(Bloomberg) -- India's government will probably scale back on its investment spending in the coming years as it curbs its budget deficit, said Goldman Sachs Group Inc., giving the private sector scope to pick up the slack.

With the government of Prime Minister Narendra Modi planning to reduce the fiscal shortfall by about 1.5 percentage points over the next two years, the rapid pace in capital expenditure growth in the past few years “cannot be sustained going forward,” Goldman's economists Santanu Sengupta, Arjun Varma and Andrew Tilton wrote in a note Monday.

Investment has been a strong driver of India's economy, contributing 3 percentage points to real gross domestic product growth of 7% annually from 2004 to 2012, the economists estimated.

While companies and households make up about 75% of investment in the economy, their pace has weakened over the past decade, mainly due to slower growth in the property market, tighter credit conditions and falling savings. Public investment in capital projects picked up over the period, though, helping to offset some of the slump.

The private sector now has a chance to increase investment again, especially as businesses realign their supply chains and look to “diversify beyond China manufacturing locations,” Goldman said. The focus on Modi's ‘Make in India' plan to boost local manufacturing gives firms an opportunity to expand as well, the economists said.

Indian firms have shed debt and banks have enough capital to lend afresh for business expansion. India's regulators are fast with their clearances and that could “aid a revival in the corporate capex cycle,” the economists said.

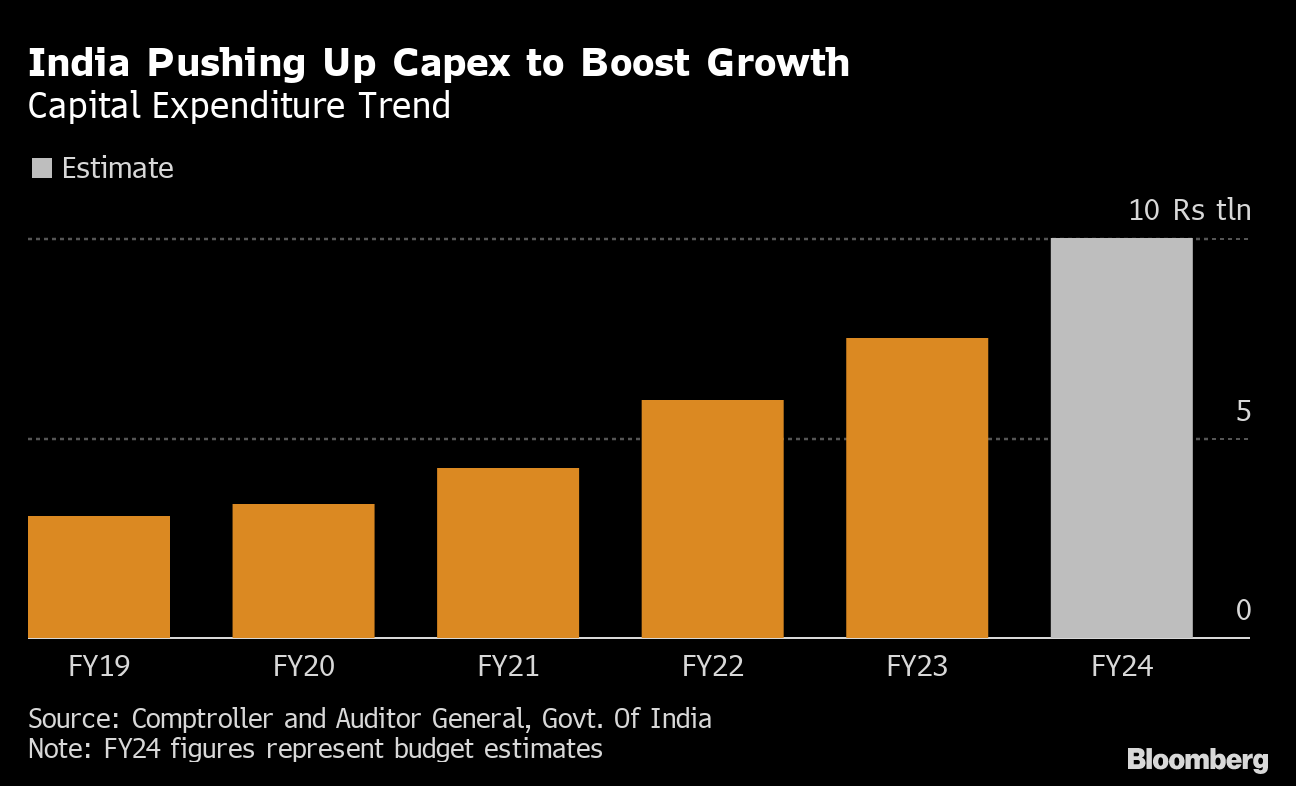

The federal government has budgeted a record 10 trillion rupees ($120 billion) for investment in the fiscal year through March 2024. It's also committed to bringing down its budget deficit to 4.5% of GDP in 2025-26 from 5.9% in the current year.

Private sector demand in the economy has strengthened after the pandemic, with credit card spending surging to a record and banks doubling their retail loan portfolio since 2019.

“We expect a pickup in private investment activity in coming years to be driven more by domestic demand, and easing of supply-side bottlenecks,” the Goldman Sachs economists wrote.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.