HDFC Bank has joined a host of major banks in cutting its benchmark marginal cost of funds-based lending rate (MCLR) across maturities. The bank has reduced its one-year benchmark rate by 75 basis points to 8.15 percent, a spokesperson told BloombergQuint over the telephone. One basis point is one hundredth of a percentage point.

“The ALCO (asset-liability committee) of the bank met today, and the new rates will be effective from January 7,” the spokesperson said.

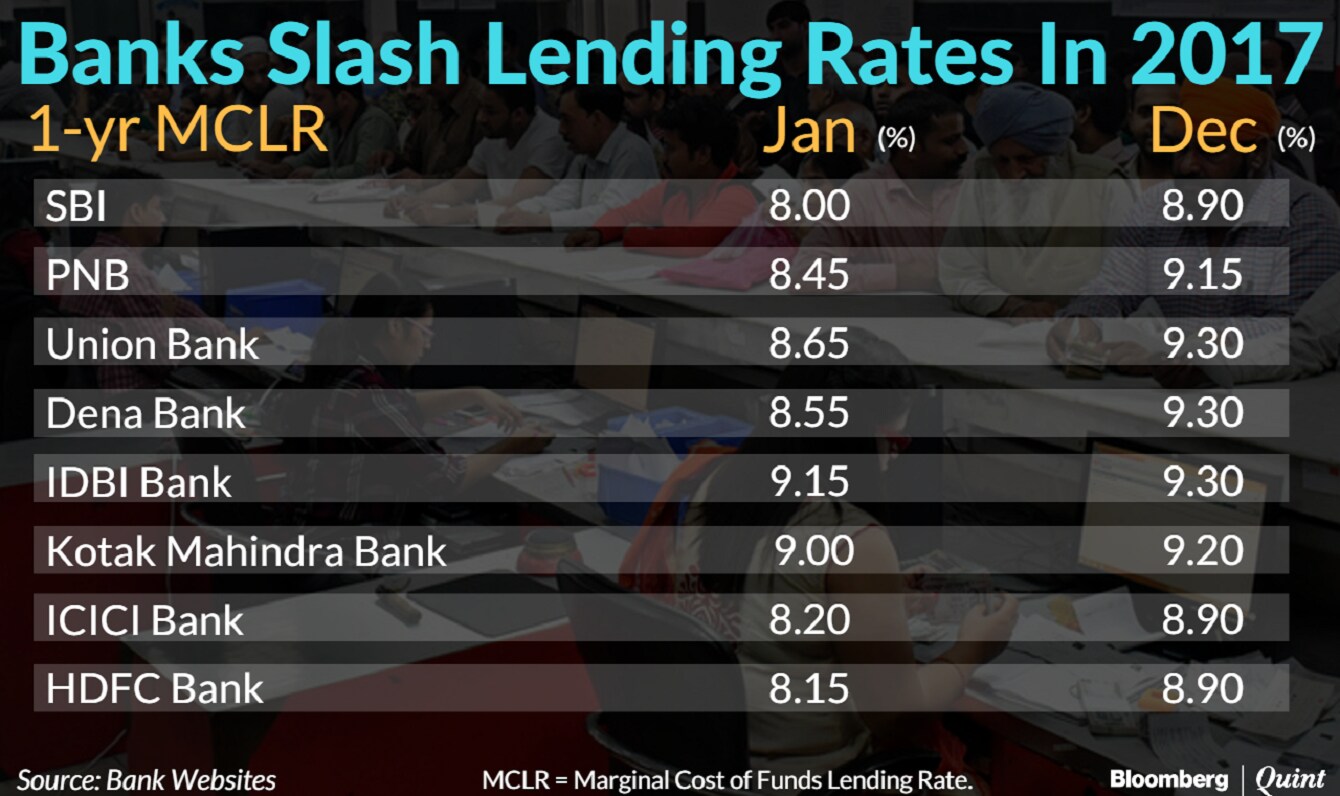

The reduction in HDFC Bank's benchmark rate is less than that undertaken by market leader State Bank of India, but more than that of its private sector peer ICICI Bank.

State Bank of India kicked off the wholesale reduction in lending rates in the new year by cutting its one-year benchmark lending rate by 90 basis points to 8 percent. ICICI Bank followed suit on Tuesday, lowering its benchmark rate by 70 basis points to 8.20 percent.

The reduction in benchmark rates generally benefits new borrowers first, followed by those whose rates are already linked to the MCLR. Older customers whose rates are linked to the base rate do not benefit. The reduction in the base rate has not kept pace with the fall in the MCLR.

SBI Chairman Arundhati Bhattacharya has said that since a different set of rules govern the base rate, it will take longer than the MCLR to come down. For SBI, only around 15 percent of retail customers have their loans linked to the MCLR.

How will the steep rate cuts impact banks? “It is too early to quantify the extent of impact on the margins of banks on account of these steep reductions in lending rate,” said Siddharth Purohit, fundamental analyst at Angel Broking. “The direct outcome of this reduction could be migration of loans from non-banking finance companies to banks if they are unable to match the rate cuts.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.