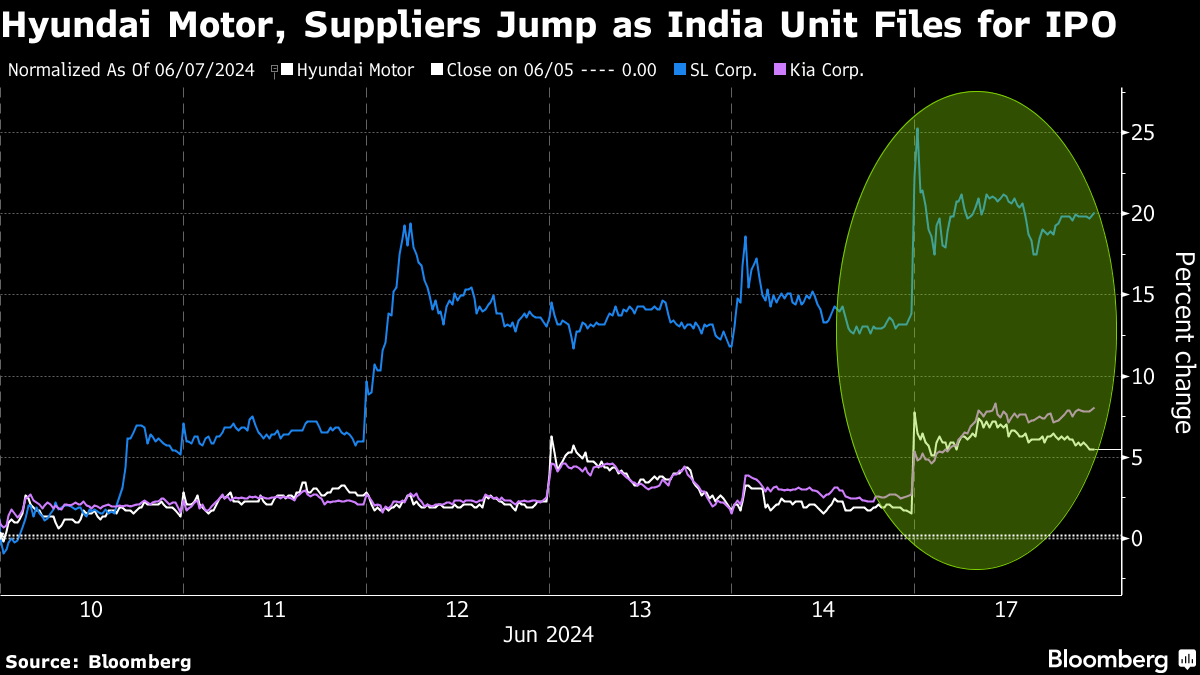

(Bloomberg) -- Plans for what may be one of India's largest-ever initial public offerings boosted Hyundai Motor Co.'s stock to a record high.

The Korean automaker is selling a 17.5% stake in Hyundai Motor India Ltd., according to its draft red herring prospectus. Shares of Hyundai — which will collect all of the proceeds from the IPO of its local unit — rose 3.9% Monday in Seoul. Related stocks also got a lift.

The maker of the Genesis sedan is seeking to raise about $2.5 billion in the IPO, with a potential listing planned by the end of the year, Bloomberg News reported last week, citing people familiar with the matter. That would rival the 2022 listing of Life Insurance Corp. of India for the nation's largest IPO on record.

Hyundai has been locked in competition with rivals including Maruti Suzuki India Ltd. and Mahindra & Mahindra Ltd. as India's car demand shifts toward sports utility vehicles and electric models. Shares of Maruti's parent Suzuki Motor Corp. fell 3.6% in Tokyo, while Indian markets were closed for a holiday.

The IPO sends “a clear message that Hyundai Motor's India investment will increase,” said Shin Yoonchul, an analyst at Kiwoom Securities Co. “While investors had expected higher investments in North America and Europe, they had not expected a big output increase in India. Investors are searching for the companies that have entered India and will see high growth in orders.”

Hyundai's suppliers and subsidiaries climbed on expectations they'll benefit from expansion by the automaker in the South Asian nation. SL Corp. jumped 5.5% while HL Mando Co. gained 5.3% and Kia Corp. rose 5.2%.

(Updates stock moves as of Monday's close)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.