Shares of Adani Ports and Special Economic Zone Ltd. hit a record high on Monday after it reported its highest-ever monthly cargo volumes of over 38 million metric tonne in March 2024.

The Adani Group company handled 420 million metric tonne cargo in FY24, a 24% year-on-year growth, with domestic ports contributing over 408 MMT of cargo, according to an exchange filing on Monday.

India's largest ports and logistics company's Mundra Port alone handled more than 7.4 million TEUs, which is over a third of India's container cargo.

During FY24, more than one-fourth of all India cargo volumes were routed through APSEZ ports, the statement said. "This significant contribution by APSEZ underscores its active role in driving India's growth trajectory."

While it took 14 years for the company to achieve the first 100 MMT of annual cargo throughput, the second and third 100 MMT throughputs were achieved in five and three years, Karan Adani, managing director, APSEZ, said.

"The latest 100 MMT mark has been achieved in less than two years. This is a testament to our ongoing commitment and efforts towards enhancing operational efficiencies and maintaining our position as a top port operator in the industry,” he said.

This accomplishment comes at a time when there are multiple challenges, such as the global trade disruptions caused by the Red Sea crisis, the Russia-Ukraine conflict and issues at the Panama Canal.

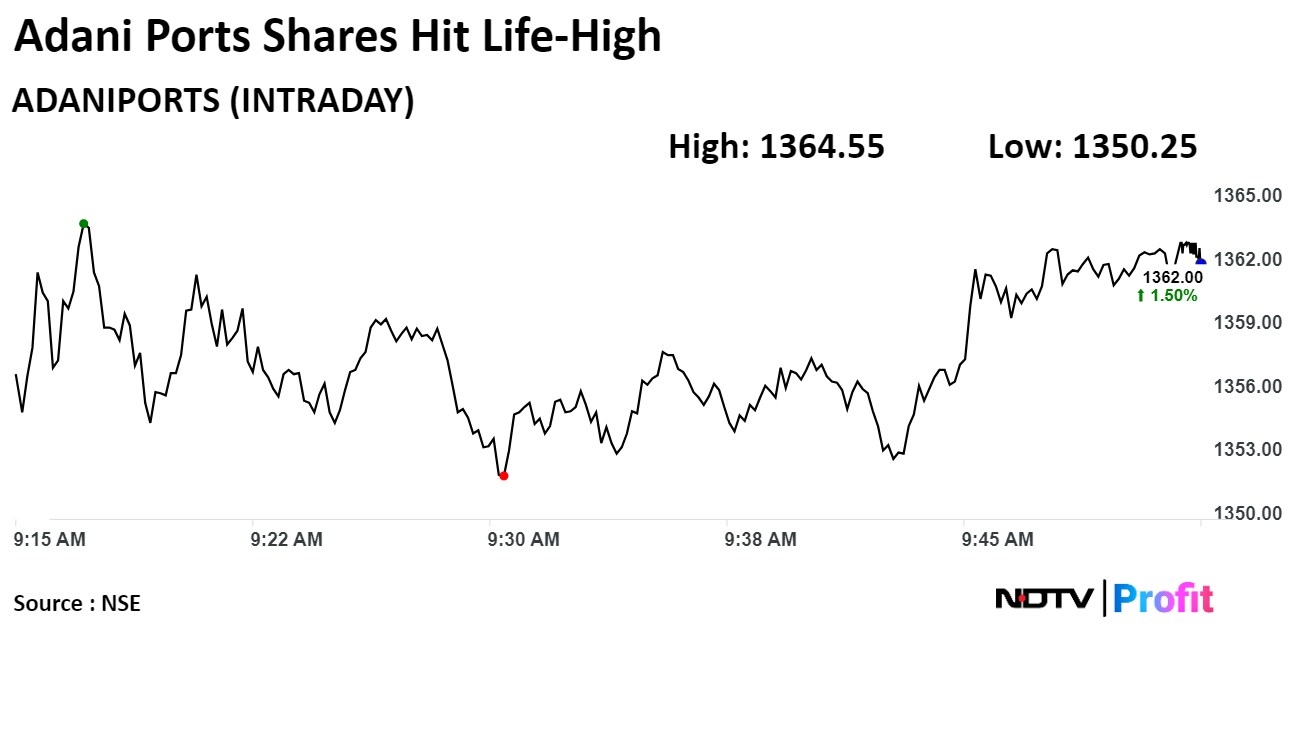

Shares of Adani Ports rose as much as 1.69% during the day to hit a lifetime high of Rs 1,364.55 apiece on the NSE. It was trading 1.54% higher at Rs 1,362.5 apiece, compared to a 0.74% advance in the benchmark Nifty 50 as of 9:50 a.m.

The stock has risen 116.7% in the last 12 months. The relative strength index was at 63.

Twenty out of the 22 analysts tracking the company have a 'buy' rating on the stock and five suggest a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 3.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.