Economists have added a big disclaimer to their view that the European Central Bank will cut interest rates three more times: Donald Trump.

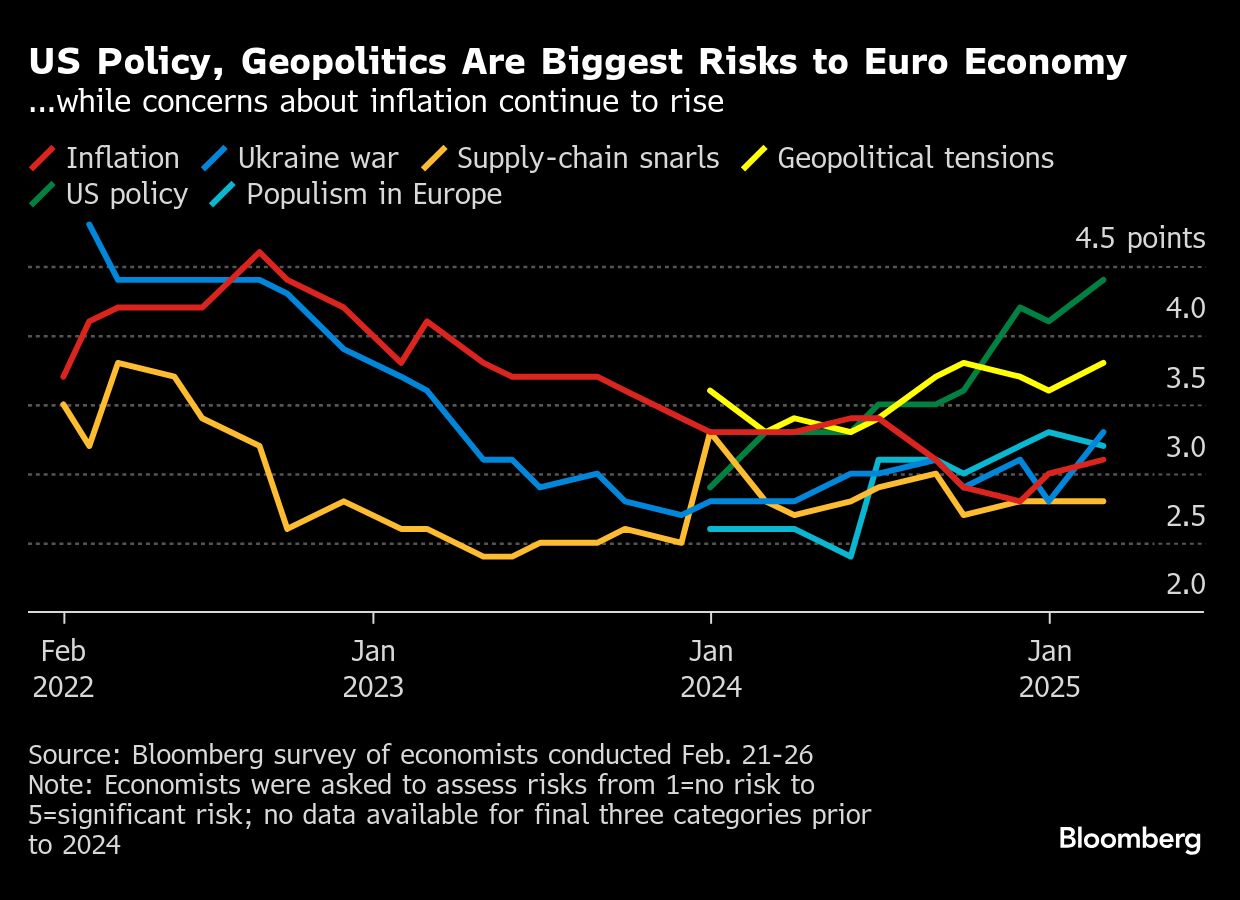

The US president's erratic behavior on trade, the international security architecture and domestic politics has left respondents in a Bloomberg survey pondering the life span of their projections.

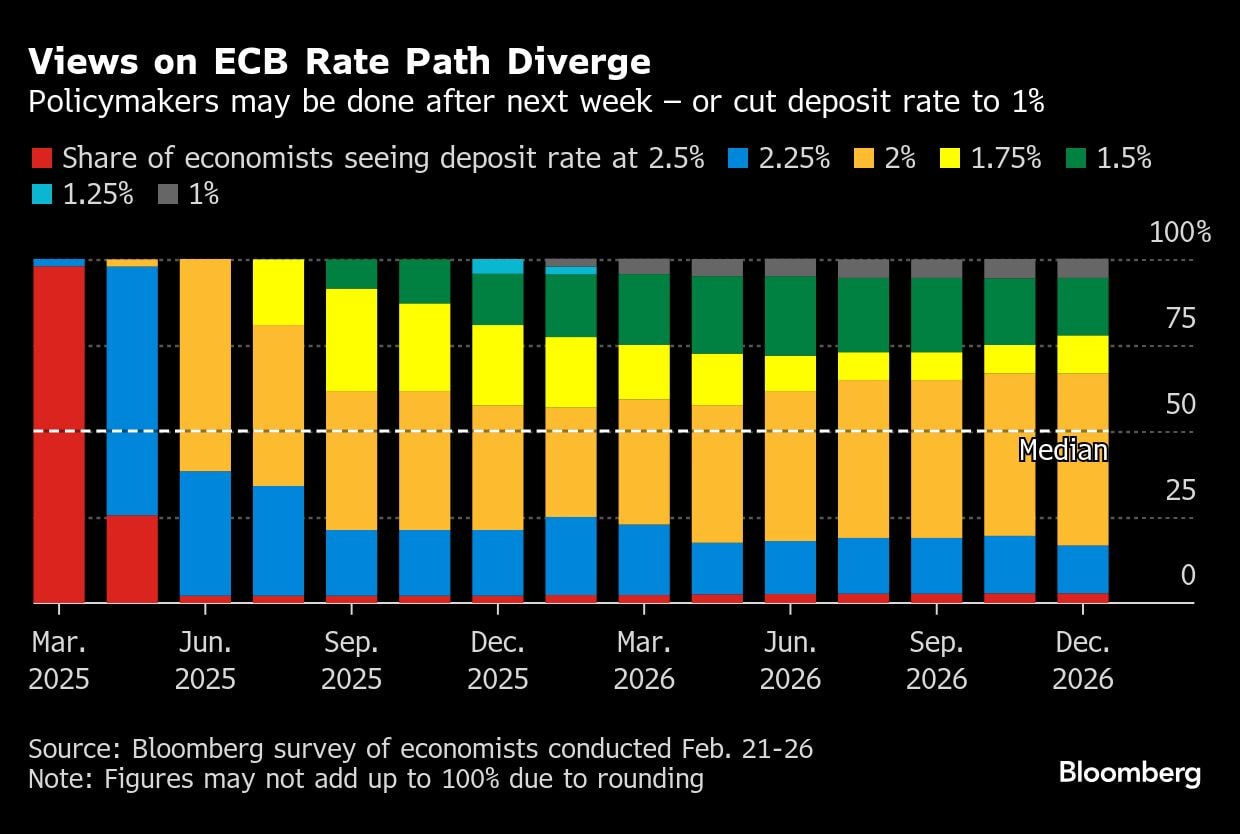

Barring major shocks, they still expect the euro-area economy to recover, and — with inflation nearing the ECB's goal — officials should be able to lower the deposit rate to 2% by June, from 2.75% now.

After an almost-certain quarter-point move next week, however, there's scope for that scenario to shift abruptly.

“The outlook could significantly change in the coming months,” said Bill Diviney, a senior economist at ABN Amro. “The new US administration's tariff policies look like being even more aggressive than we are currently assuming,” while “there are signs that we could see more government spending in the euro zone, especially on defense.”

Unlike most economists, he sees the deposit rate dropping all the way to 1% in early 2026. At the other end of the spectrum, Sylvain Broyer of S&P Global Ratings reckons policymakers will be done lowering borrowing costs after next week's reduction to 2.5%.

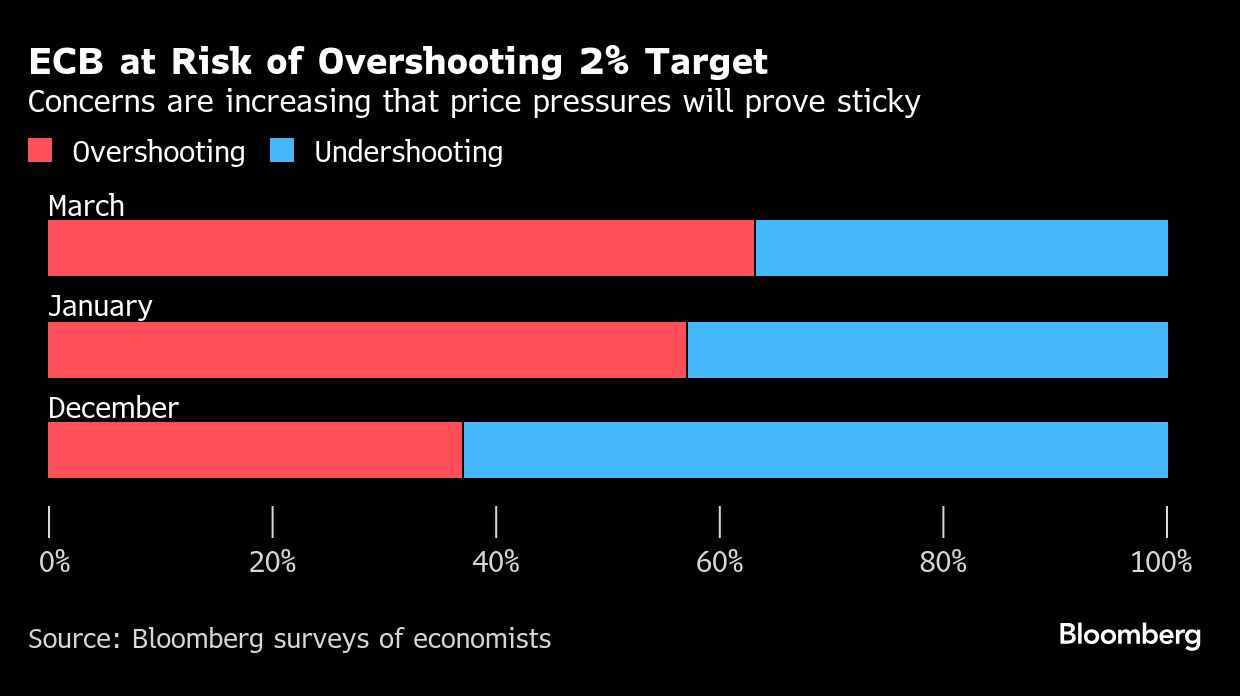

He's among a growing share of respondents worried that the ECB will overshoot its 2% inflation target in the medium term, though French inflation data Friday produced the weakest reading in four years. Divisions are emerging within the 26-strong Governing Council, too.

Piero Cipollone, a dove, has suggested the ECB may need to decrease rates further to compensate for the monetary tightening induced by unwinding old stimulus drives. His hawkish colleague Isabel Schnabel shot back by warning against too much activism.

“The ECB would be prudent to be more cautious with its rates policy after a March reduction, to avoid cutting too quickly or too far when core inflation has remained sticky and the effects of Trump's trade wars and de-globalization might abruptly send inflation higher,” said Dennis Shen, an economist with Scope Ratings who predicts a pause in April. “Euro-area unemployment remaining near its record lows also supports some element of caution.”

What Bloomberg Economics Says...

“The ECB will almost certainly lower interest rates again on March 6. However, resistance to additional easing after that is building. The most interesting aspect of the upcoming gathering will probably be any hints that are provided on what comes next. April's decision will be finely balanced, but we expect a pause.”

—David Powell, senior euro-area economist.

Trump's latest salvos include a tariff threat of 25% on “cars and all other things” from the European Union that risks weighing on already sluggish growth. Analysts are pessimistic on the bloc's ability to avert levies. A broad majority sees it retaliating with action worth 50% or more of the initial hit.

Such prospects have further elevated US policy as the biggest risk to Europe, with more than half of respondents describing it as “significant.”

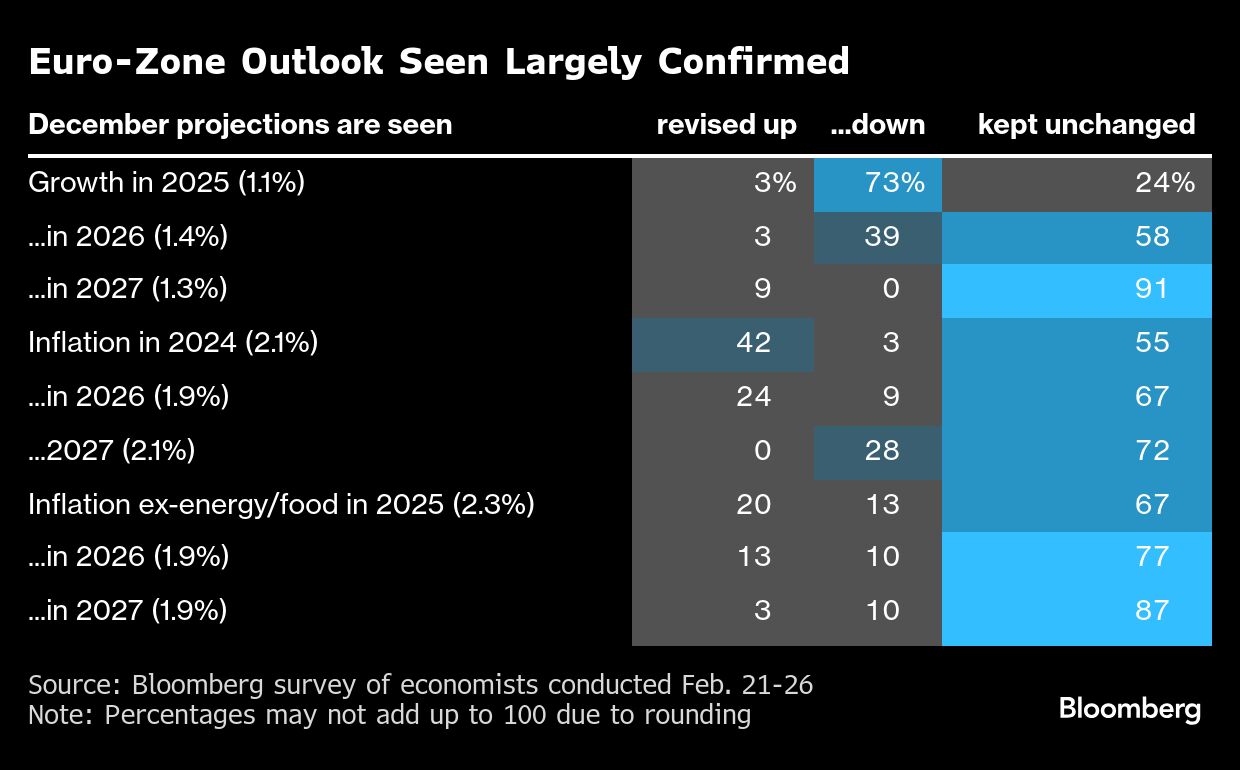

While a majority expects economic expansion in the euro area to suffer due to steps taken across the Atlantic, analysts don't predict major revisions to the ECB's quarterly projections for gross domestic product and inflation, beyond a softer outlook for this year.

Germany and France, the region's two top economies, started 2025 on the back of contractions in the fourth quarter — the former due to slumping exports and modest household spending, the latter on declining investments.

Officials have repeatedly described growth risks as tilted to the downside, citing geopolitics, fiscal concerns and trade friction. With price pressures continuing to abate, they argued at their January meeting, rates should fall further toward neutral levels, which the ECB puts at 1.75% to 2.25%.

The bulk of respondents sees neutral — a theoretical point where borrowing costs neither restrict nor accommodate economic growth — at 2%.

About two-thirds of analysts expect the ECB to already next week drop language in its statement calling policy restrictive. But more than 90% of those don't anticipate officials characterizing settings as neutral amid concerns that that would fuel speculation over whether rates had already reached a floor.

Economists including AFS Interest's Arne Petimezas and Pantheon Macroeconomics's Claus Vistesen argue the ECB will get around this problem by no longer qualifying their stance.

More than nine in 10 respondents don't expect any official forward guidance either.

“It will be a challenge to President Christine Lagarde to balance different views within the Governing Council when commenting on prospects for further rate cuts,” said Jussi Hiljanen, head of macro and fixed-income research at SEB. “Therefore, she'll stick to a data-dependent approach with no pre-commitments.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.