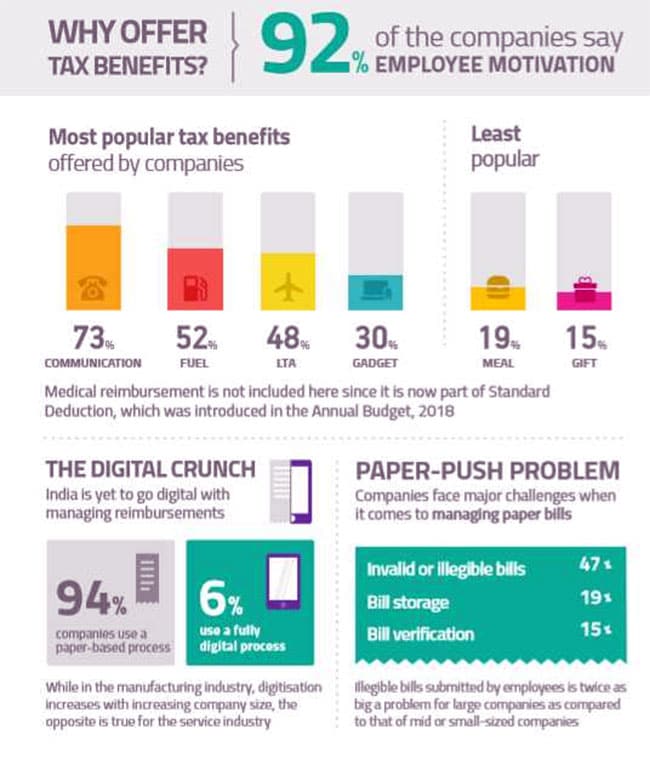

Companies often offer the option of filing medical, conveyance and telephone bills to their employees, to claim income tax deduction. However, a significant majority of employees opt out of it thinking that this will increase their-in-hand salary, a survey found. The survey by data measurement company Nielsen and fintech startup Zeta stressed on the need to make employees aware of the income tax benefits that these reimbursement claims offer. A total of 56 six per cent of employees who opt out of reimbursements do so for a higher in-hand salary, according to the findings of the survey.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.