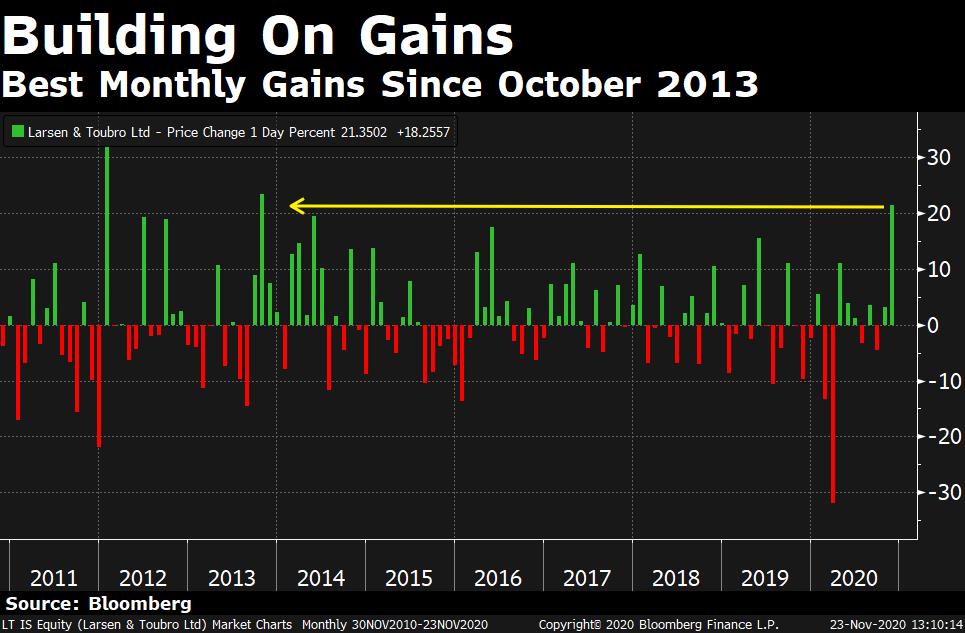

Shares of Larsen & Toubro Ltd. are on track to post their best monthly gains in more than seven years as India's largest construction and engineering company reported sustained order inflow and improved execution.

The stock has gained nearly 22% so far in November. That's the best streak of monthly rise since October 2013.

L&T's transportation infrastructure business secured what it describes as a “mega order” for the construction of 87.6 kilometres of the Mumbai-Ahmedabad high-speed rail project on Nov. 19. L&T defines 'mega' orders as those valued more than Rs 7,000 crore. This is in addition to its largest order for its construction and mining equipment business from Tata Steel Ltd. on Nov. 18. The company did not disclose the value of that order.

The large order wins—Rs 2,500 crore to Rs 5,000 crore—announced since the start of the ongoing quarter have allayed most of the street's concerns over slowdown in order intake and delay in execution.

Including orders announced in the third quarter so far, L&T is estimated to have already won Rs 60,000 crore worth of orders in its core engineering and construction (excluding services) business so far this fiscal against the forecast of Rs 1,20,000-1,30,000 crore for the full fiscal ending March, Citi said in a report.

Given the ordering prospects of Rs 6 lakh crore in the second half of the fiscal, a macro pick-up and seasonally strong fourth quarter—average inflow of Rs 47,000 crore in 4QFY19/20—L&T appears well positioned to meet the forecast, it said.

Credit Suisse revised its orderbook estimates on optimism that stable state and central government finances should help revive inflows.

Subhadip Mitra, lead analyst at JM Financial Institutional Securities, said with labour availability at full strength in the third quarter, the brokerage expects a sustained execution pick-up and improving productivity in second half of the fiscal.

Trades At A Discount

Analysts are also bullish as the stock trades at a discount to its historical valuations. Shares of the company trade at 17.8 times its trailing 12-month earnings, according to Bloomberg data. That compares with the 10-year average of 23.8 times.

38 of 41 analysts have a ‘buy' rating on the stock; 2 suggest ‘hold' and 1 ‘sell'. The average of 12-month price targets suggest an upside of 6.5% from the current levels.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.