Biocon Biologics, a subsidiary of Biocon Ltd., has refinanced its $1.1-billion long-term debt through the issuance of $800 million senior secured notes, an exchange filing by the parent company said.

With this, the company has recorded the largest high yield debut USD bond issuance from India in the last 10 years. In rupee terms, the long term debt of $1.1 billion translates to Rs 9,346.8 crore and $800 million senior secured notes is Rs 6,676.3 crore.

The pricing of $800-million senior secured notes, due 2029, has been set at a coupon of 6.67%, the filing said. The bonds are expected to be rated BB by both S&P and Fitch and will be listed on the Singapore Stock Exchange. The transaction is expected to settle on Oct. 9, subject to customary closing conditions, it said.

Additionally, Biocon Biologics has entered into a commitment agreement for a new syndicated debt facility. "The proceeds of the bonds, together with the new syndicated debt facility being raised, will be used to substantially re-finance existing debt of USD 1.1 billion (INR 93,468 million) which will help improve the company's liquidity profile, provide financial flexibility and opportunity to re-invest the cash into the business," it said.

BofA Securities, Citigroup, HSBC and Standard Chartered Bank acted as joint global coordinators, lead managers and bookrunners and BNP Paribas and Mizuho acted as joint lead managers and bookrunners.

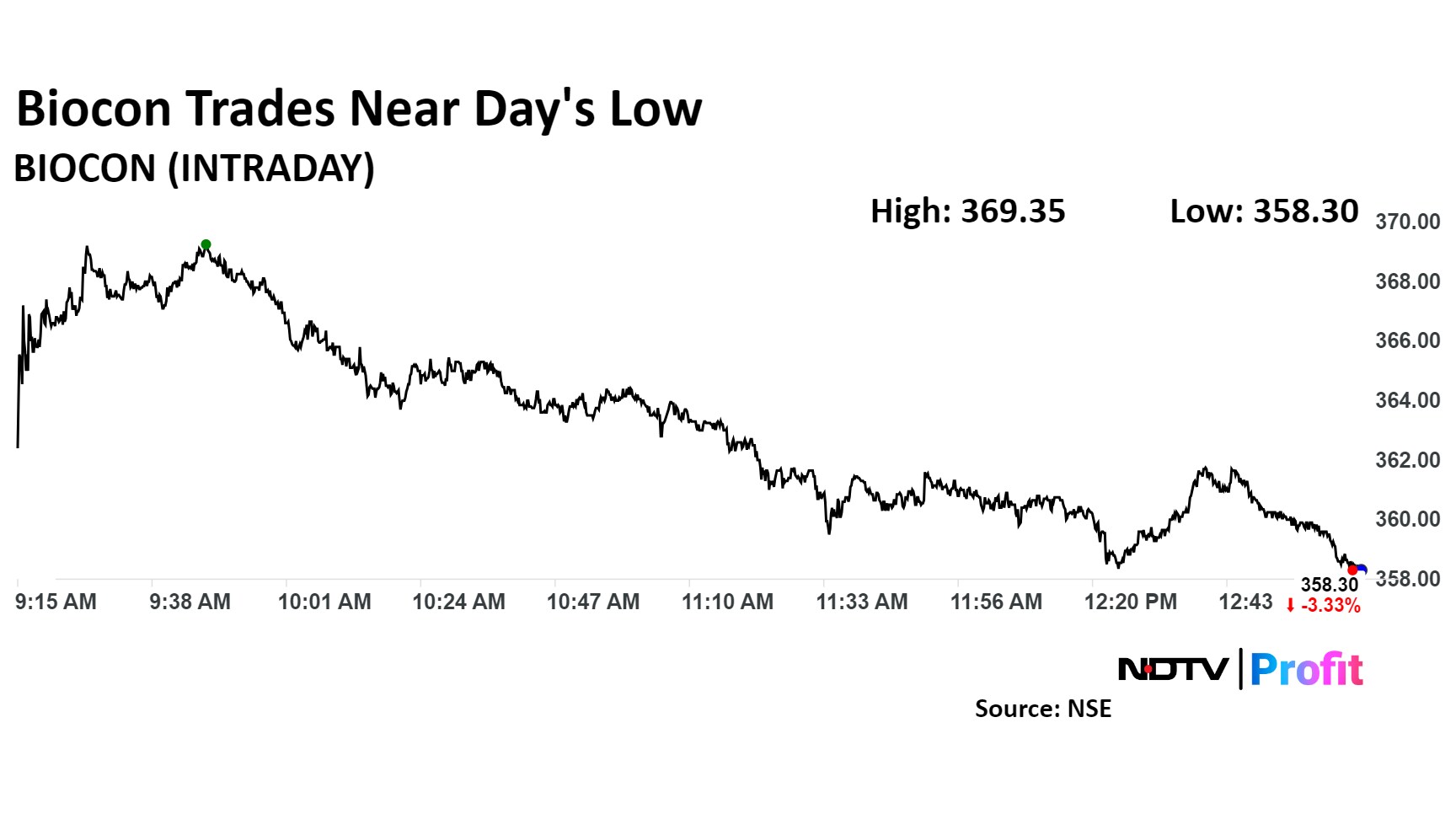

Biocon Share Price

Despite this, shares of Biocon fell as much as 3.87% before paring some loss to trade 3.70% lower at Rs 356.95 per share at 1:37 p.m., compared to a 1.97% decline in the NSE Nifty 50.

The stock has risen 43.4% year-to-date. Total traded volume so far in the day stood at 0.22 times its 30-day average. The relative strength index was at 44.

Out of 18 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 32%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.