HDFC Life Insurance Co. will raise up to Rs 1,000 crore via non-convertible debentures, according to an exchange filing on Wednesday.

The insurer received an in-principle approval by the board for a proposal to raise funds through issuance of up to 90,000 non-convertible debentures for an aggregate nominal value of up to Rs 900 crore. The company also has a green shoe option of up to Rs 100 crore, according to the exchange filing.

The NCDs are proposed to be listed on the WDM segment of the National Stock Exchange of India Ltd., it said.

HDFC Life's net profit rose 14% year-on-year in the October–December quarter, meeting analysts' estimates.

The insurer posted a net profit of Rs 415 crore in the quarter ended Dec. 31, 2024. That compares with a consensus estimate of Rs 417 crore by analysts polled by Bloomberg. In the year-ago period, the company posted a net profit of Rs 365 crore.

The value of new business during three months to December grew, surprising analysts and brokerages. Most of them maintained their rating and target prices.

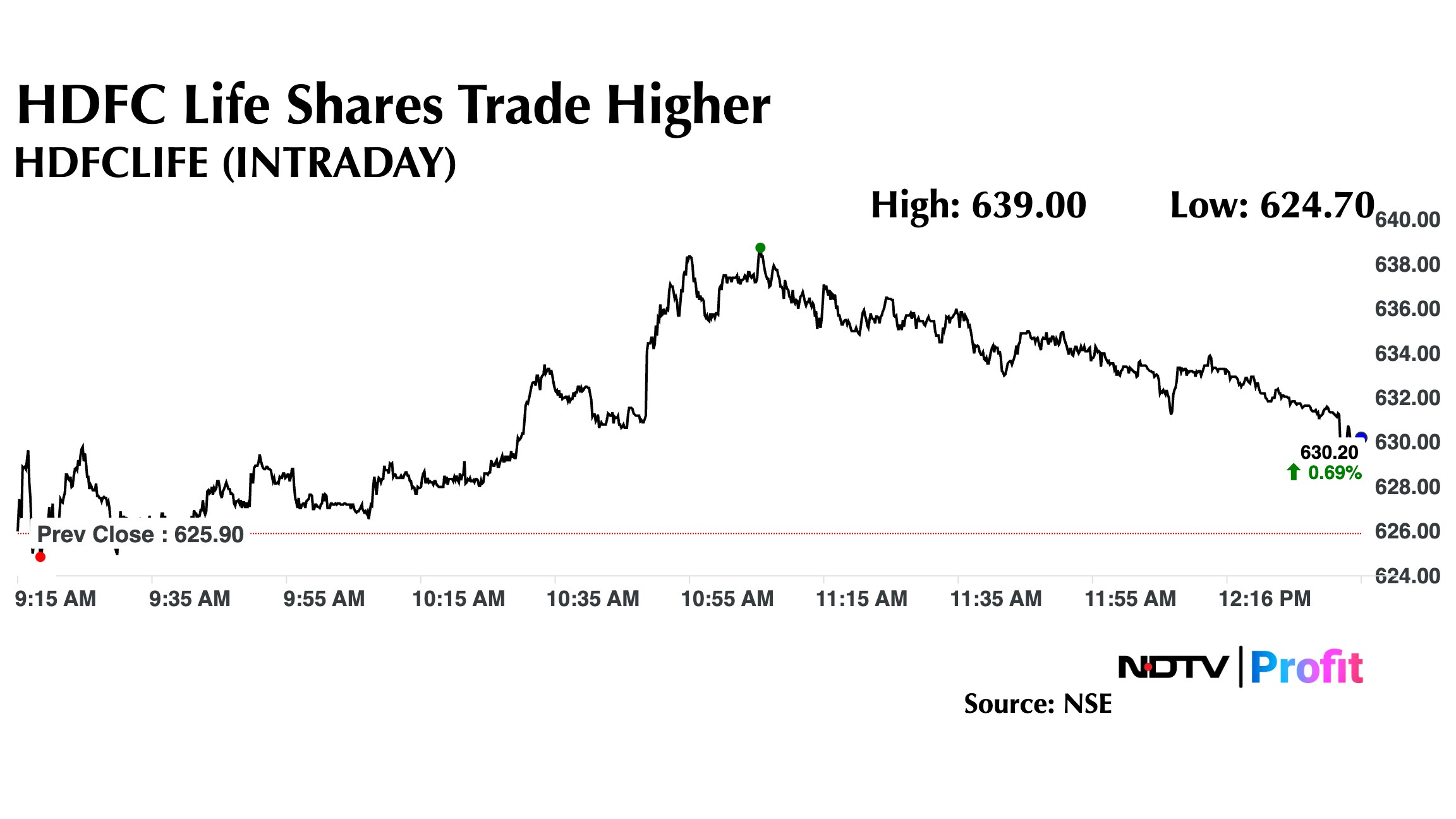

HDFC Life Insurance Share Price

HDFC Life's share price rose as much as 2.09% intraday to Rs 639 apiece. The scrip was trading 0.93% higher at Rs 631 per share as of 12:28 p.m. The benchmark NSE Nifty 50 was flat.

The stock has risen 12.12% in the last 12 months and 2.34% on a year-to-date basis. Total traded volume so far in the day stood at 2.35 times its 30-day average. The relative strength index was at 34.

Thirty of the 35 analysts tracking the company have a 'buy' rating on the stock, and five recommend a 'hold', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 22%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.