Reliance Industries Ltd. will likely claim the lion's share of the Indian e-commerce space due to its retail and mobile network, digital ecosystem and "home-field advantage in a famously complex regulatory and operating environment", according to Alliance Bernstein LP.

In a report on Wednesday, the U.S. asset management firm said the Indian e-commerce market is expected to reach $133 billion by 2025 from $24 billion in 2018, a rise of over five times with a compound annual growth rate of around 30%.

"This is a $100-billion incremental opportunity with only three scaled players in the market (Amazon.com Inc., Reliance and Walmart Inc.)," it said. "The winner in the Indian e-commerce market will be the one with the most compelling integrated value proposition, offline + online + prime."

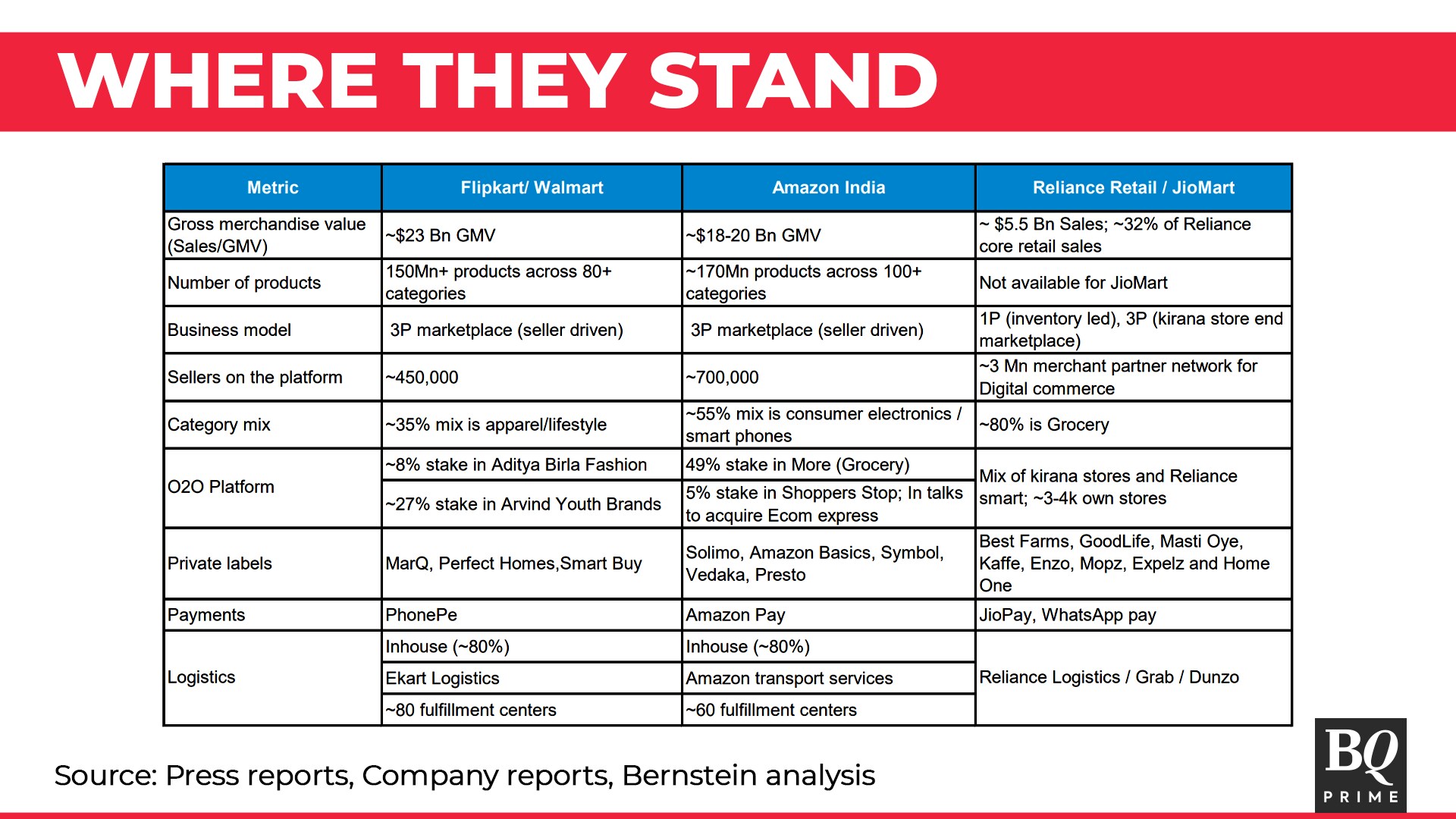

Bernstein highlighted that Reliance had the most disruptive playbook, using an integrated approach to consumers—$18 billion gross merchandise value (Reliance Retail Ventures Ltd.), 35.5 crore consumers (Jio Platforms) and compelling prime apps (JioTV, MyJio, JioSaavn and Jio Prime). "This makes RIL the only Indian player to have an integrated offering and the ability to compete with global tech giants (Amazon, Walmart)."

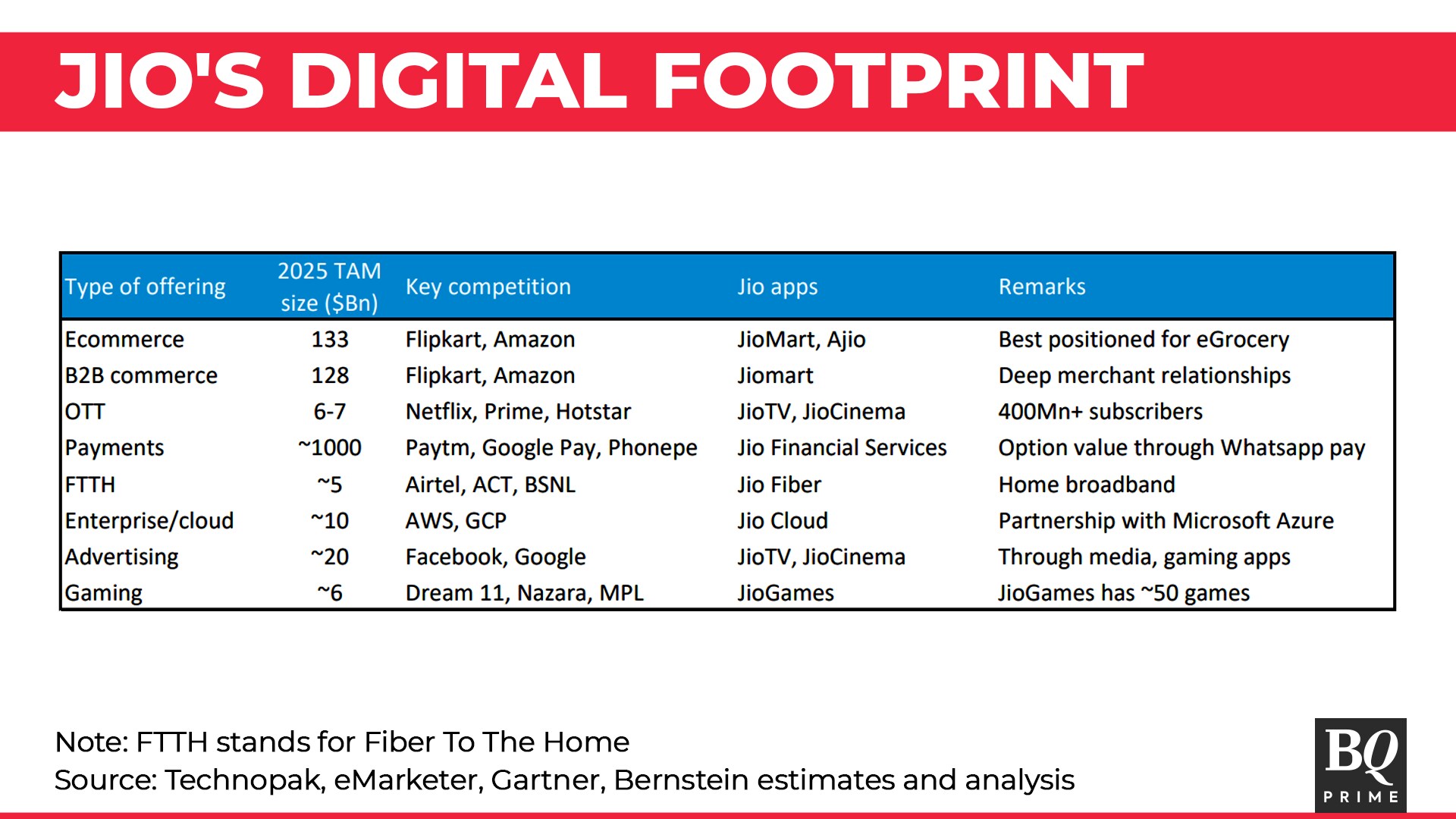

Bernstein expects Jio to become the core platform for India's digital economy, based on the launch of JioMart to build e-commerce, partnership with Facebook to build a communications platform through WhatsApp Business and deep content distribution of Jio apps. "We view this capability as Jio's strength in the digital economy and a core component of India's digital ecosystem."

Fashion

Reliance is well-poised in the fashion segment as well. "India added over 4 crore online shoppers in 2022 and 1.6 crore were added from fashion," Bernstein said. "Reliance is strongest positioned in fashion with AJio and Reliance Trends, with a 20% market share."

According to it, a regulatory policy would also work in favour of Reliance. "FDI regulations disallow non-Indian e-commerce firms from running the first-party model in India or owning more than 25% equity stake in a seller on its platform."

This basically means that both Amazon and Walmart (Flipkart) operate through a marketplace model with affiliate sellers—with equity stake—and third-party sellers instead of an inventory model, which Reliance can deploy. Such a model gives the advantages of inventory control, pricing and better customer experience, according to Bernstein.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.