(Bloomberg) -- The dollar extended a weekly winning streak after the Federal Reserve kept interest rates elevated, a move that traders correctly positioned for in the days leading up to the June policy decision.

The Bloomberg Dollar Spot Index capped a fourth-straight week of gains on Friday, the longest stretch since February, after US policymakers kept interest rates on hold and projected just one reduction in 2024. The gauge is now just shy of its strongest level of the year.

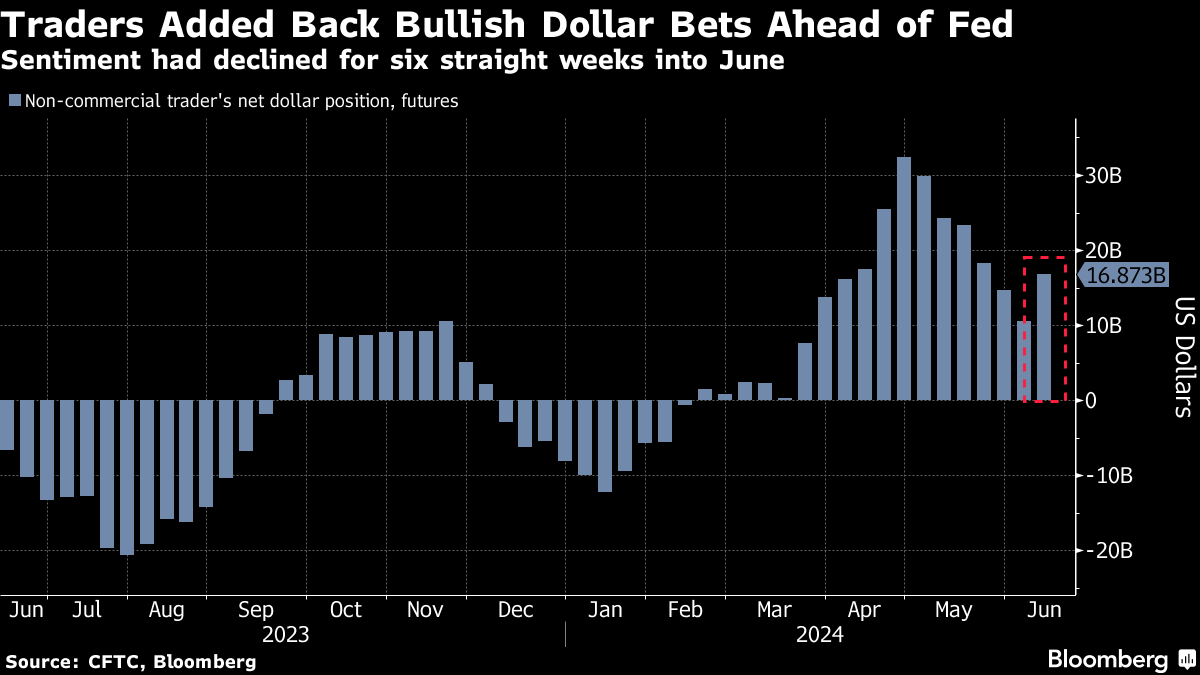

It's a welcome development for speculative traders who loaded up on contracts that would benefit from a stronger dollar in the week ending Tuesday. After pulling back on their bullish dollar bets for most of May, they added back more than $6 billion worth of bets on dollar gains in the week through June 11, according to Commodity Futures Trading Commission data compiled by Bloomberg. That's the biggest jump in positive sentiment since late April.

“The dollar is reaping the benefits of the dot plot's changes this week,” said Helen Given, a foreign-exchange trader at Monex. The Fed's forecast for only one 25-basis-point cut this year “will raise the interest-rate differential between the US and the vast majority of the Group of 10, helping the dollar run up.”

Fed policy that diverges from global peers has been offering support for the dollar in recent weeks, especially after two of the Fed's major peers — the European Central Bank and Bank of Canada — embarked on easing cycles. Market turmoil in France, prompted by President Emmanuel Macron's snap-election call, has also weighed on the euro and boosted the safe-haven dollar and peers like the Swiss franc.

(Updates to include latest CFTC data.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.