Tata Elxsi saw a sharp fall in its share price on Friday, a day after the company reported weak performance for the quarter ended December, missing analysts' expectations.

The design and technology provider posted a profit of Rs 199 crore in the quarter ended December, according to an exchange filing. Analysts tracked by Bloomberg had a consensus estimate of Rs 216 crore.

Tata Elxsi Q3 FY25 Highlights (Consolidated, QoQ)

Revenue down 1.7% to Rs 939.2 crore versus Rs 955.1 crore (Bloomberg estimate: Rs 987 crore).

EBIT down 8% to Rs 220.6 crore versus Rs 239.3 crore (Estimate: Rs 259 crore).

Margin narrows to 23.5% versus 25.1% (Estimate: 26.3%).

Net profit down 13% to Rs 199 crore versus Rs 229.4 crore (Estimate: 216 crore).

Brokerage JP Morgan has cut its target price for the stock to Rs 5,400 from Rs 5,700 earlier, implying a 16% downside, while maintaining 'underweight'. It said 3Q was a sharp miss on all fronts and auto growth outlook in near term is weak. There are broad based portfolio challenges, according to the brokerage, which also sees valuation at 41 times of FY26 price to earnings expensive.

Morgan Stanley has also cut its target price to Rs 6,000 from Rs 6,500 earlier. The stock has underperformed last year vs. Sensex (-22%. vs Sensex +9%), but still trades at rich valuations and with limited visibility on growth and margins, the brokerage said, maintaining its 'underweight' rating.

It also said that weakness in European transportation continues and significant recovery in Media and Healthcare remains elusive. "With limited growth visibility, potential cut to consensus numbers and high valuations, the stock could continue to underperform," the brokerage said.

While Morgan Stanley believes that its capabilities are well rounded and management commentary for fiscal 2025 is constructive, growth expectations are already high. "Margins have been resilient and, despite investments in the business, continue to trend in a similar range," it said.

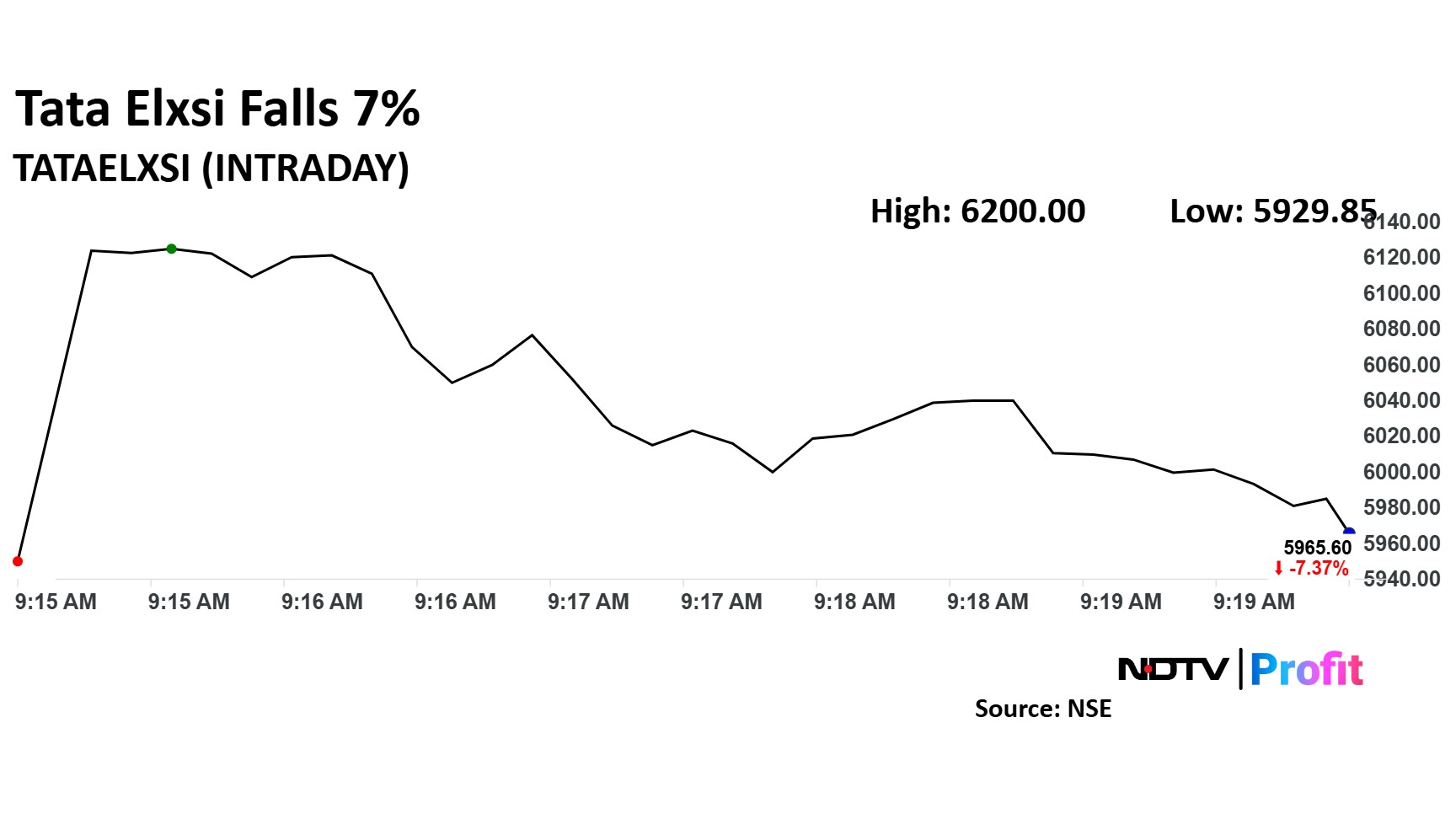

Tata Elxsi fell as much as 7.92% to Rs 5,929.85 apiece, the lowest level since March 29, 2023. It pared losses to trade 7.5% lower at Rs 5,953.5 apiece, as of 9:38 a.m. This compares to a 0.4% decline in the NSE Nifty 50 Index.

It has fallen 2.8% in the last 12 months. Total traded volume so far in the day stood at 2.70 times its 30-day average. The relative strength index was at 19.27, indicating that the stock may be oversold.

Out of 14 analysts tracking the company, three maintain a 'buy' rating, and 11 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.