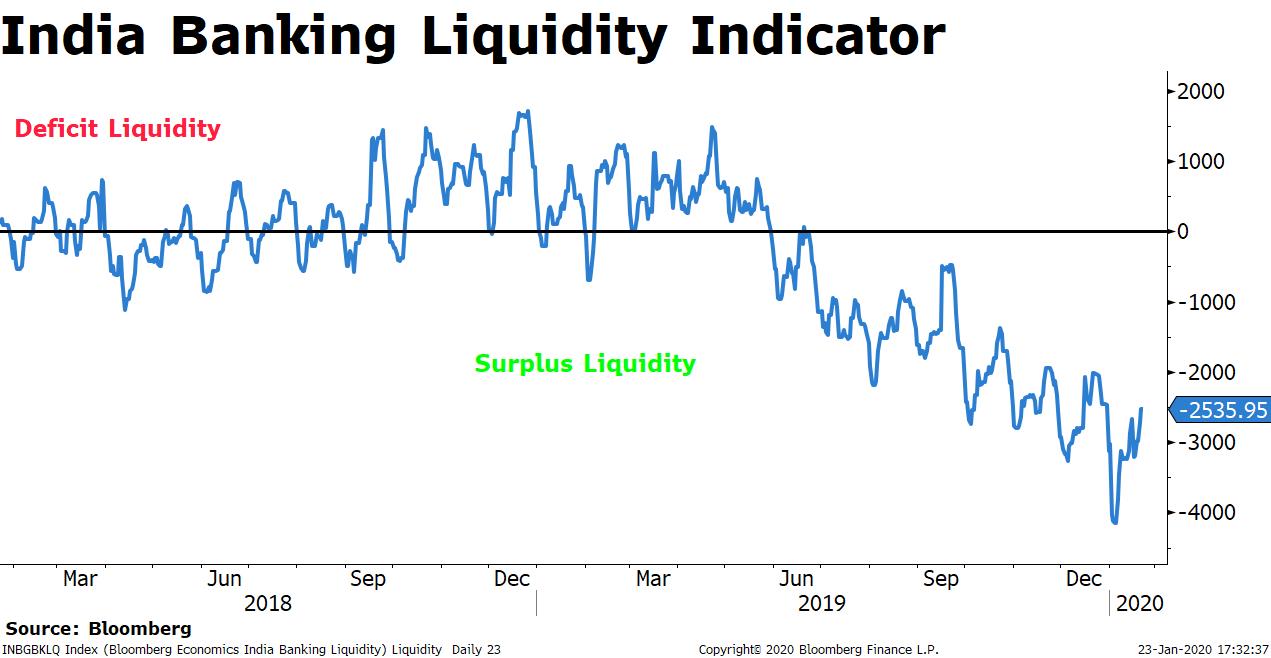

An extended period of surplus liquidity has driven down the cost of short-term borrowings for companies perceived to be safe in an environment ridden with risk.

The large amount of money chasing relatively few firms has led to a distortion in the market, where short-term borrowing costs for some have fallen below the Reserve Bank of India's policy repo rate.

The repo rate, the overnight rate at which banks borrow from the central bank, should ideally be the floor for interest rates in the economy now that it is the sole policy rate. To be sure, at times of ample liquidity, the market begins to treat the reverse repo rate — the rate at which banks park funds with the RBI — as the benchmark rate, even though the central bank has technically moved away from the dual-policy rate regime that existed earlier.

The liquidity surplus of Rs 2-3 lakh crore meant that borrowing costs for a few corporates have been closer to the reverse repo rate of 4.9 percent.

Data from the RBI showed that the lower end of the range at which commercial paper for short-term borrowings was issued remained below 5 percent for three months between October and December. The upper end of the borrowing range remained as high as 13-14 percent, which reflects the continued divergence in the perception of quality among borrowers.

The combination of rate cuts from the MPC and an improvement in liquidity conditions has led to a drop in commercial paper rates, said Mahendra Kumar Jajoo, head of fixed income at Mirae Asset Global Investments (India) Pvt. Ltd. “If liquidity continues to be positive and if the RBI continues with its accommodative stance, the rates could stabilise at the current level,” Jajoo said.

Who Are The Lucky Ones?

According to data from Prime Database, at least 19 entities concluded 81 CP issues, raising a total of Rs 70,115 crore, at a coupon rate which was pegged at or below the prevailing repo rate of 5.15 percent.

In contrast, only a handful of state-run oil companies were able to issue CPs below the repo rate the year before. A total of 24 CP issues, worth Rs 11,155 crore, were issued at or below the repo rate in 2018 before the collapse of the Infrastructure Leasing and Financial Services Group in September that year, Prime Database showed.

This year, those lucky enough to raise short-term funds below the repo rate include a few private firms too.

State-run companies like Indian Oil Corporation Ltd. and NTPC Ltd. were able to benefit from low-cost CP issues. In addition, non-banks like Cholamandalam Investment and Finance Company Ltd., L&T Housing Finance Ltd. and Housing Development Finance Corporation Ltd. also managed to raise short-term funds below the repo rate. Non-financial companies like UltraTech Cement Ltd., Larsen & Toubro Ltd., and Grasim Industries Ltd. benefited as well. The list is not exhaustive but illustrative.

Banks, corporates and mutual funds, who have excess liquidity and large treasury operations, are fueling demand for CPs, leading to lower rates for the stronger companies, said Dwijendra Srivastava, chief investment officer (debt) at Sundaram Mutual Fund. “The combination of these has helped in rate transmission for the strong NBFCs and HFCs and even industrial companies that do not have high debt leverage, in the three-month bucket,” he said.

A mutual fund manager, on condition of anonymity, said there was a limited supply of CPs against the high demand from mutual funds, banks and other investors for high-quality debt papers. This has left fund managers with a narrower choice of instruments to invest in, this person said.

Government Benefited Too

The easy liquidity also helped the government to some extent as interest rates on short-term treasury bills fell below the repo rate.

The 91-day treasury bills have been auctioned at rates below the repo rate since October. In November and December, 91-day treasury bill rates fell below 5 percent. Rates have, however, slowly inched back up with these bills being auctioned at 5.11 percent on Jan. 22.

As such, short-term borrowing rates for corporations may start to move back towards the policy rate as well.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.