Shares of midcap stocks witnessed a sharp decline in their market capitalisation on Saturday following the announcement of the Union Budget for fiscal 2026, led by Finance Minister Nirmala Sitharaman.

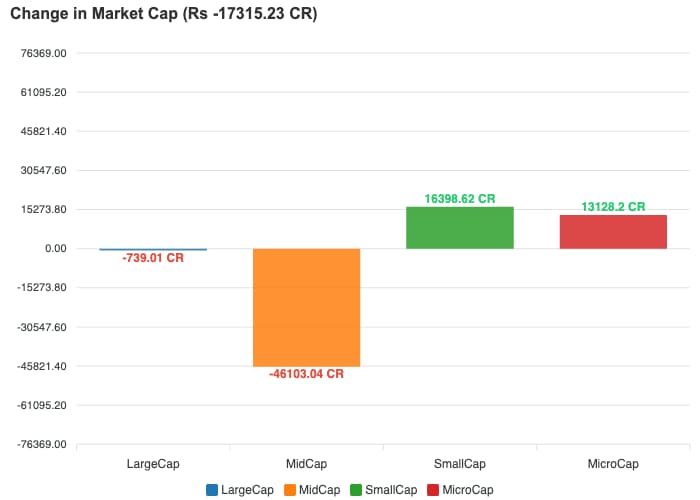

Mazagon Dock Shipbuilders Ltd., Torrent Power Ltd., and Cummins Ltd. were among the biggest losers in the BSE Midcap 150 index which collectively wiped out Rs 46,103.04 crore in investor wealth—significantly higher than the Rs 739 crore loss recorded by large-cap companies.

Why Did Midcaps Fall?

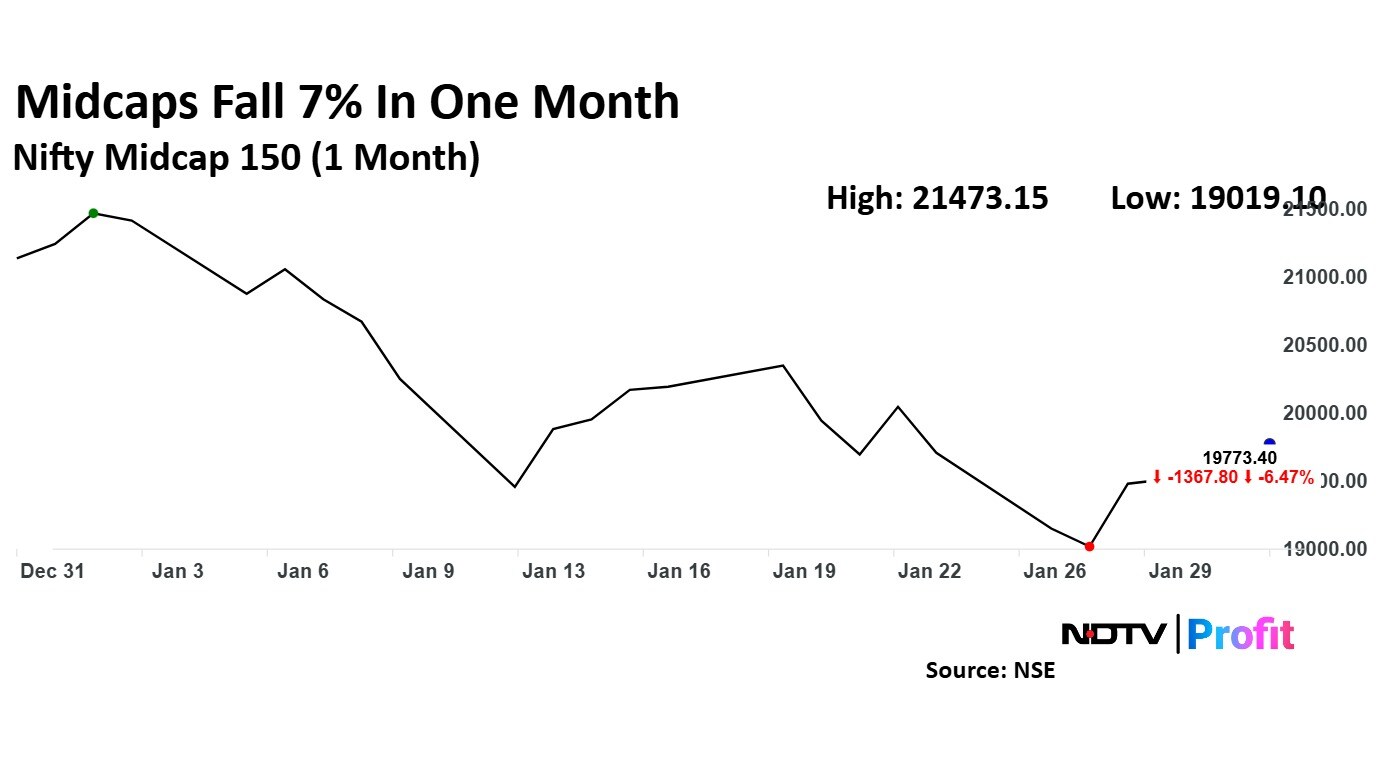

A market expert attributed the midcap slump to sustained losses across the broader market, with primary markets also trading in the red. Over the past month, the BSE Midcap 150 index has fallen 6.93%, extending its decline on Saturday.

According to G Chokkalingam, Founder of Equinomics Research Pvt. Ltd., the budget failed to introduce any specific measures that could trigger an uptrend in midcap stocks, leading to continued selling pressure.

Defence Stocks Disappoint

Despite receiving the highest allocation in the budget, defence stocks failed to meet market expectations. Mazagon Dock Shipbuilders, a key player in the defence sector, saw a significant dip in market its market capitalisation.

"The defence outlay did not meet anticipated levels, which contributed to the sharp fall in stock," Chokkalingam noted.

Mazagon Dock Shipbuilders saw a dip of Rs 4,792 crore in market cap, the highest fall in the day. Shares of the shipbuilder closed 5.02% lower on the NSE at Rs 2,373 apiece, as compared to a 0.11% decline in the benchmark Nifty 50.

Torrent Power and Cummins posted a loss of Rs 3,328 crore and Rs 3,232 crore, respectively. Shares of both the companies were trading over 4% lower on the NSE at market close.

Other companies which witnessed a similar decline in market cap include Ashok Leyland, Muthoot Finance, Hindustan Petroleum Corp., Tube Investments, Supreme Industries, BHEL, and Hitachi Energy.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.