Monthly auto sales are likely to end 2024 the same way they have fared most of the year: in the slow track. This belies the expectations of a ‘'better than usual'' month on account of slower sales in first eight months of the current fiscal, and favourable base effect.

It should be noted that the month-on-month comparison might not be relevant for most segments — barring commercial vehicles — this month due to Diwali falling at the start of November.

December generally is a slow month for sales, and expectations are subdued across most companies and segments. Mahindra & Mahindra Ltd., Eicher Motors Ltd. and Escorts Kubota Ltd. should be watched on the chance of positive growth, as per brokerage estimates. Meanwhile, Maruti Suzuki India Ltd., Tata Motors Ltd. and Hero MotoCorp Ltd. might take a hit on sales.

Two Wheelers: Growth Loses Steam, But Chugs On

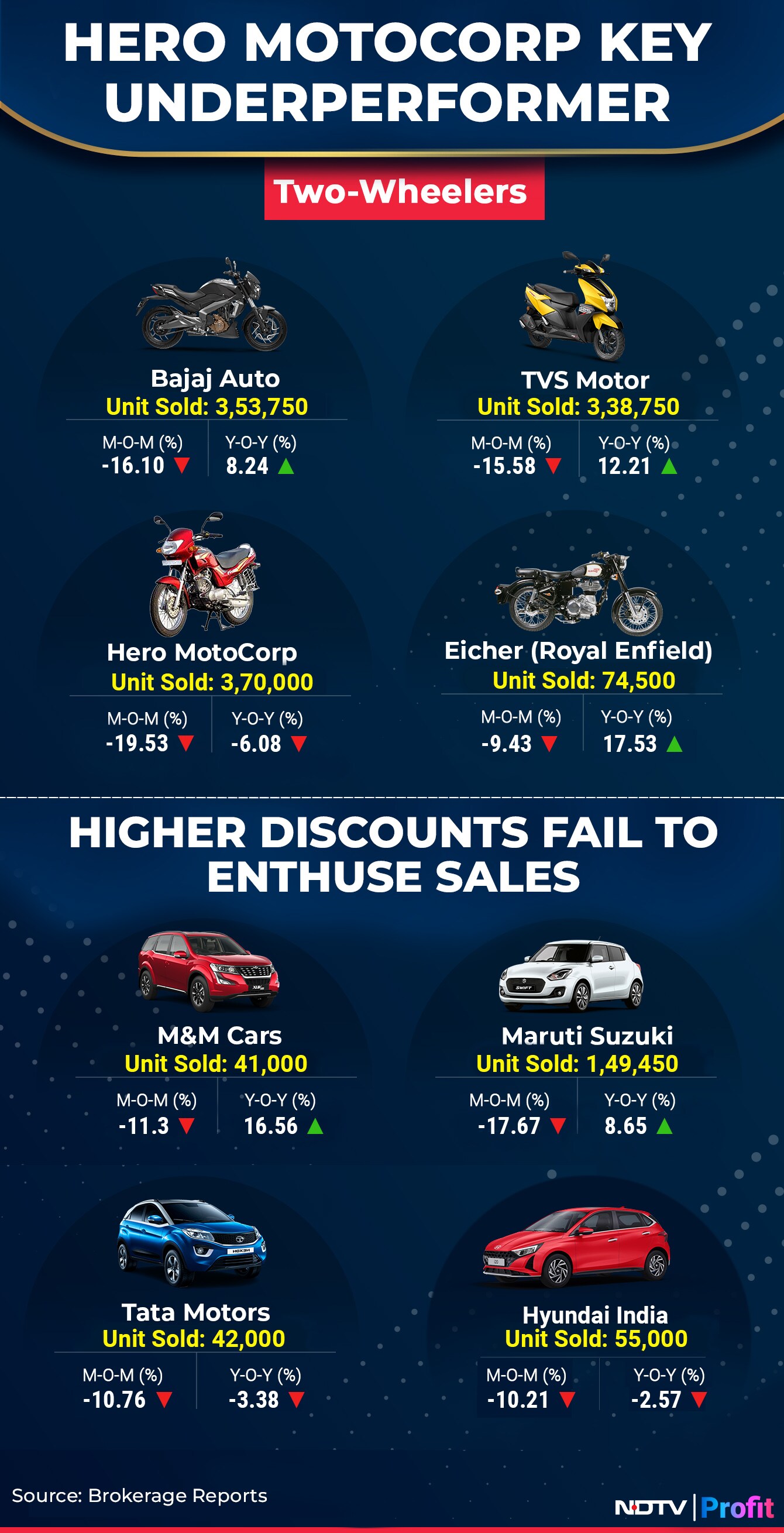

While FY25 has been strong for two-wheeler manufacturers compared to all other categories, the growth seen earlier has slowed down. In December, Hero MotoCorp is expected to actually show a 6% fall in sales compared to last year according to brokerage estimates.

TVS Motor — the steadiest growth maker this year — stayed its course with growth rates in mid-teens, despite cyclicality within the industry. Its nearest competitor Bajaj Auto has launched new version of the Chetak electric scooter, which is expected to drive margins higher for the company.

Royal Enfield maker Eicher Motors is expected to show the highest growth this month, with the stellar gains coming on a favourable base. At roughly 75,000 units this month, sales grew 17% on-year, but still fell short of the average monthly target of 80,000 units that most analyst pencilled in post Eicher's second quarter results.

Passenger Cars: Higher Discounts Fail to Enthuse Sales

It's expected to be another slow month for carmakers in a slow year, barring M&M. Despite a favourable base and higher discounts compared to last year, Maruti, Hyundai Motor India Ltd. and Tata Motors will have a forgettable month with focus of any growth starkly on the last quarter of the fiscal year.

Mahindra continues its mid-teens growth, driven by higher demand for its SUVs. It recently launched its electric cars BE-6 and XEV-9E, which will be key to volume growth going into the next fiscal.

Commercial Vehicles: Strong Sequential Growth

Commercial vehicles are expected to log subdued growth in annual terms for December, buy are likely to see the strong month-on-month growth. This shows the increased demand for the segment's products led by rise in construction activities.

Most infrastructure projects and new orders were delayed due to elections and monsoons between April and October this year and that has guided sales to be flat to negative for all three players.

Tractors: Healthy Retail Traction

Tractors have been in the same boat as commercial vehicles this year — progressing at a slow pace. But demand in the segment has increased steadily after strong monsoons. While growth was driven by Western states in first half, the trend is expected to spread to the Northern markets in next three to four months. Escorts will be a key beneficiary if this fructifies.

M&M, traditionally holding 50% market share in Western India, has benefitted from the rising demand in the region and will also be in focus.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.