Indian businesses are fearing a spike in inflation due to supply disruptions caused by measures introduced to stem the spread of Covid-19. This, despite the fact that demand is expected to remain weak through the course of this year.

India has been under a 40-day nationwide lockdown, which began on March 24. In addition, restrictions on production and movement of goods globally have led to supply chains being disrupted.

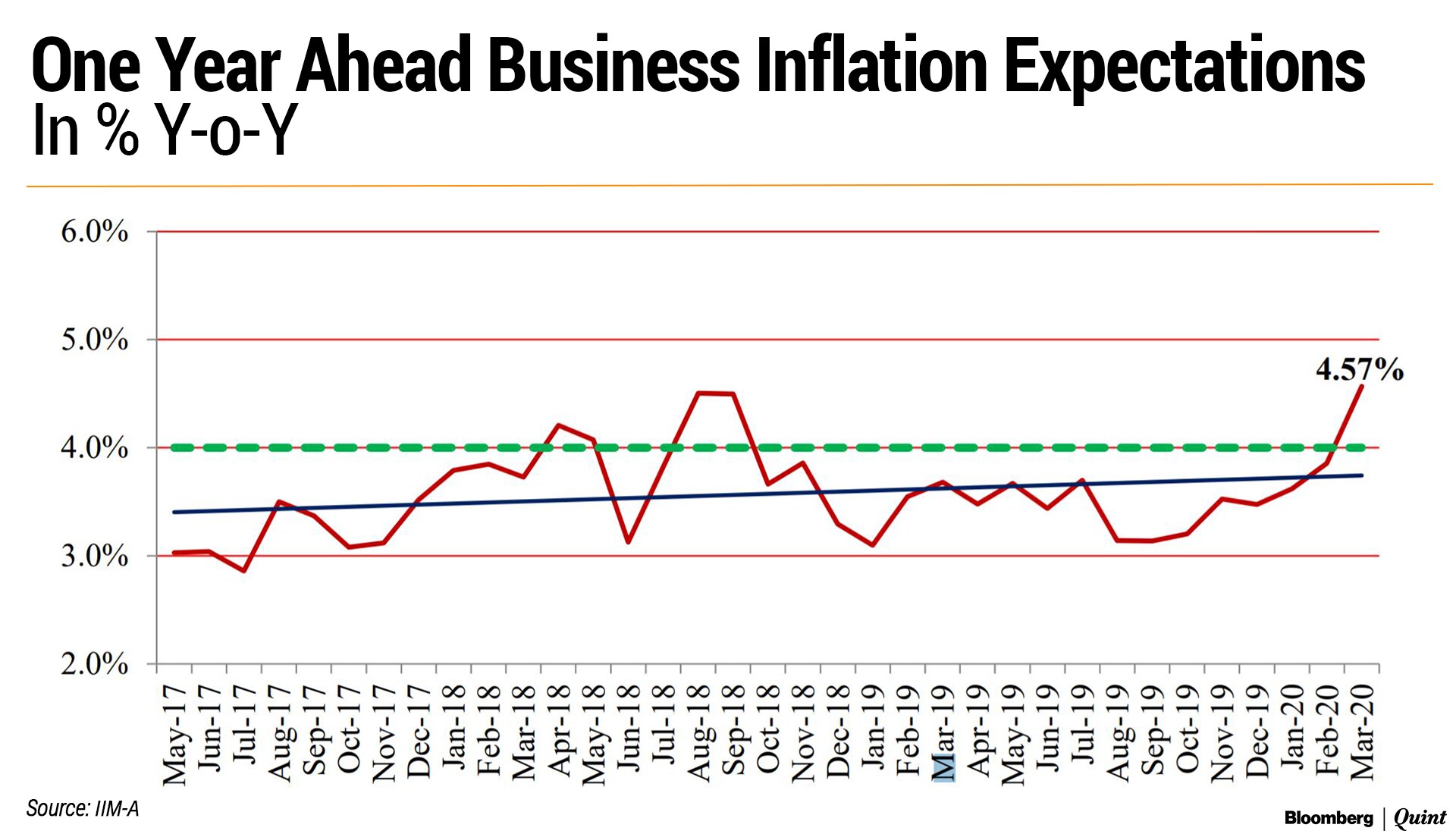

A business inflation expectation survey, compiled by Indian Institute of Management-Ahmedabad and tracked widely by policymakers, shows that companies are expecting prices to rise due to these disruptions.

The one-year ahead business inflation expectation shot up to 4.57 percent in March 2020 from 3.85 percent reported in February 2020, according to a release by the IIM-A on Thursday. This is the highest ever print recorded since the inception of this survey in May 2017, the release said.

“For the first time, respondents attached a 21 percent probability that one-year ahead inflation expectations would be above 10 percent,” it added.

The survey results are based on the responses of over 1300 companies primarily from the manufacturing sector. The number of respondents in this round rose by over 300 from the February round of the survey. The inflation expectations for one-year ahead are estimated from the mean of the individual probability distribution of unit cost increase.

The effect of extension of lockdown against the backdrop of COVID-19 spread is clearly seen in the results of this round, said Abhiman Das, RBI Chair Professor for Finance and Economics at the IIM-Ahmedabad. The economy has come to a standstill and inflation expectations are rising fast, he explained.

The survey's findings are at odds with the expectation that inflation will fall because of weaker demand. Early developments suggest that inflation is on a declining trajectory, Reserve Bank of India Governor Shaktikanta Das had said in his statement on April 17, 2020. In the period ahead, inflation could recede even further, barring supply disruption shocks, and may even settle well below the target of 4 percent by the second half of 2020-21, said Das, suggesting that this may leave room for further monetary policy easing.

To be sure, the inflation expectation of businesses could diverge from those of households. The latter is captured in the RBI's inflation expectations survey, scheduled to be released next in June.

What Businesses Are Expecting

Along with a build-up in cost pressures, businesses are expecting lower sales and weaker profit margins.

Sales Levels

- Over 81 percent of firms in March 2020 reported that sales are ‘much less than normal' as against over 64 percent firms reporting in February 2020.

- Around 93 percent of firms report that sales are ‘somewhat or much less than normal' as against 85 percent in February 2020.

Profit Margins

- The proportion of firms in the sample reporting ‘much less than normal' profit jumped to 79 percent in March 2020 from 65 percent in February 2020.

- Over 93 percent of firms in the sample expect ‘much less than normal or somewhat less than normal' profit margins. This proportion has remained around 75 percent since June 2019 till January 2020, the release said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.