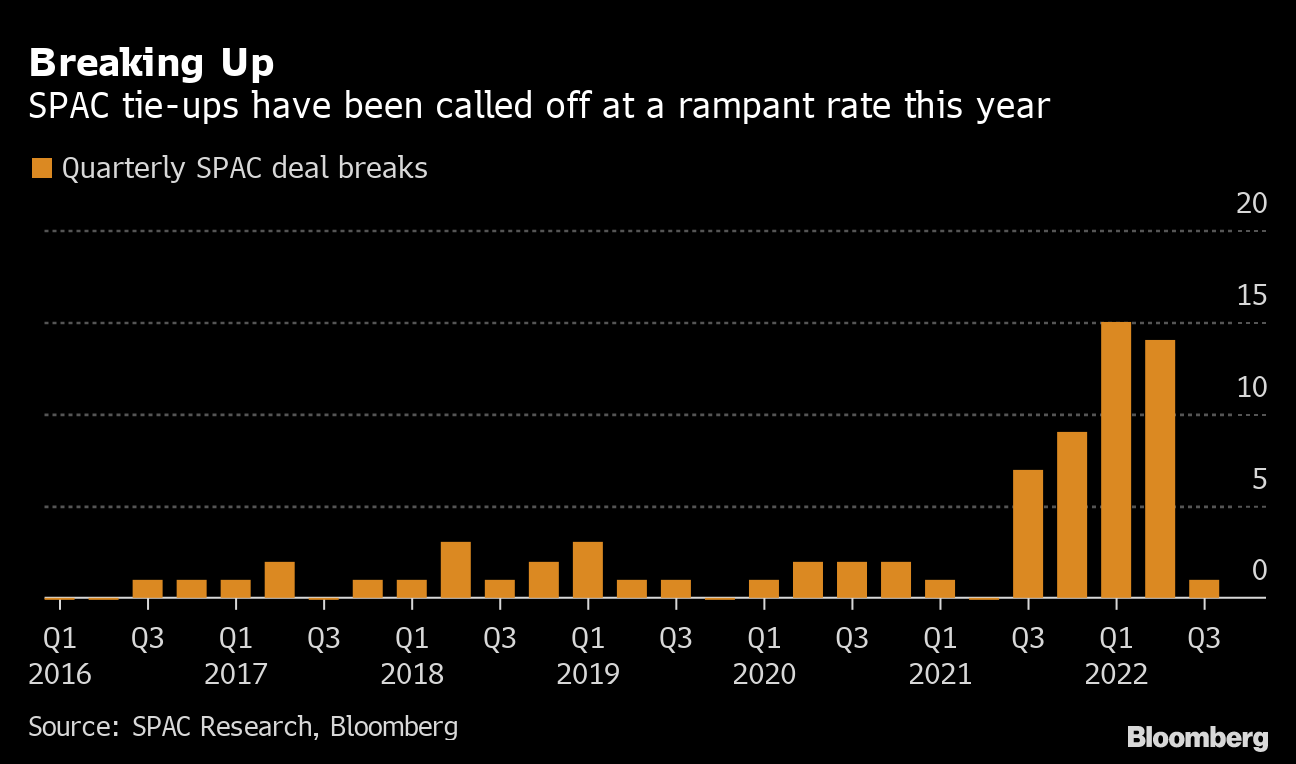

(Bloomberg) -- A flurry of blank check mergers were called off over the past 24 hours as target firms and SPAC sponsors deal with market turmoil that has shaken the industry and capital markets.

At least four special-purpose acquisition company tie-ups have been called off since the end of Thursday's trading, bringing the year's total to 30 breakups. The malaise is expected to keep Panera Brands, the owner of Panera Bread and Einstein Bros. Bagels, and online brokerage eToro private.

With just over half the year gone, SPACs and the companies that went public by merging with them have fizzled amid one of the stock market's worst routs in decades that has been particularly cruel to riskier stocks. The De-SPAC Index, a basket of companies that completed their tie-ups, has crashed 68% and more than 700 SPACs are either on the hunt for deals or racing the clock to close ahead of deadlines.

Panera's canceled merger leaves restaurateur Danny Meyer's USHG Acquisition Corp. with about eight months to find and close a deal before a deadline. The broken deal between Betsy Cohen's FinTech Acquisition Corp. V and eToro, according to the Information, would give the SPAC until December to merge with a partner and mark the second canned SPAC tie-up for one of the industry's most well-known sponsors.

SPACs are known as blank checks because they raise money through a public offering with the goal of buying a private business. They have limited time to complete a deal, typically about two years. If they don't meet that deadline, the company must return the cash to shareholders, though they can buy a short extension by giving holders more cash.

Industry uncertainty and a backlog of deal-needy SPACs have driven at least eight sponsors to close shop and return cash to investors this year. The glut of teams on the hunt and unpredictability hanging over the equity markets have pushed dealmakers to withdraw and quietly abandon planned SPACs that would have raised roughly $30 billion so far this year, according to data compiled by Bloomberg.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.