Systematic investment plans, seen as the most-durable source of inflows for the mutual funds sector, have been added at a rapid clip in 2022.

This has mitigated the impact of a rise in SIP closures in the recent past, , according to data from the Association of Mutual Funds in India.

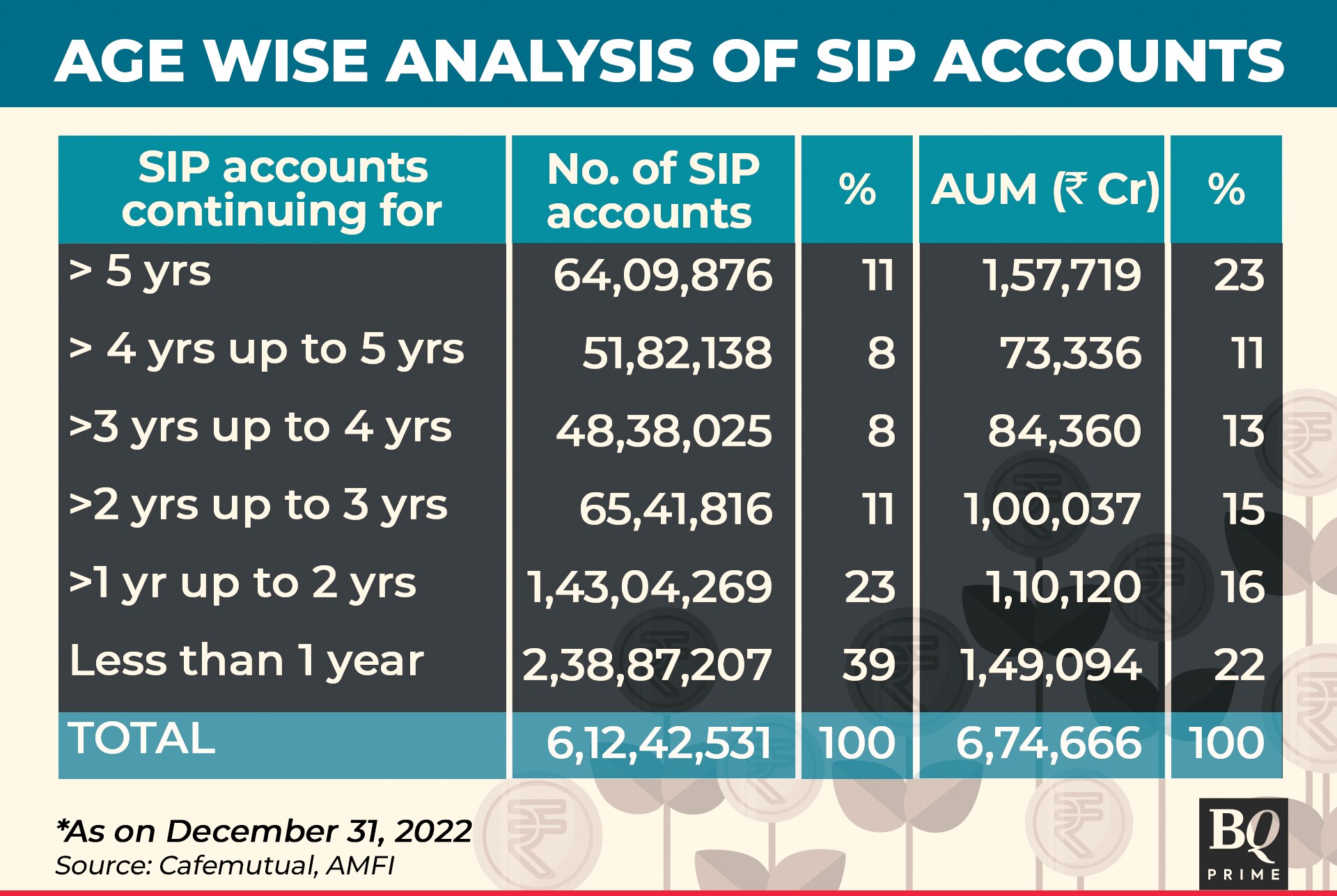

The Indian mutual funds industry had a total of 6.12 crore SIP accounts till Dec. 31, the data compiled by Cafemutual showed. The number net rose by over 1.21 crore in 2022.

As many as 1.17 crore SIP accounts were closed in 2022, according to the data. If it were not for account closures, the total number of such accounts would have been significantly higher.

The outperformance of equity markets in 2020 and 2021 brought a rush of new investors, both to the stock market and the mutual fund industry. The benchmark Nifty rose 14.9% in 2020 and then 24.1% in 2021. Last year, however, was lacklustre with a rise of only 4.3%.

There have been some that attributed the closure of SIPs to an underperformance of equity in 2022. But, Amol Joshi, founder of PlanRupee Investment Services, believes that it is only a small reason for the churn.

"SIP stoppage and closures are as old as the hills. There have been many instances over the past decade when there has been a spike in closures," Joshi said.

"The primary reason for the current churn is the rapid rise in digitisation. It is much easier for a retail investor to pause or even close an SIP."

A large number of investors who started SIPs during the Covid-19 pandemic have not experienced a major fall in the equity market, said Kirtan Shah, founder of Credence Wealth Advisors Pvt..

"That's why, despite advice to the contrary, there is a propensity to chase returns. This churn is a consequence of investor behaviour and technology," he said.

"A lot of investors tend to look at the performance of their mutual fund equity on a daily basis—just like they would their direct equity portfolio."

A large part of this is re-allocation by the more active investors, Joshi added.

The data compiled by Cafemutual shows that a substantial amount of assets under management in SIP accounts is those that were started at least three years ago and going back over five years. As much as 47% of assets under management in SIP accounts are in those that have been running for over three years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.