03_06_24.jpg?downsize=773:435)

Adani Enterprises Ltd. on Monday announced that it will exit Adani Wilmar Ltd. by divesting its entire 44% stake in the joint venture Adani Wilmar Ltd. that will raise over $2 billion.

Adani Enterprises will divest 13% of its shares in Adani Wilmar to achieve compliance with minimum public shareholding requirements via an offer for sale. In addition, Wilmar International Ltd. has agreed to acquire the 31% stake held by the Adani flagship in the edible oil maker.

Adani Enterprises, subsidiary Adani Commodities LLP, and Lence Pte Ltd, a wholly owned subsidiary of Wilmar International, have entered into an agreement through which Lence will acquire shares of Adani Wilmar held by ACL as of the date of exercise of the call option or put option, as the case may be, in respect of a maximum of 31.06% of the existing paid-up equity share capital of AWL, the exchange filing said.

The exercise of the call and put options can only occur after 12 months from the agreement date, in accordance with applicable laws.

However, Adani and Wilmar will explore and assess alternative options to speed up the sale and purchase of the shares, as long as these options comply with the law. This will happen as soon as Adani Wilmar meets the minimum public float under the relevant regulations.

The shares will be sold to Lence at a price that is mutually agreed upon by the parties, provided that such price per share shall not exceed Rs 305, the filing said.

As of September, Adani Commodities and Lence held a 43.94% stake each, based on the shareholding pattern on the BSE.

The proceeds shall be utilised to turbocharge the growth of the Adani Group flagship in the core infrastructure businesses—energy and utility, transport and logistics, along with primary industry-adjacent businesses, the company said in a press release.

"AEL will continue to invest in infrastructure sectors, which will further strengthen AEL's position as India's largest listed incubator of platforms playing the key macro themes underpinning India's growth story," the statement said.

Adani's nominee directors, Pranav Adani and Malay Mahadevia, will step down from the board of Adani Wilmar. After Adani's exit, steps will be taken for a change of the company's name.

Adani Companies' Share Price Movement

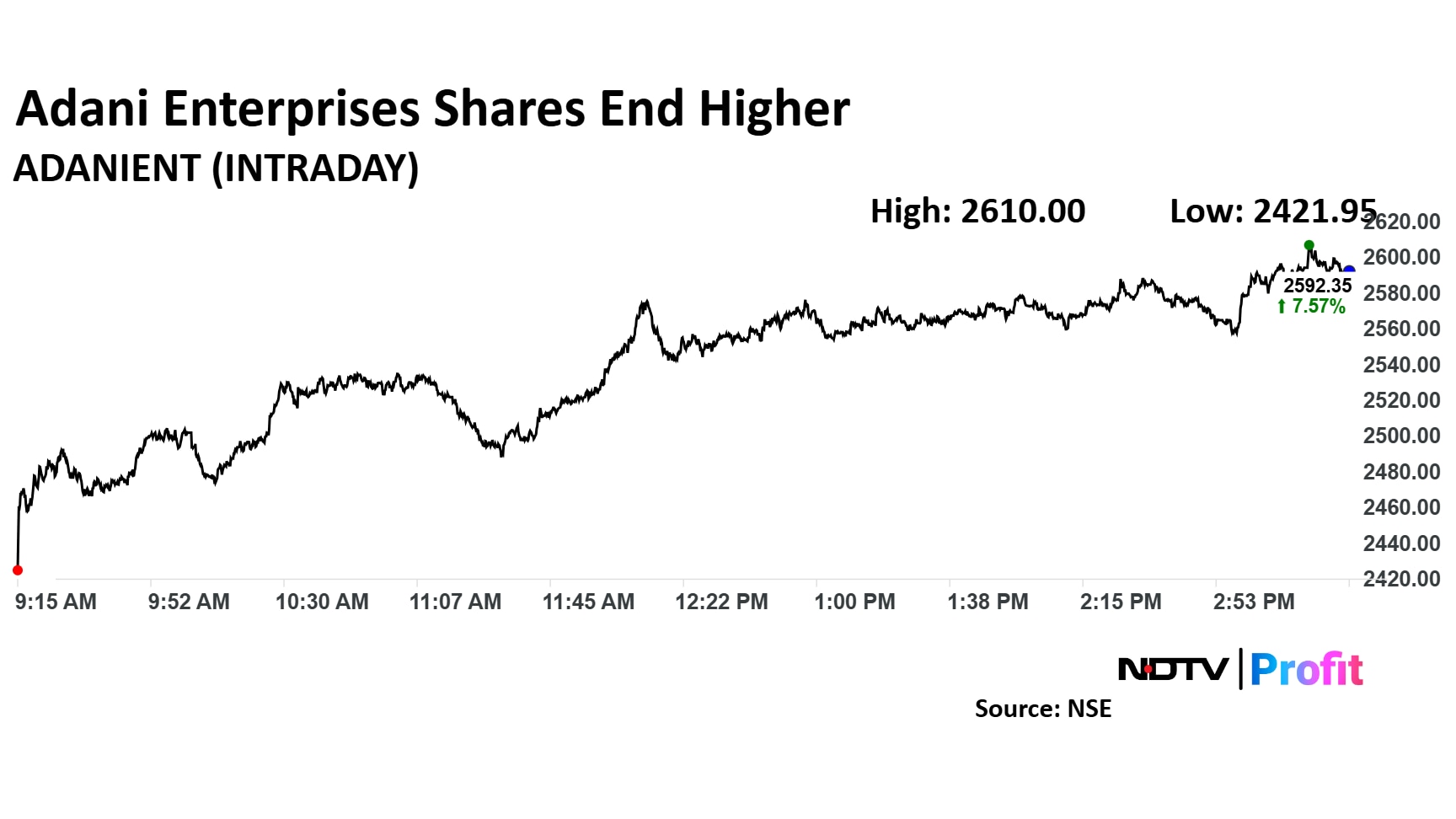

Adani Enterprises' share price closed 7.57% higher at Rs 2,592.35 apiece on Monday. The announcement of the JV exit came during the final hour of trading. The stock has declined 9% this year.

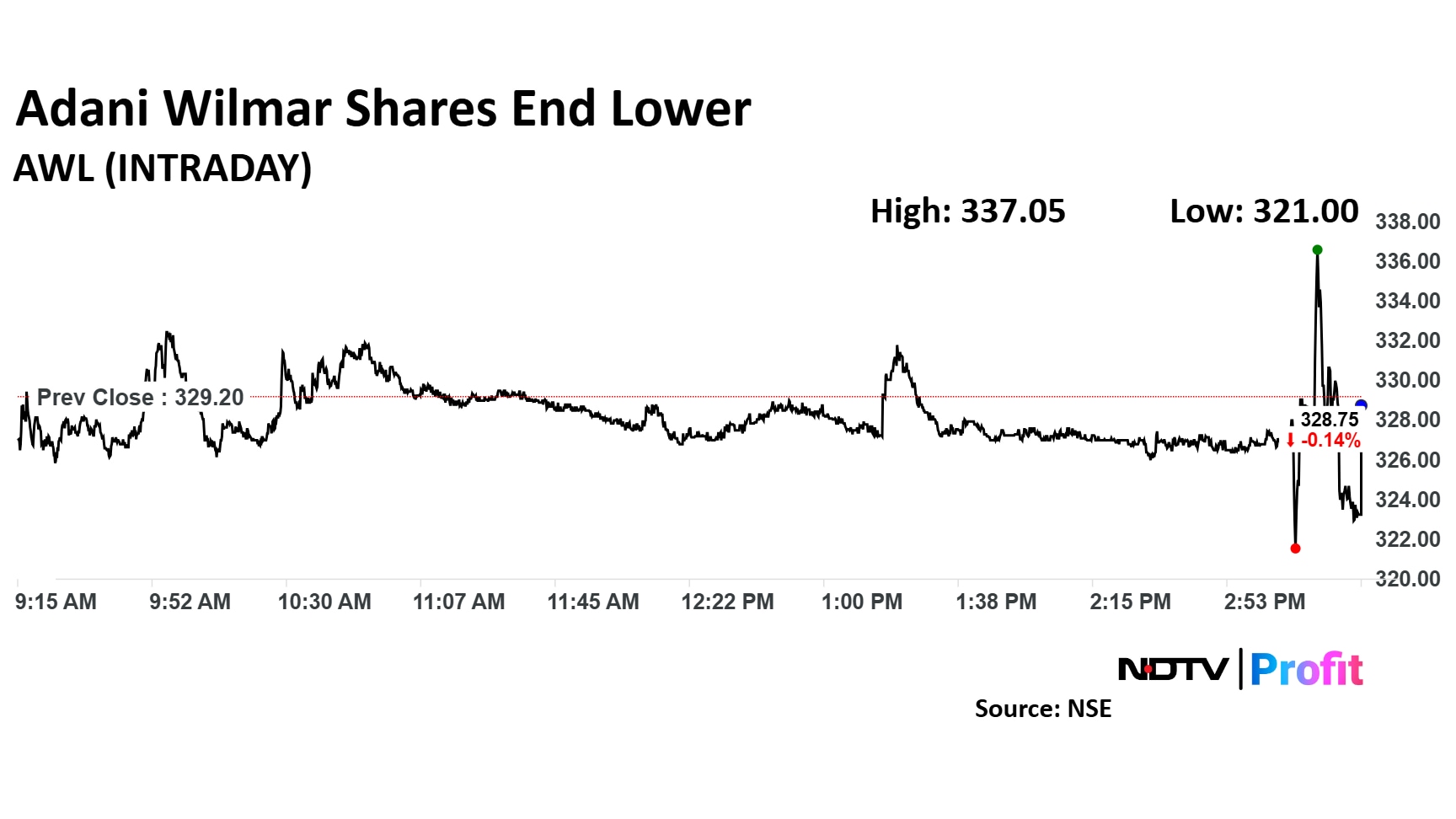

On the other hand, shares of Adani Wilmar closed 0.14% lower at 328.75 apiece. The stock has lost 7.37% this year.

The benchmark Nifty 50 ended 0.71% lower.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.