EaseMyTrip parent Easy Trip Planners Ltd.'s stock surged over 17% on Monday after the company's former Chief Executive Officer and Co-founder Nishant Pitti announced that he will retain the position of chairman in the company, with his role particularly focusing on international expansion. His brother, Rikant Pitti, who previously served as the company's chief financial officer, has been appointed as the new CEO.

Nishant had announced his decision to step down as CEO of the company, effective Jan. 1, 2025.

On Dec. 31, Easy Trip promoter Nishant divested a 1.4% stake in the company for Rs 78.32 crore through an open market transaction. This triggered the stock to tumble in multiple sessions.

"I'll be taking care of international expansion...related to selling part, we had confirmed that there is no more selling from promoters side and...we are a boot stacked company. When we did not have any investor before on our table, we were 100% owned by us between the family. Now, we are going ahead with a different dimension and there will be massive hiring in senior management team also," Nishant told NDTV Profit.

Nishant also addressed the transition in a post on X. “Exciting times ahead for @EaseMyTrip! As Chairman, I'll focus on shaping our future and driving international expansions, while Rikant steps in as CEO to lead day-to-day operations and driving our vision forward...We've been profitable since inception with a no-convenience-fee model. Focused on global expansion and entering new verticals like corporate travel and luxury tourism. Leveraging AI, data analytics, and exploring blockchain for enhanced customer experiences. Promoting eco-friendly travel and carbon offset programs. Transparent pricing, operational efficiency, and strong customer trust.”

Despite the stake dilution over the past months, Nishant emphasised that EaseMyTrip is focused on its future and on leveraging new technologies to enhance its services.

Following the 1.4% stake sale, Nishant's stake in EaseMyTrip decreased to 12.8%, with the combined promoter holding dipping to 48.97% from 50.38%. This followed a similar sale in September 2024, where he sold a 14% stake, raising Rs 920 crore.

He addressed the rationale behind the stake dilution. “Tell me one e-commerce company in which the promoter still owns 50% stake, you won't find it. All companies in the e-commerce space have to dilute stake to raise money, and we've been profitable since the inception of the company. It was certain that this was a necessary step for the family.”

EaseMyTrip, founded in 2008 by the Pitti brothers and Prashant Pitti, has expanded its services across various sectors of the travel industry. The company has also ventured into corporate travel with its new platform, EMT Desk, launched in late 2024.

EaseMyTrip Share Price Today

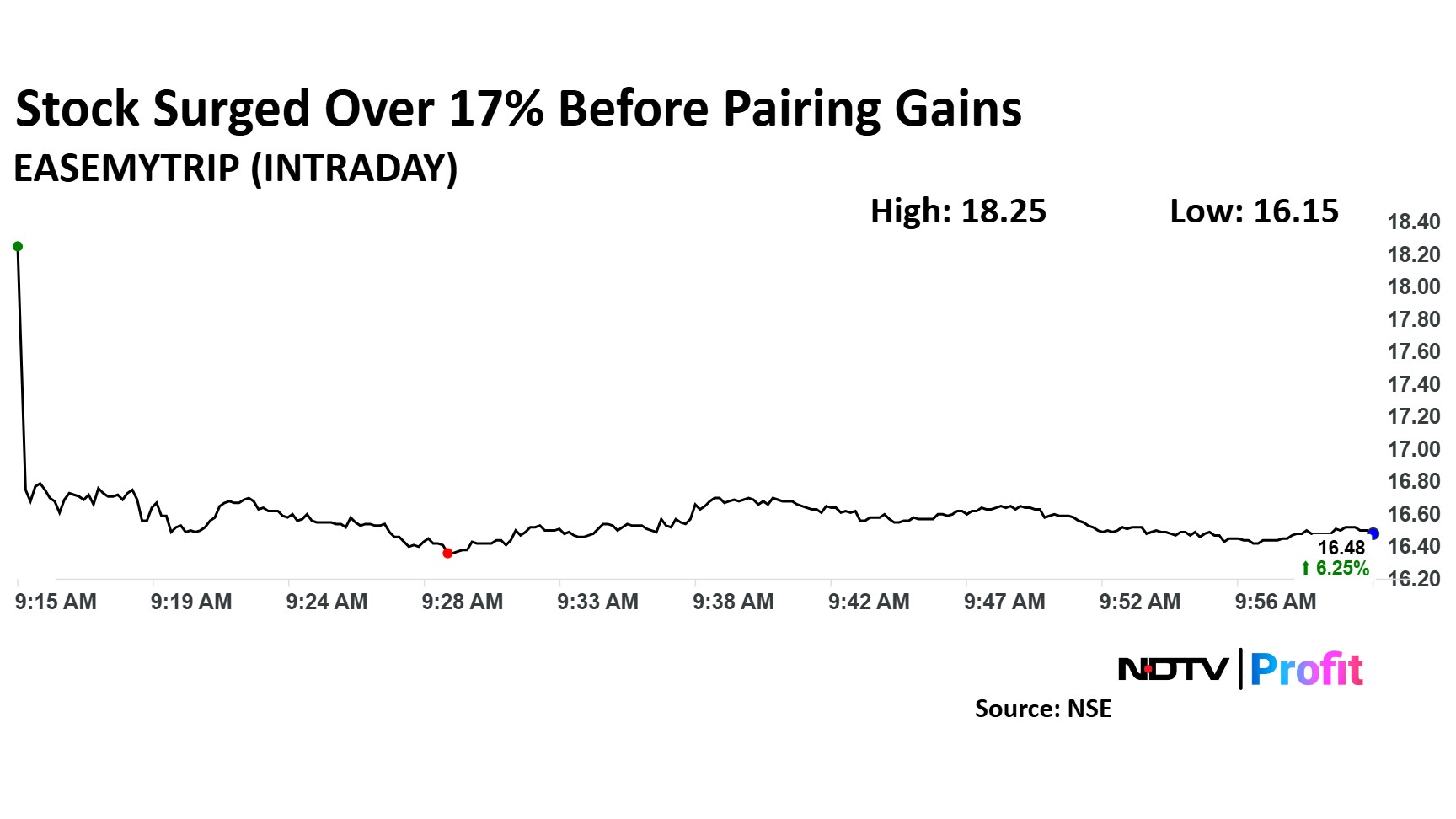

The scrip rose as much as 17.67% before paring gains to trade 6.38% higher at Rs 16.50 apiece, as of 09:57 a.m. This compares to a 0.22% decline in the NSE Nifty 50.

It has fallen 24% in the last 12 months. Total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 51.

The one analyst tracking the company has a 'sell' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 26.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.