(Bloomberg) -- Prices of US goods and services probably climbed last month at a pace that remains discomforting for consumers as well as for Federal Reserve policy makers seeking greater progress in their battle to beat back inflation.

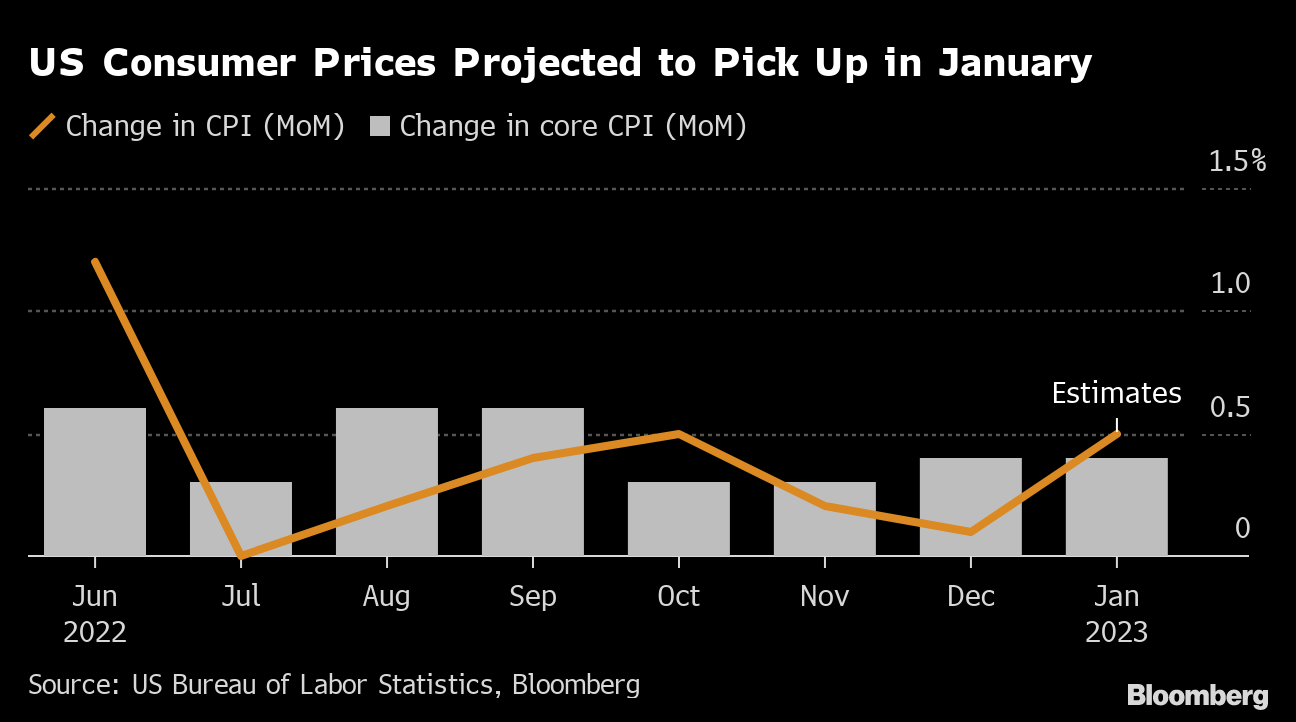

The January consumer price index on Tuesday is expected to increase 0.5% from a month earlier, spurred in part by higher gasoline costs. That would mark the biggest gain in three months. Excluding fuels and foods, so-called core prices — which better reflect underlying inflation — are seen rising 0.4% for a second month.

Such gains are consistent with the Fed's view that, while inflation is moderating from a four-decade high last year, further interest-rate increases will be needed to ensure price pressures are extinguished. Officials will also watch the behavior of core services costs to gauge the impact of a still-tight job market on inflation.

Core CPI is seen rising 5.5% from a year ago, which would be the smallest annual gain since late 2021. The central bank's goal, based on a different inflation metric, is 2%.

Persistent price pressures explain why many Americans are gloomy about their personal finances. A Gallup poll released Wednesday showed 50% of respondents describing their personal financial situations as worse than a year ago — the highest share since 2009.

Read more: Half of Americans Say They're Worse Off, Most Since 2009: Gallup

The good news for consumers, as well as Fed Chair Jerome Powell and his colleagues, is that core goods prices declined in each of the final three months of 2022, the longest such stretch since the start of the pandemic.

“With less of a drag from core goods, core inflation should tick higher in the upcoming release,” Morgan Stanley economists led by Ellen Zentner, wrote in a report. “But given that goods prices are not increasing meaningfully from here, price pressures should remain below the peaks of the summer and fall.”

What Bloomberg Economics Says:

“We expect the monthly change in January's CPI index to blunt the three-month trend of disinflation. A rise in gasoline prices, slowing momentum in goods inflation, and still robust gains in service prices should boost both headline and core prints. That should bolster market bets that the Fed will have to raise rates to a higher peak than currently priced in, or than indicated in December's dot plot.”

—Anna Wong, Eliza Winger and Niraj Shah, economists. For full analysis, click here

Services prices have been slower to adjust, but there were signs of moderation in the fourth quarter. Powell has argued that less wage pressure is part of the answer to cooling off inflation in core services, excluding housing.

Among other US economic reports in the coming week, the government will release January retail sales and industrial-production data. Figures that showed a healthy pickup in motor-vehicle purchases probably helped propel overall retail sales that indicate resilient consumer spending. Factory output also likely bounced back.

- For more, read Bloomberg Economics' full Week Ahead for the US

Regional Fed bank presidents speaking this coming week include Lorie Logan, Patrick Harker, John Williams, James Bullard, Loretta Mester and Thomas Barkin.

Elsewhere, weakening UK inflation, European Commission forecasts, and the nomination of Japan's next central-bank chief may draw attention. Among only a handful of rate decisions, Indonesian officials are likely to stay on hold.

Click here for what happened last week and below is our wrap of what's coming up in the global economy.

Asia

Japan's government is set to officially nominate Kazuo Ueda as its pick for Bank of Japan governor on Tuesday, after media reports indicated that the front-runner, Deputy Governor Masayoshi Amamiya, had turned the job down.

Gross domestic product figures for last quarter are likely to show Japan's economy rebounded from a contraction, largely helped by improved trade terms as the yen rose.

In China, the central bank will likely keep one of its key rates unchanged on Wednesday, while injecting more funds into the financial system to ease a liquidity squeeze.

Jobless figures in South Korea will offer the latest sign of how higher borrowing costs there are impacting the economy as Governor Rhee Chang-yong prepares for a meeting later in the month amid consensus for a hold decision.

Australia will also release jobs data that may provide a steer on whether the central bank acts on its warning of possible further hikes. Governor Philip Lowe gives testimony in parliament on Friday amid chatter over his prospects for staying on as Reserve Bank of Australia chief past his seven-year term.

Singapore will report GDP a day before announcing this year's budget plan on Tuesday.

Indonesia and the Philippines are scheduled to hold rate meetings on Thursday, with the former seen at the tail-end of hikes while a surprise inflation uptick in the latter may add pressure on authorities to extend their most aggressive tightening cycle in two decades.

- For more, read Bloomberg Economics' full Week Ahead for Asia

Europe, Middle East, Africa

It's a crucial week for the Bank of England as it considers whether it can soon end its most aggressive tightening cycle in three decades.

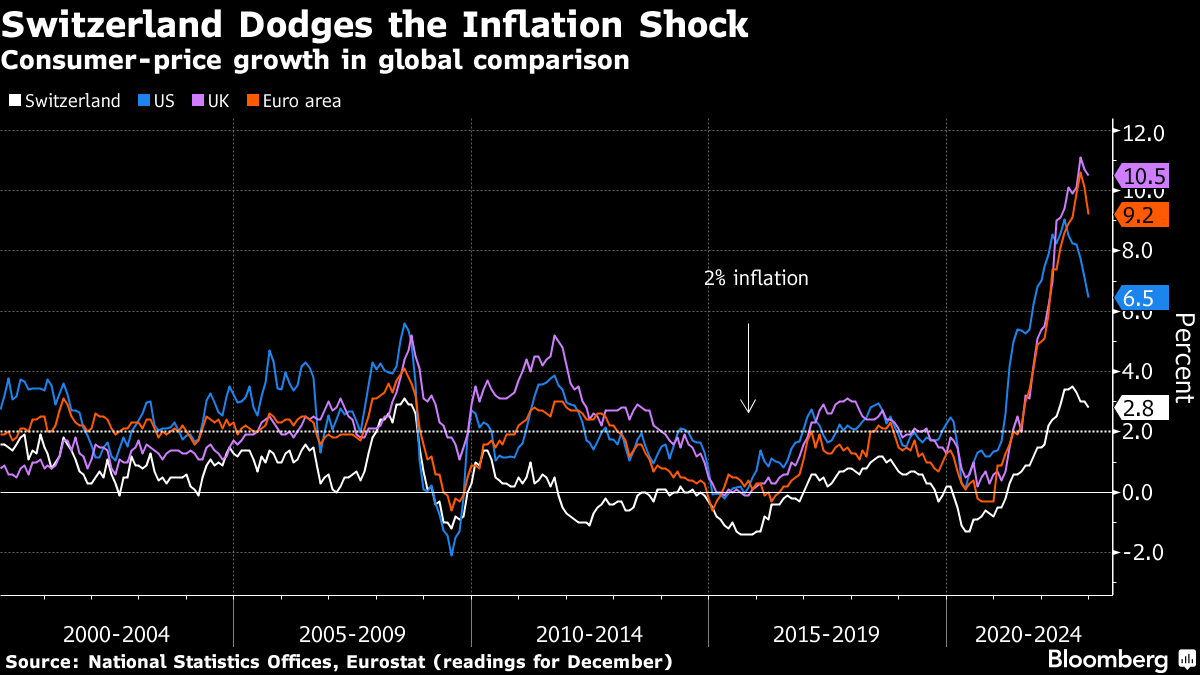

UK inflation – currently at 10.5% – is set to slow for a third straight month in January's figures on Wednesday.

Officials will consider the monthly jobs report released the day before just as closely: wages are rising at their fastest pace outside of the pandemic, and some economists expect the fourth quarter saw a further acceleration.

BOE watchers will also eye job vacancies and unemployment numbers for any other signs of a loosening labor market, and may focus on remarks by its chief economist, Huw Pill, on Thursday. Markets are leaning toward a quarter-point rate hike at the BOE meeting in March, with the hiking cycling to end by August.

In the euro zone, meanwhile, the highlight may arrive on Monday with quarterly forecasts from the European Commission. Data in the region will be relatively sparse, with a second reading of GDP on Tuesday and industrial production the next day among the main attractions.

Among the European Central Bank officials scheduled to speak is Chief Economist Philip Lane on Thursday, as well as governors from Portugal, Germany and France scattered throughout the week.

In Switzerland, which has so far had the softest consumer-price shock in the OECD, data on Monday may show inflation moved back above 3% in January.

Looking east, Romanian central bank Governor Mugur Isarescu presents new inflation forecasts on Tuesday, and GDP data the same day in Hungary are likely to confirm that the economy entered a recession in the second half of 2022.

Turning south, the Bank of Zambia's Monetary Policy Committee will likely lift its key rate for the first time in more than a year to support a weakening local currency that's placing upward pressure on inflation.

Slow progress in talks to restructure Zambia's $12.8 billion of external loans has fueled a 13% depreciation in the kwacha against the dollar since the MPC last met on Nov. 23.

Also Wednesday, Namibia's rate setters are forecast to track neighboring South Africa and raise borrowing costs by 25 basis points. The nation's peg with the rand means its rate decisions mostly follow the South African Reserve Bank's.

Inflation in South Africa is expected to edge down toward the 6% ceiling of the central bank's target range.

Israeli consumer-price data due that day are expected to show continued acceleration in January, after hitting the highest levels since 2008 at the end of last year. That's far above the central bank's target range, despite a wave of rate hikes.

- For more, read Bloomberg Economics' full Week Ahead for EMEA

Latin America

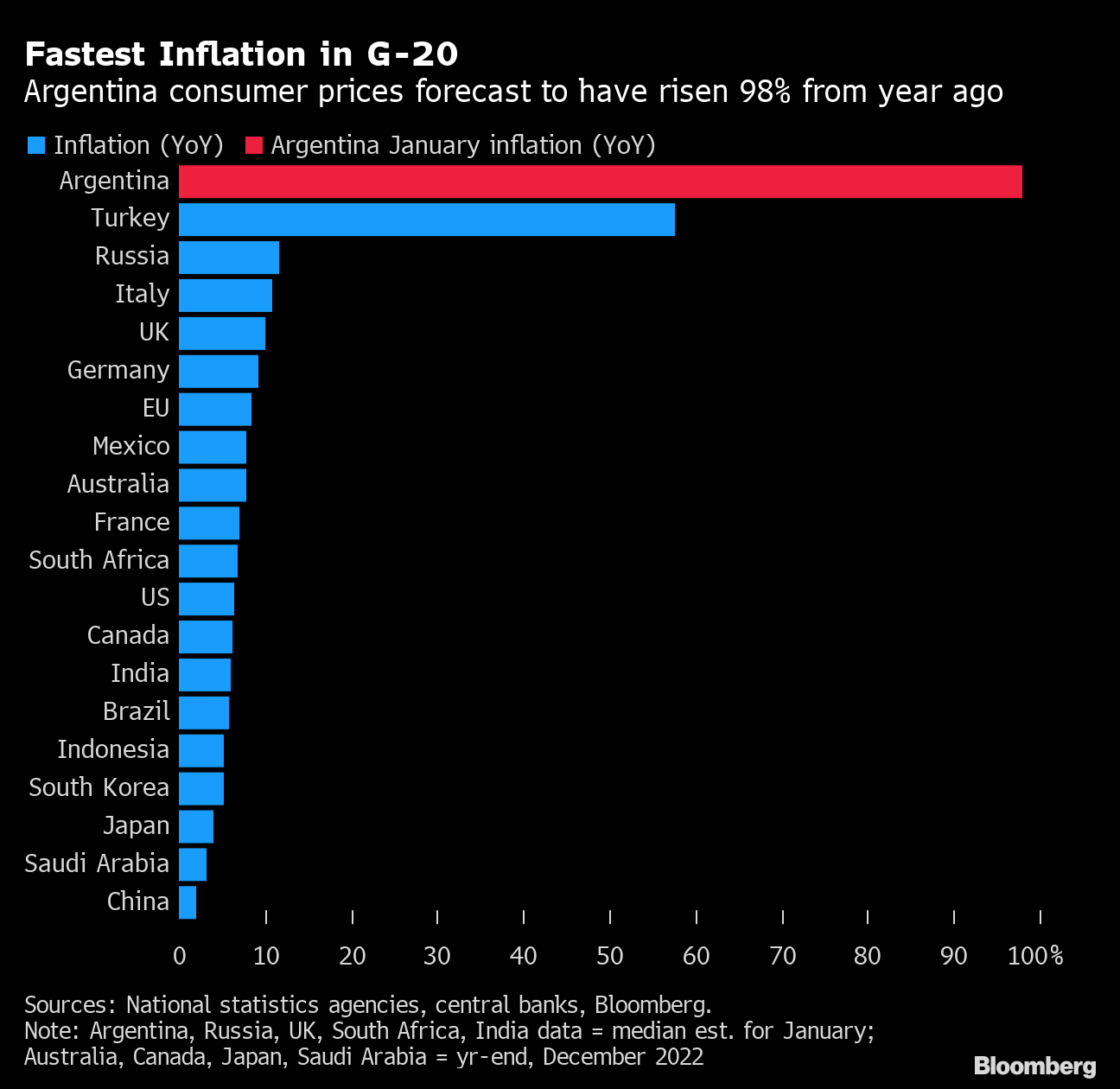

After closing out 2022 at a three-decade high, inflation in Argentina probably accelerated again in January to within a few percentage points of 100%, just above local economists' forecasts for year-end 2023.

Uruguay's central bank will likely join peers in Brazil, Chile, Peru and Paraguay by opting to keep its rate unchanged this week. Twelve straight hikes have brought it to 11.5%, and inflation is clearly in retreat though still above the central bank's 3% to 6% target.

Both Brazil and Peru report GDP-proxy data for December. Of the two, the latter's results are expected to be marginally better despite violent nationwide protests over the ouster and arrest of leftist President Pedro Castillo early in the month. For 2023, analysts see sub-par to meager growth for each.

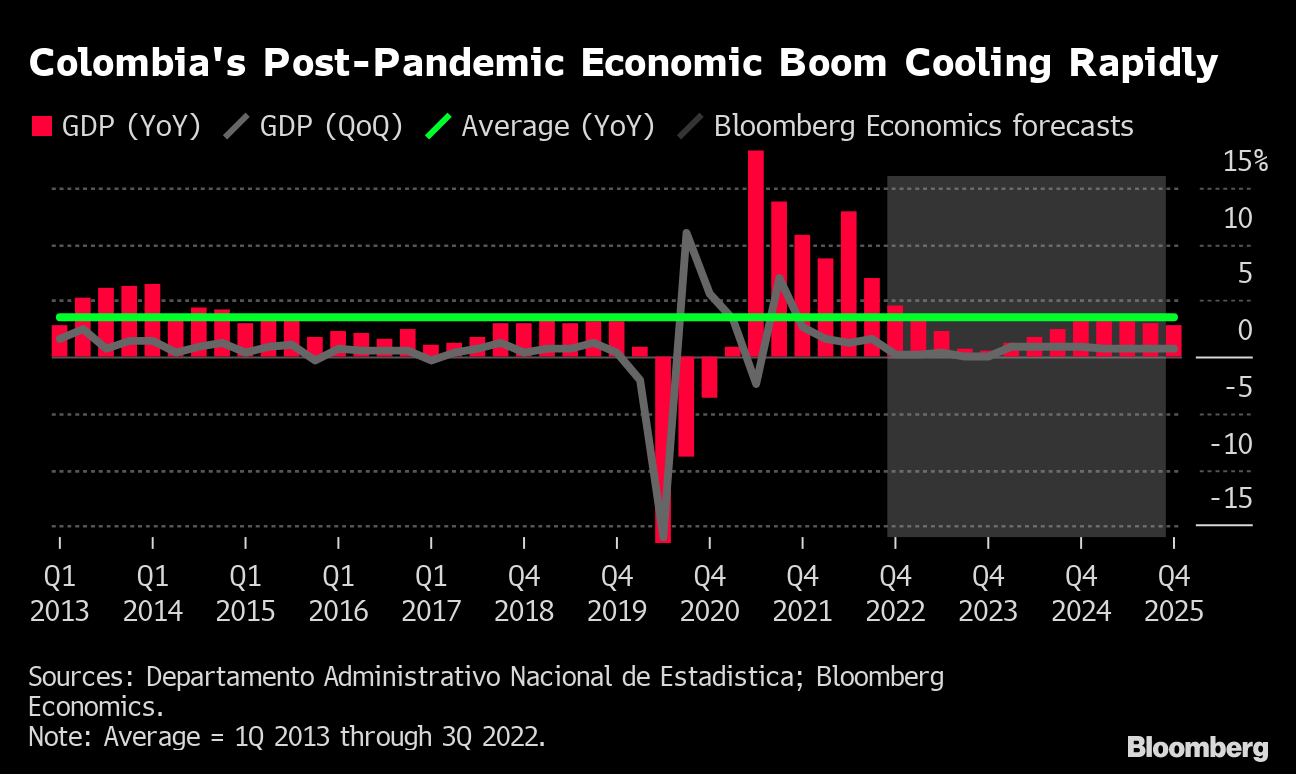

A raft of data from Colombia in the coming week should show the economy's spectacular rebound from the pandemic shock is rapidly losing momentum. Retail sales, manufacturing and industrial output figures for December will all likely be well off their 2022 highs as double-digit inflation and rates begin to cool demand.

Full-year and Oct-Dec output data may show some fraying on the margins as the economy encountered end-of-year headwinds, but Colombia's 2022 and fourth-quarter GDP results should still set the standard for the region's major economies.

- For more, read Bloomberg Economics' full Week Ahead for Latin America

--With assistance from , , , and .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.