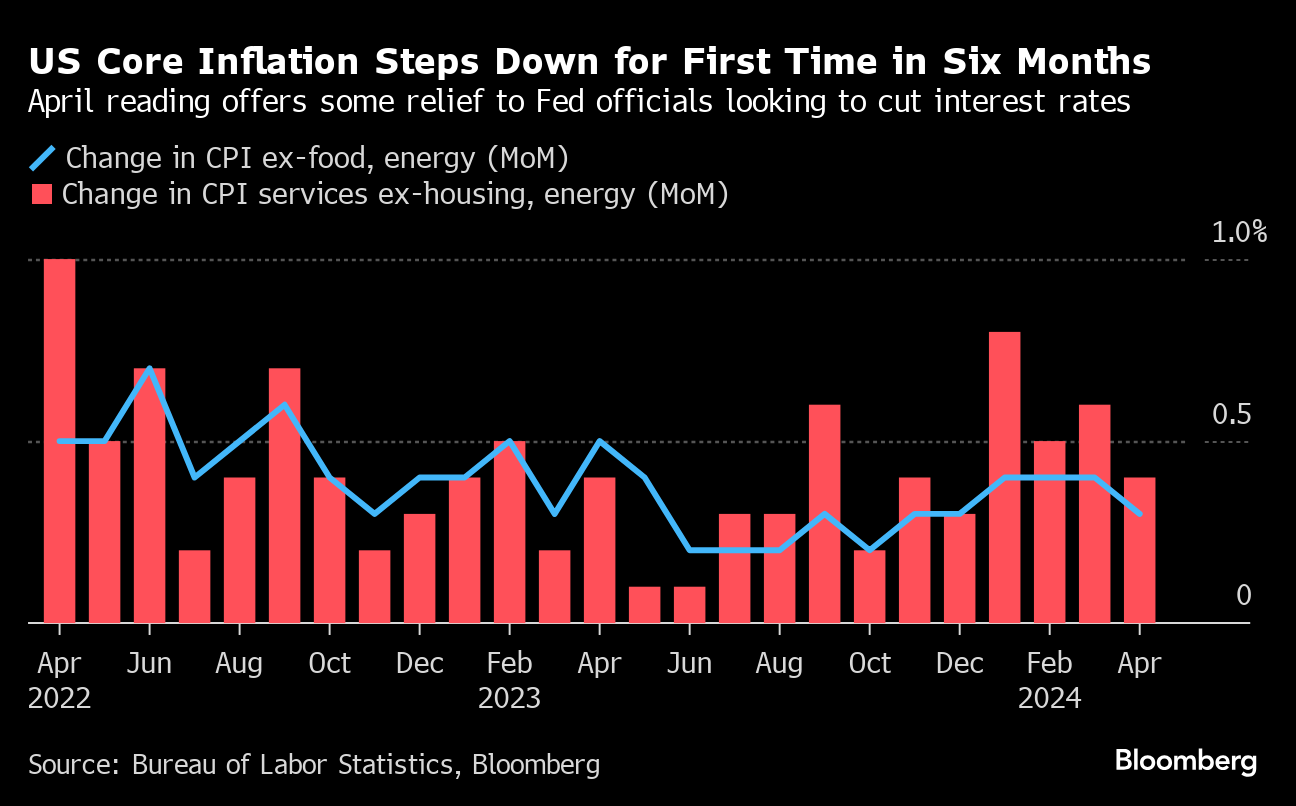

(Bloomberg) -- A measure of underlying US inflation cooled in April for the first time in six months, a small step in the right direction for Federal Reserve officials looking to start cutting interest rates this year.

The so-called core consumer price index — which excludes food and energy costs — climbed 0.3% from March, snapping a streak of three above-forecast readings which spurred concern that inflation was becoming entrenched. The year-over-year measure cooled to the slowest pace in three years, Bureau of Labor Statistics figures showed.

The Fed is trying to rein in price pressures by weakening demand across the economy. Another report out Wednesday showed retail sales stagnated in April, indicating high borrowing costs and mounting debt are encouraging greater prudence among consumers.

Follow the reaction in real time on Bloomberg's TOPLive blog

While the figures may offer the Fed some hope that inflation is resuming its downward trend, officials will want to see additional readings to gain the confidence they need to start thinking about cutting interest rates. Chair Jerome Powell said Tuesday the central bank will “need to be patient and let restrictive policy do its work,” and some policymakers don't expect to cut rates at all this year.

Read this next: What 60,000 Headlines Say About the Fed's Next Move

“It does open the door to a potential rate cut later in the year,” said Kathy Jones, Charles Schwab's chief fixed-income strategist. “It will take a few more readings indicating that inflation is coming down for the Fed to act.”

Treasury yields fell, the S&P 500 opened higher and the dollar weakened. Traders boosted the odds of a September rate cut to about 60%.

Core CPI over the past three months increased an annualized 4.1%, the smallest since the start of the year.

Economists see the core gauge as a better indicator of underlying inflation than the overall CPI. That measure climbed 0.3% from the prior month and 3.4% from a year ago. Shelter and gasoline accounted for over 70% of the increase, the BLS said in the report.

Additionally, the advance in the CPI was driven once again by services like car insurance and medical care. Apparel prices rose by the most since June 2020.

Shelter prices, which is the largest category within services, climbed 0.4% for a third month. Owners' equivalent rent — a subset of shelter, which is the biggest individual component of the CPI — rose by a similar amount. Robust housing costs are a key reason why inflation not only in the US, but also in many other developed economies has refused to ebb.

Read More: Why Powell Sees Rent Quirks as a Barrier to Rate Cuts: QuickTake

Excluding housing and energy, services prices advanced 0.4% from March, the weakest pace this year, according to Bloomberg calculations. While central bankers have stressed the importance of looking at such a metric when assessing the nation's inflation trajectory, they compute it based on a separate index.

That measure, known as the personal consumption expenditures price index, doesn't put as much weight on shelter as the CPI does. That's part of the reason why the PCE is trending closer to the Fed's 2% target.

A report Tuesday showed producer prices rose in April by more than projected, but key categories that feed into the PCE were more muted. Combined with CPI components that also inform the PCE calculation, economists expect that measure to come in softer when April data is released later this month.

What Bloomberg Economics Says...

“The report will probably add a bit to Fed confidence about disinflation progress — but they're likely still less confident than they were entering 2024. At least April's CPI should keep the chances of a July rate cut alive, for now.”

— Anna Wong, Stuart Paul and Estelle Ou

To read the full note, click here

Unlike services, a sustained decline in the price of goods over most of the past year has largely been providing some relief to consumers — though economists expect that to be a less reliable source of disinflation going forward. So-called core goods prices, which exclude food and energy commodities, fell slightly, dragged down by motor vehicles.

Separate data Wednesday showed real earnings on an annual basis rose at the slowest pace in nearly a year.

--With assistance from Kristy Scheuble, Mark Niquette, Matthew Boesler, Daniel Neligh and Steve Matthews.

(Updates with market open)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.