Advanced Enzyme Technologies Ltd. will hit the capital markets today to raise over Rs 411 crore through its initial public offering.

The IPO comprises fresh issue of equity shares worth Rs 50 crore and an offer for sale for up to 4,034,470 shares at face value of Rs 10, aggregating up to Rs 355-361.5 crore. The price band has been fixed at Rs 880-896 per equity share. The IPO will open for subscription today and close on July 22.

The company has reserved up to 50 percent of the issue for qualified Institutional buyers, 15 percent for high networth individuals (HNI) and 35 percent for retail Investors. The shares will be listed on the National Stock Exchange and Bombay Stock Exchange. ICICI Securities and Axis Capital are the lead managers to the issue.

Anchor Allotment

Ahead of the IPO, the company mopped up nearly Rs 123 crore from as many as 15 anchor investors. A little over 13.71 lakh shares were allotted to anchor investors at Rs 896 apiece.

Use of IPO Proceeds

Of the Rs 50 crore that the company will raise through the issue of fresh shares, Rs 40 crore will be used to repay the debt of its wholly-owned US subsidiary. The remaining Rs 10 crore will be utilised for general corporate purposes.

Business

Advanced Enzyme Technologies supplies enzyme products and customised enzyme solutions to diverse end-user industries like human healthcare and animal nutrition, baking, dairy, brewing, biofuels, textile processing etc. It is a pure enzyme player and vertically integrated.

The company operates in two primary business verticals – healthcare & nutrition (human and animal) and bio-processing (food and non-food). The healthcare & nutrition vertical constitutes about 88 percent of the company's revenue.

The U.S. market, where the company is focused on nutraceuticals, remains a key focus area for the company. Revenue share from the U.S. stood at 55 percent in FY16, while India contributed 36 percent of total sales. In India, the focus is on pharmaceutical companies. Exports form about 60 percent of the company's sales.

Financials

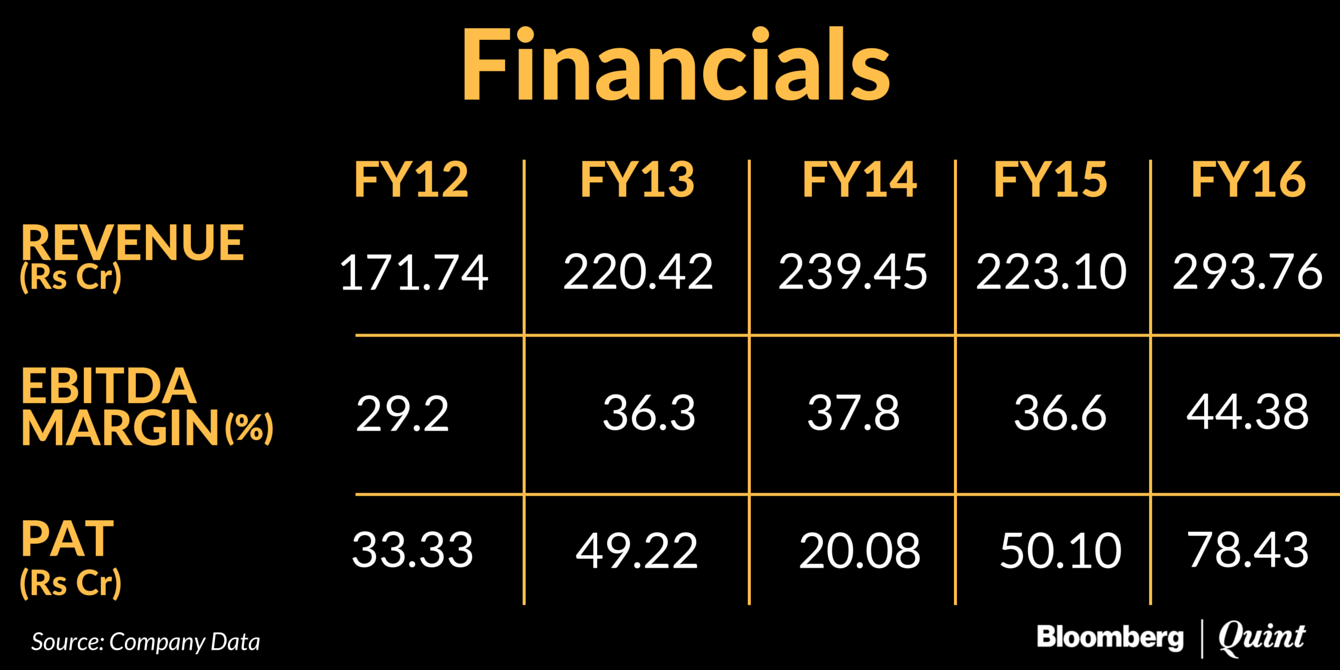

In the last two years, revenue has grown at 14.36 percent compounded annual growth rate, restricted by the impact of voluntary product recalls in the U.S. Net profit has risen 23.85 percent over the five-year period ending FY16. The EBITDA margin stood at 44.38 percent in financial year 2016.

The company has total debt of Rs 683.86 crore, which translates into a debt-to-equity ratio of 0.245.

Valuation

Advanced Enzymes Technologies does not have a comparable India-listed peer. At the upper price band of Rs 896 per equity share, the company is valued at trailing price to earnings (P/E) ratio of 24.9 based on FY16 earnings.

Its largest global competitor, Danish company Novozymes, trades at a current price-to-earnings ratio of 34.86 and has an operating margin of about 37 percent. The company's valuation of Rs 2,000 crore stands at seven times its FY16 revenue, comparable to Novozymes.

Most Brokerages Bullish

Broking firms seem to be divided over the valuation of the issue, but most have recommended subscribing to the issue.

Anand Rathi: Subscribe

Giventhat AETL's scale of operation is very low (below Rs 300 crore), it has immensescope and opportunity to grow. Weexpect AETL to post 25 percent growth in FY17. the upper end pricing of the IPO price band values Advanced Enzyme at 24.7x earnings inFY16. It is available at a P/E of 20.3x its FY17 earnings. The company has nolisted peer in India while global enzymes leader Novozymes trades at a price-to-earnings ratio of 35.5. Thus we recommend a “Subscribe”.Anand Rathi Research's IPO note

GEPL Capital: Subscribe

Advanced Enzyme Technologies stands to gain from operating leverage. At a P/E of 28.4xwe believe that the company demands a discount to its domestic peers.GEPL Capital's IPO note

Angel Broking: Neutral

Given the management's experience in the industry and cost advantage in India, we believe that the company can post robust growth goingforward.At a price band of Rs 880-896 per share, the company isavailable at 6.1-6.2x its FY17E P/BV. We believe the price fully discountsall the positives.Angel Broking's IPO note

Sushil Finance: Subscribe

The company's asking price of Rs 896 seems a little expensive, but considering the strongbalance sheet and increase in customer base with price-to-earnings of around 25, one can investin the long-term.Sushil Finance's IPO note

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.