China's top leaders changed their stance on monetary policy for the first time in some 14 years, as policymakers gird themselves for a second trade war when Donald Trump returns to the White House next month.

The Politburo, comprising the ruling Communist Party's most senior 24 officials and led by President Xi Jinping, announced it will embrace a “moderately loose” strategy, in a sign of greater easing ahead that will likely be welcomed by investors hungry for more stimulus.

Officials also said they will implement a “more proactive” fiscal policy, according to the read out published Monday — previously, the group had said fiscal policy would be “proactive.” That comes after the official Xinhua News Agency said the country had room to increase its borrowing and fiscal deficit in 2025, in a commentary on Friday.

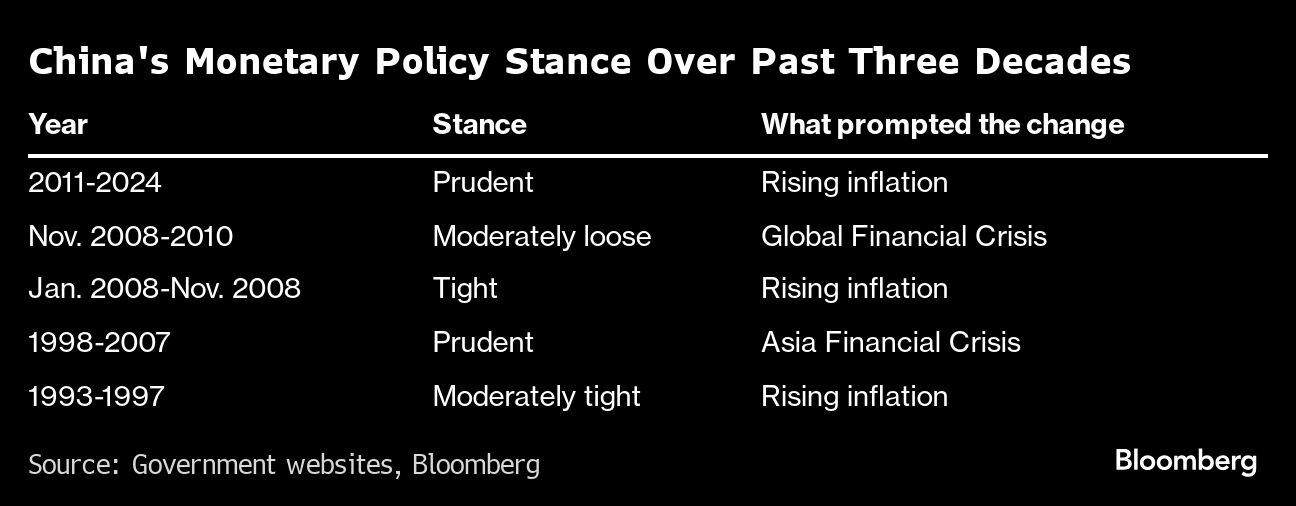

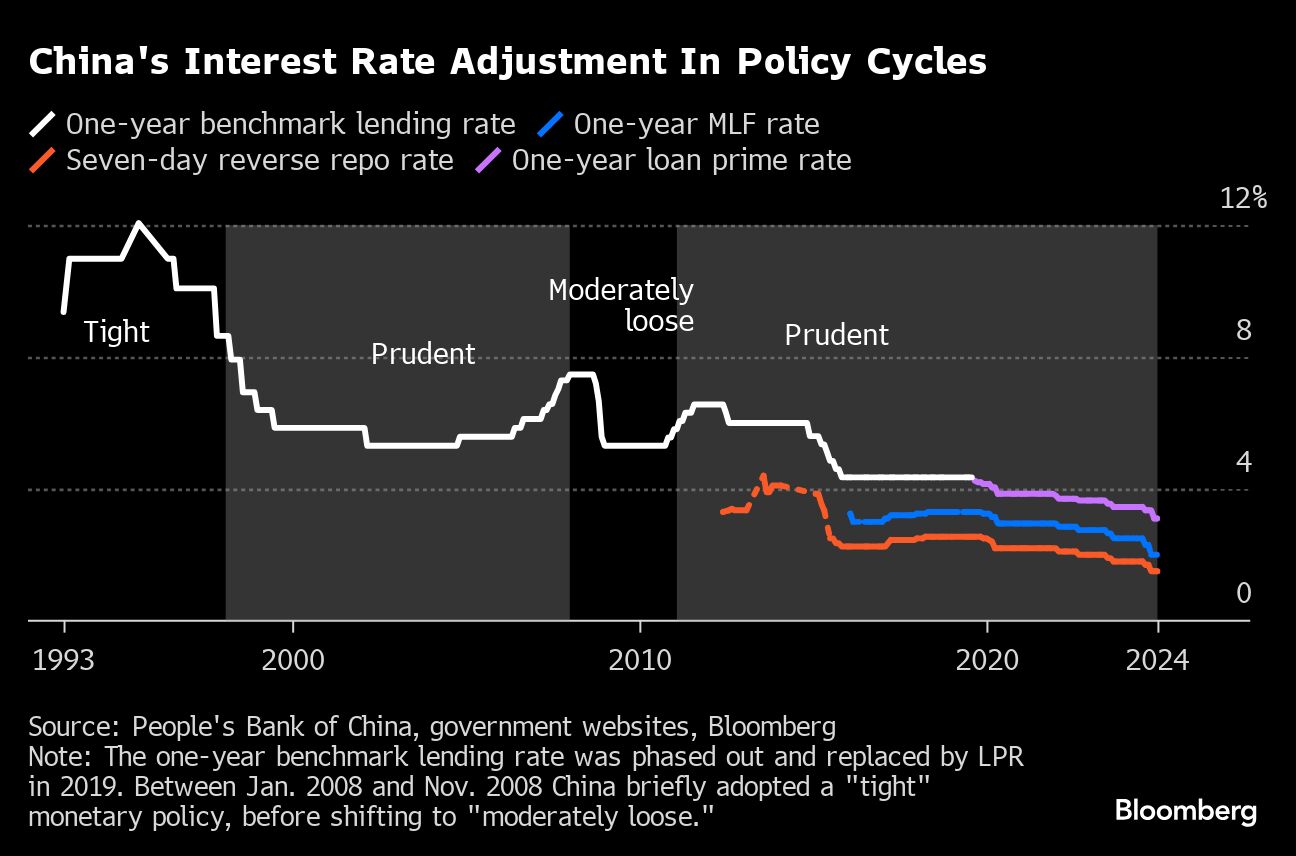

While China has gone through several tightening and loosening cycles in monetary policy recent years, it's stuck with the overarching characterization of “prudent” policy since 2011. At that time, authorities shifted away from the previous stance of “moderately loose” adopted during the Global Financial Crisis, to cool rising inflation.

The latest departure reflects an urgency to step up the easing mode adopted by the central bank after an expected post-pandemic boom failed to materialize. That push has seen the People's Bank of China slash interest rates and lower the amount of cash banks must set aside in reserves several times, although authorities have found it hard to spur greater borrowing.

The December conclave typically sets the agenda for the larger Central Economic Work Conference that crafts priorities for the following year, and where officials are expected to discuss the 2025 growth goal.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.