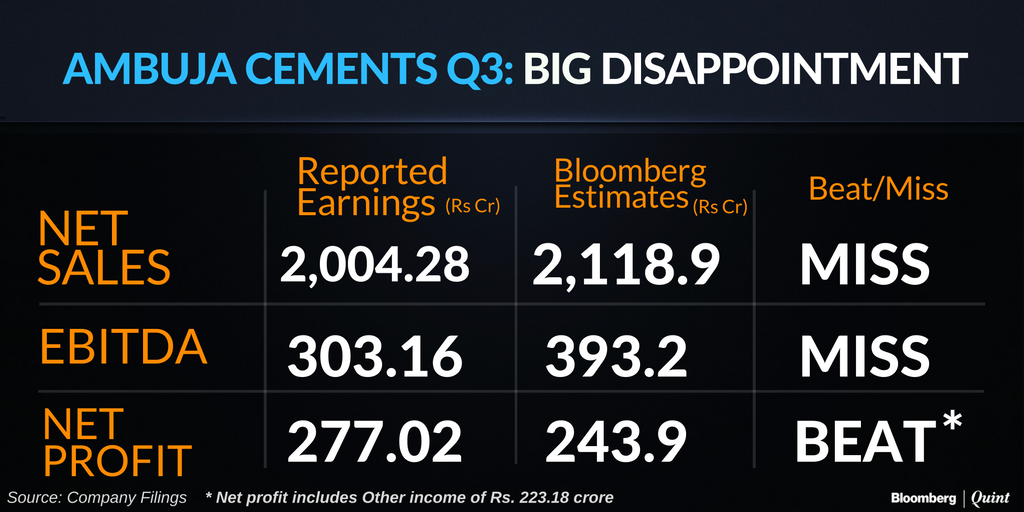

Ambuja Cements Ltd.'s net profit increased 80 percent to Rs 277 crore in the third quarter of calendar year 2016 from Rs 154 crore in the same quarter last year.

Profit was boosted by other income which grew three times to Rs 223.18 crore compared to Rs 74.10 crore in October last year, after the company received a dividend payout from ACC Ltd., after the amalgamation of Holcim lndia Pvt Ltd. with itself.

The said increase is mainly on account of dividend income of < (Rs) 103 crore from ACC Ltd, upon amalgamation of Holcim lndia Pvt Ltd. with the company.Ambuja Cements' statement on stock exchanges

Total income fell 3.76 percent to Rs 2,031.44 crore from Rs 2,110 .87 crore on a year-on-year basis, the company said in a filing on the Bombay Stock Exchange. The decline was on account of lower volume growth.

The cement maker disappointed the street as net sales fell to Rs 2,004.3 crore against the Bloomberg consensus estimate of Rs 2,118.9 crore. Earnings before interest, tax, depreciation and amortisation stood at Rs 303.2 crore for the quarter, again missing the Bloomberg consensus estimate of Rs 393.2 crore. EBIDTA fell due to lower volume pick-up on account of heavy monsoons and higher diesel costs.

The EBITDA margin did register a slight uptick of 23 basis points to 14.92 percent from 14.69 percent over the same period last year.

Power and fuel costs grew two-fold year-on-year to Rs 975.07 crore in the third quarter, compared to Rs 487.35 crore in the same period last year.

Sales Volumes Disappoint

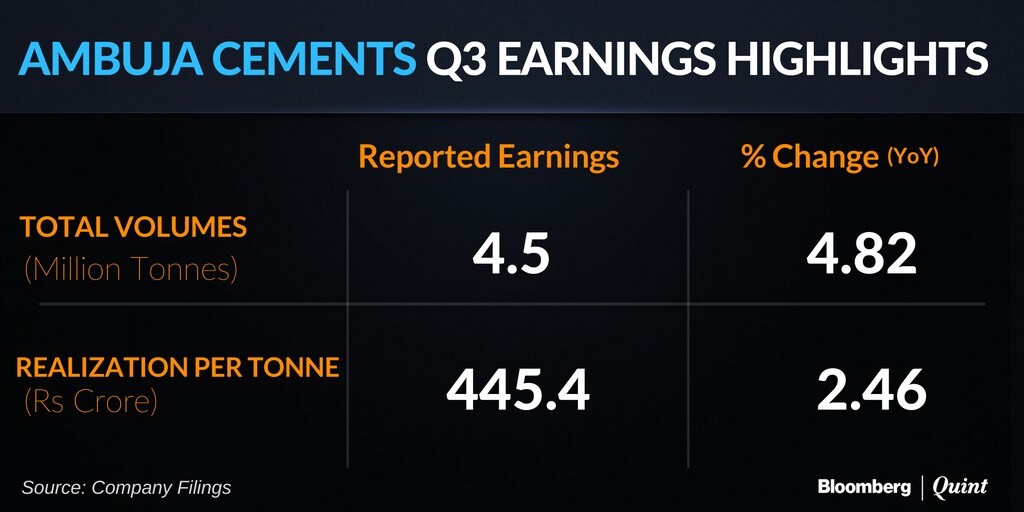

Heavy rains in Ambuja Cements' core markets in India led to a 6.6 percent decline in sales volume on a year-on-year basis to 4.50 million tonnes. Sales realisations improved 2.8 percent in the same period.

Optimistic Outlook

The company is optimistic over the medium to long term, it said in its media statement.

The medium- to long-term outlookfor cement demand remains positive considering good monsoon this year and the government'sfocus on housing and infrastructure development. Ambuja Cements would continue to focuson improving operational efficiency.Ajay Kapur, MD & CEO, Ambuja Cements

Post the announcement, shares of the company fell as much as 2.1 percent, only to erase the losses and gained as much 2 percent to Rs 245.40 per share.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.